Radio Shack 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

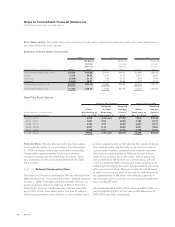

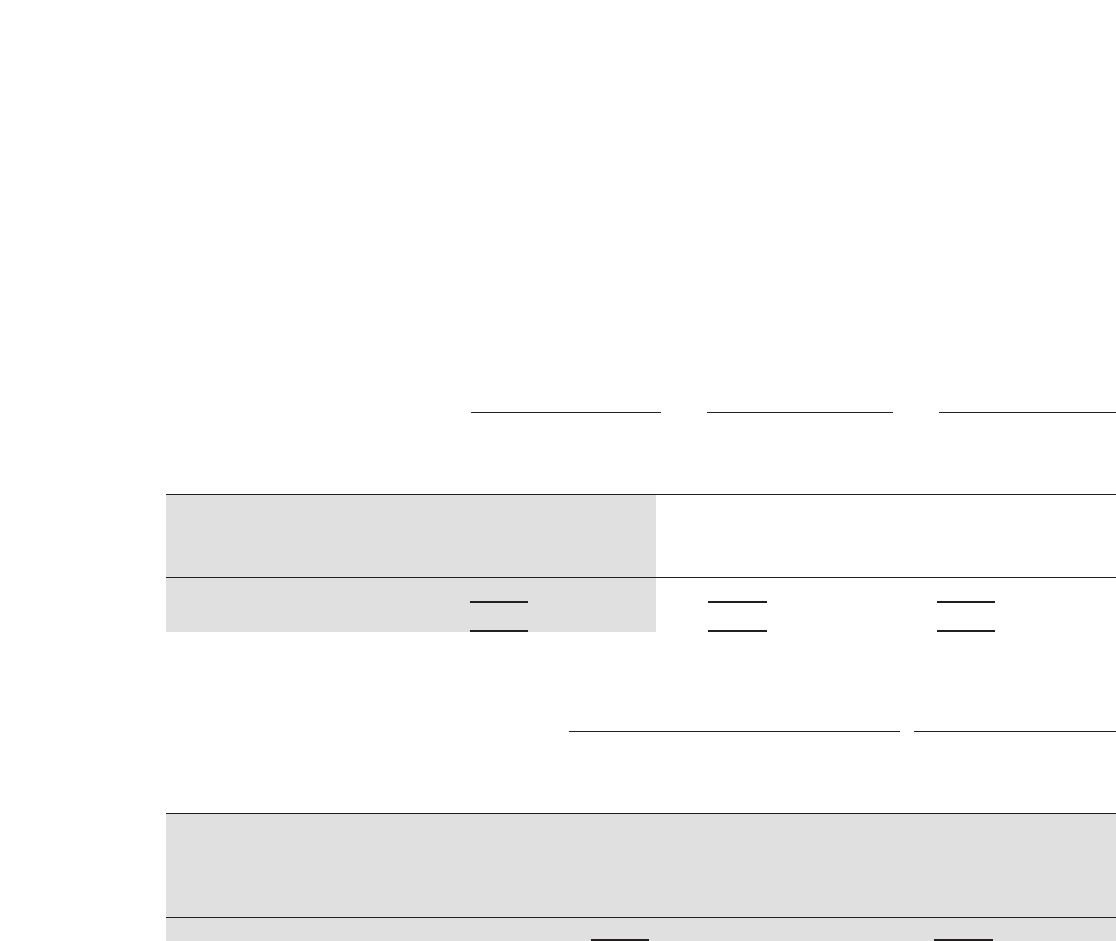

Stock Option Activity: See tables below for a summary of stock option transactions under our stock option plans and informa-

tion about fixed price stock options.

Summary of Stock Option Transactions

2004 2003 2002

Weighted Weighted Weighted

Average Average Average

Exercise Exercise Exercise

(Share amounts in thousands) Shares Price Shares Price Shares Price

Outstanding at beginning of year 23,889 $32.85 22,816 $34.32 22,869 $34.34

Grants 1,256 34.97 3,541 21.31 1,515 28.80

Exercised (2,399) 21.17 (755) 20.72 (525) 17.50

Forfeited (1,843) 38.87 (1,713) 33.85 (1,043) 35.23

Outstanding at end of year 20,903 $33.79 23,889 $32.85 22,816 $34.32

Exercisable at end of year 17,295 $35.27 17,438 $34.99 14,227 $34.25

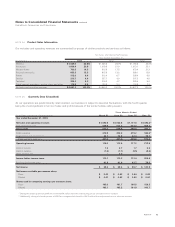

Fixed Price Stock Options

Options Outstanding Options Exercisable

Weighted Weighted Weighted

Shares Average Average Shares Average

(Share amounts in thousands) Outstanding at Remaining Exercise Exercisable at Exercise

Range of Exercise Prices Dec. 31, 2004 Contractual Life Price Dec. 31, 2004 Price

$ 10.05 – 23.00 3,823 4.73 years $19.69 1,873 $18.48

25.00 – 28.12 2,807 3.94 26.48 2,792 26.47

28.55 – 37.19 4,740 4.67 30.69 3,097 29.13

38.35 – 38.35 4,237 6.14 38.35 4,237 38.35

38.41 – 69.34 5,296 5.01 46.96 5,296 46.96

$ 10.05 – 69.34 20,903 4.97 years $33.79 17,295 $35.28

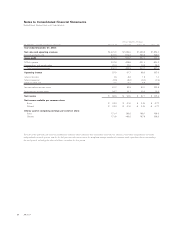

or stock acquired under an NQ exercise that would otherwise

vest. Cash deferrals may be made in our common stock or

mutual funds; however, restricted stock deferrals and defer-

rals of stock acquired under an NQ exercise may only be

made in our common stock. We match 12% of salary and

bonus deferrals in the form of our common stock. We will

match an additional 25% of salary and bonus deferrals if the

deferral period exceeds five years and the deferrals are invest-

ed in our common stock. Payment of deferrals will be made

in cash or our common stock in accordance with the employ-

ee’s specifications at the time of the deferral; payments to

the employee will be in a lump sum or in annual installments

not to exceed 20 years.

We contributed $0.9 million, $0.4 million and $0.5 million to

the Compensation Plans for the years ended December 31,

2004, 2003 and 2002, respectively.

Restricted Stock: We may also use restricted stock grants

to compensate certain of our employees. As of December

31, 2004, no shares of restricted stock were outstanding.

Compensation expense related to restricted shares is

recognized ratably over the related service period. There

was no expense for the years ended December 31, 2004,

2003 or 2002.

NOTE 17 Deferred Compensation Plans

The Executive Deferred Compensation Plan and the Executive

Deferred Stock Plan (“Compensation Plans”) became effective

on April 1, 1998. These plans permit employees who are cor-

porate or division officers to defer up to 80% of their base

salary and/or bonuses. Certain executive officers may defer

up to 100% of their base salary and/or bonuses. In addition,

officers are permitted to defer delivery of any restricted stock

Notes to Consolidated Financial Statements

RadioShack Corporation and Subsidiaries

50 AR2004