Radio Shack 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

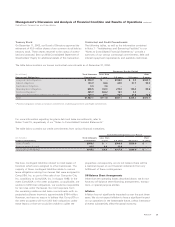

Factors That May Affect Future Results

Matters discussed in MD&A and in other parts of this report

include forward-looking statements within the meaning of

the federal securities laws. These matters include statements

concerning management’s plans and objectives relating to

our operations or economic performance and related assump-

tions. We specifically disclaim any duty to update any of the

information set forth in this report, including any forward-look-

ing statements. Forward-looking statements are made based on

management’s current expectations and beliefs concerning

future events and, therefore, involve a number of risks and

uncertainties. Management cautions that forward-looking state-

ments are not guarantees, and our actual results could differ

materially from those expressed or implied in the forward-look-

ing statements. Important factors that could cause our actual

results of operations or financial condition to differ materially

include, but are not necessarily limited to, the following factors.

General Business Factors

>Changes in national or regional U.S. economic conditions,

including, but not limited to, recessionary or inflationary

trends, equity market levels, consumer credit availability,

interest rates, consumers’ disposable income and spending

levels, continued rise of oil prices, job security and unem-

ployment, and overall consumer confidence;

>changes in the amount and degree of promotional intensity

exerted by current competitors and potential new competi-

tion from both retail stores and alternative methods or

channels of distribution, such as e-commerce, telephone

shopping services and mail order;

>any potential tariffs imposed on products that we import

from China, as well as the potential strengthening of

China’s currency against the U.S. dollar;

>continuing terrorist activities in the U.S., as well as the

international war on terrorism;

>the disruption of international, national or regional trans-

portation systems;

>the lack of availability or access to sources of inventory;

>changes in the financial markets that would reduce or

eliminate our access to longer term capital or short-term

credit availability;

>the imposition of new restrictions or regulations regarding

the products and/or services we sell or changes in tax rules

and regulations applicable to us; and

>the occurrence of severe weather events or natural disasters

which could significantly damage or destroy outlets or

prohibit consumers from traveling to our retail locations,

especially during the peak holiday shopping season.

RadioShack Specific Factors

>The inability to successfully execute our solutions strategy to

dominate cost-effective solutions to meet everyone’s routine

electronics needs and families’ distinct electronics wants;

>the failure to differentiate ourselves as an electronics

specialty retailer in the U.S. marketplace;

>the failure to maintain or increase the level of sales in our

non-wireless business categories;

>any reductions or changes in the growth rate of the wireless

industry and changes in the wireless communications indus-

try dynamics, including the effects of industry consolidation;

>the inability to create, maintain or renew profitable contracts

or execute business plans with providers of third-party brand-

ed products and with service providers relating to cellular

and PCS telephones which could cause the reduction or

elimination of our commissions as well as residual income;

>the presence or absence of new services or products and

product features in the merchandise categories we sell and

unexpected changes in our actual merchandise sales mix;

>the inability to effectively manage our inventory levels in a

rapidly changing marketplace;

>the inability to attract, retain and grow an effective man-

agement team in a dynamic environment or changes in

the cost or availability of a suitable workforce to manage

and support our operating strategies;

>the inability to optimize and execute our strategic

plans, including our retail services operations and

other sales channels;

>the existence of contingent lease obligations related to our

discontinued retail operations arising from an assignee’s or a

sub-lessee’s failure to fulfill its lease commitments, or from

our inability to identify suitable sub-lessees for vacant facilities;

>the inability to successfully identify and analyze emerging

growth opportunities in the areas of strategic business

alliances, acquisitions, licensing opportunities, new markets,

non-store sales channels, and innovative products; and

>the inability to successfully identify and enter into relation-

ships with developers of new technologies or the failure

of these new technologies to be adopted by the market.

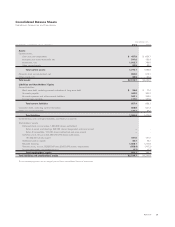

Management’s Report on Internal Control over

Financial Reporting

Our management is responsible for establishing and maintain-

ing adequate internal control over financial reporting, as such

term is defined in Exchange Act Rule 13a-15(f). Under the

supervision and with the participation of our management,

including our CEO and Acting CFO, we conducted an evaluation

of the effectiveness of our internal control over financial report-

ing based on the framework in “Internal Control – Integrated

Framework” issued by the Committee of Sponsoring

Organizations of the Treadway Commission. Based on our eval-

uation under the framework in “Internal Control – Integrated

Framework,” our management concluded that our internal

control over financial reporting was effective as of December

31, 2004. Our management’s assessment of the effectiveness

of our internal control over financial reporting as of December

31, 2004, has been audited by PricewaterhouseCoopers LLP,

an independent registered public accounting firm, as stated in

their report which is included herein.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

RadioShack Corporation and Subsidiaries

32 AR2004