Radio Shack 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accor-

dance with generally accepted accounting principles (“GAAP”)

in the United States. The application of GAAP requires us to

make estimates and assumptions that affect the reported

values of assets and liabilities at the date of the financial

statements, the reported amount of revenues and expenses

during the reporting period, and the related disclosures of

contingent assets and liabilities. The use of estimates is per-

vasive throughout our financial statements and is affected

by management judgment and uncertainties. Our estimates,

assumptions and judgments are based on historical experi-

ence, current market trends and other factors that we believe

to be relevant and reasonable at the time the consolidated

financial statements are prepared. We continually evaluate

the information used to make these estimates as our business

and the economic environment changes. Actual results

may differ materially from these estimates under different

assumptions or conditions.

In the Notes to Consolidated Financial Statements, we

describe our significant accounting policies used in the prepa-

ration of the consolidated financial statements. The account-

ing policies and estimates we consider most critical are: rev-

enue recognition; inventory valuation under the cost method;

estimation of reserves and valuation allowances, specifically

related to insurance, tax and legal contingencies; and valua-

tion of long-lived assets and intangibles, including goodwill.

We consider an accounting policy or estimate to be critical

if it requires our most difficult, subjective or complex judg-

ments, and is material to the portrayal of our financial condi-

tion, changes in financial condition or results of operations.

The selection, application and disclosure of our critical

accounting policies and estimates have been reviewed by the

Audit and Compliance Committee of our Board of Directors.

Revenue Recognition: Our revenue is derived principally from

the sale of private label and third-party branded products and

services to consumers. Revenue is recognized, net of an esti-

mate for customer refunds and product returns, when persua-

sive evidence of an arrangement exists, delivery has occurred

or services have been rendered, the sales price is fixed or

determinable, and collectibility is reasonably assured.

Certain products, such as wireless telephones and satellite

systems, require the customer to use the services of a third-

party service provider. In most cases, the third-party service

provider pays us a fee or commission for obtaining a new

customer, as well as a monthly recurring residual amount

based upon the ongoing arrangement between the service

provider and the customer. Fee or commission revenue, net

of a reserve for estimated service deactivations, is generally

recognized at the time the customer is accepted as a sub-

scriber of a third-party service provider.

Estimated product refunds and returns, service plan deacti-

vations, residual revenue and commission revenue adjust-

ments are based on historical information pertaining to these

items. If actual results differ from these estimates due to

various factors, the amount of revenue recorded could be

materially affected. A 10% difference in our reserves for the

estimates noted above would have affected net sales and

operating revenues by approximately $1.7 million for the

fiscal year ended December 31, 2004.

Inventory Valuation: Our inventory consists primarily of finished

goods available for sale at our retail locations or within our

distribution centers and is recorded at the lower of average

cost or expected sales price (i.e., market value). The cost com-

ponents recorded within inventory are the vendor invoice cost

and certain allocated external and internal freight, distribution,

warehousing and other costs required to transport the mer-

chandise from the vendor to the point-of-sale, usually a store.

Typically, the market value of our inventory is higher than its

cost. Determination of the market value may be very complex

and, therefore, requires a high degree of judgment. In order

for management to make the appropriate determination of

market value, the following items are commonly considered:

inventory turnover statistics, current selling prices, seasonality

factors, consumer trends, competitive pricing, performance

of similar products or accessories, planned promotional incen-

tives, and estimated costs to sell or dispose of merchandise

such as sales commissions.

If the calculated market value is determined to be less than

the recorded average cost, a provision is made to reduce the

carrying amount of the inventory item. Differences between

management estimates and actual performance and pricing

of our merchandise could result in inventory valuations that

differ from the amount recorded at the financial statement

date, and could also cause fluctuations in the amount of

recorded cost of products sold.

If our estimates regarding market value are inaccurate or

changes in consumer demand affect certain products in an

unforeseen manner, we may be exposed to material losses or

gains in excess of our established valuation reserve.

Estimation of Reserves and Valuation Allowances: The amount

of liability we record for claims related to insurance, tax and

legal contingencies requires us to make judgments about the

amount of expenses that will ultimately be incurred. We use

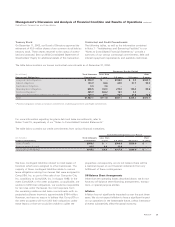

Management’s Discussion and Analysis of Financial Condition and Results of Operations

RadioShack Corporation and Subsidiaries

30 AR2004