Radio Shack 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

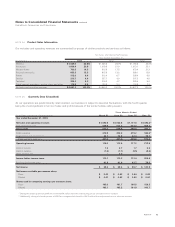

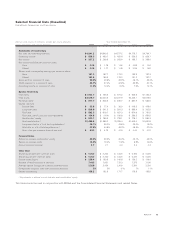

The components of the provision for income taxes and a

reconciliation of the U.S. statutory tax rate to our effective

income tax rate are given in the two accompanying tables.

Income Tax Expense (Benefit)

Year Ended December 31,

(In millions) 2004 2003 2002

Current:

Federal $140.6 $117.5 $127.3

State 21.1 21.9 13.3

Foreign 4.6 3.3 3.3

166.3 142.7 143.9

Deferred:

Federal 36.1 33.5 17.5

State 2.5 (1.9) 0.1

38.6 31.6 17.6

Provision for income taxes $204.9 $174.3 $161.5

Statutory vs. Effective Tax Rate

Year Ended December 31,

(In millions) 2004 2003 2002

Components of income from

continuing operations:

United States $520.3 $456.5 $408.8

Foreign 21.8 16.3 16.1

Income before income taxes 542.1 472.8 424.9

Statutory tax rate x 35.0% x 35.0% x 35.0%

Federal income tax expense

at statutory rate 189.7 165.5 148.7

State income taxes,

net of federal benefit 15.4 13.0 8.7

Non-deductible goodwill –– 2.8

Other, net (0.2) (4.2) 1.3

Total income tax expense $204.9 $174.3 $161.5

Effective tax rate 37.8% 36.9% 38.0%

We anticipate that we will generate sufficient pre-tax income

in the future to realize the full benefit of U.S. deferred tax

assets related to future deductible amounts. Accordingly, a

valuation allowance was not required at December 31, 2004

or 2003. Our tax returns are subject to examination by taxing

authorities in various jurisdictions. The Internal Revenue

Service is currently in the process of concluding its examina-

tion of our federal income tax returns for the taxable years

from 1993 through 2001. Several states are also currently in

the process of examining our state income tax returns. We

record tax reserves based on our best estimate of current

tax exposures in the relevant jurisdictions. While we believe

that the reserves recorded in the consolidated financial state-

ments accurately reflect our tax exposures, our actual tax lia-

bilities may ultimately differ from those estimates if we prevail

in matters for which accruals have been established, or if taxing

authorities successfully challenge the tax treatment upon which

our management has based its estimates. Accordingly, our

effective tax rate for a particular period may materially change.

The American Jobs Creation Act of 2004 (“AJC Act”) was

signed into law on October 22, 2004, and provides a one-time

elective incentive to repatriate foreign earnings by providing an

85% dividends received deduction, reducing the effective fed-

eral income tax rate on such earnings from 35% to 5.25%. The

earnings must be reinvested in the U.S. under a qualified plan

that has been approved by our CEO and Board of Directors. We

are currently assessing the impact that the AJC Act might have

with respect to our foreign earnings, primarily in Asia. We are

unable to quantify any tax benefit that might be received from

the repatriation of our foreign earnings in the future, or the

effect this repatriation might have on our effective tax rate.

However, we do not expect that any repatriation would

materially affect our results of operations or financial position.

NOTE 14 Litigation

On July 28, 2003, we received payment of $15.7 million

resulting from the favorable settlement of a lawsuit we had

previously filed. We recorded this settlement in the accompa-

nying Consolidated Statement of Income in the third quarter

of 2003 as other income of $10.7 million, net of legal expens-

es of $5.0 million paid as a result of the lawsuit.

In October 2002, a court approved the final settlement of

$29.9 million in a class action lawsuit, which was originally

filed in March 2000 in Orange County, California. Actual pay-

ments under this lawsuit totaled $29.0 million. The lawsuit

related to the alleged miscalculation of overtime wages for

certain of our former and current employees in that state.

Notes to Consolidated Financial Statements continued

RadioShack Corporation and Subsidiaries

47

AR2004