Radio Shack 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements continued

RadioShack Corporation and Subsidiaries

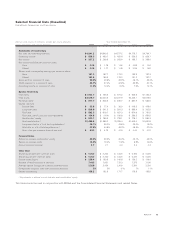

applicable, are unable to fulfill these obligations, we would

be responsible for rent due under the leases. Our rent expo-

sure from the remaining undiscounted lease commitments

with no projected sublease income is approximately $154

million. However, we have no reason to believe that CompUSA

or the other assignees will not fulfill their obligations under

these leases or that we would be unable to sublet the

properties; consequently, we do not believe there will be a

material impact on our consolidated financial statements as

a result of the eventual resolution of these lease obligations.

Purchase Obligations: We have purchase obligations of

$485.9 million at December 31, 2004, which include our

product commitments, marketing agreements and freight

commitments. Of this amount, $464.2 million relates to 2005.

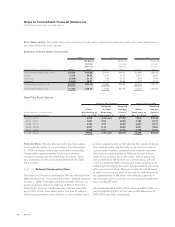

NOTE 16 Stock Options and Performance Awards

We have implemented several plans to award employees stock-

based compensation. Under the Incentive Stock Plans (“ISPs”)

described below, the exercise price of options must be equal to

or greater than the fair market value of a share of our common

stock on the date of grant. The 1997, 1999 and 2001 ISPs each

terminate after ten years; no option or award may be granted

under the ISPs after the ISP termination date. The Management

Development and Compensation Committee of our Board of

Directors specifies the terms for grants of options under these

ISPs; terms of these options may not exceed 10 years. Grants

of options generally vest over three years and grants typically

have a term of seven or 10 years. Option agreements issued

under the ISPs generally provide that, in the event of a change

in control, all options become immediately and fully exercisable.

Repricing or exchanging options for lower priced options is not

permitted under the ISPs without shareholder approval.

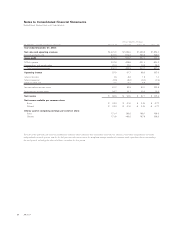

In 2004 the stockholders approved the RadioShack 2004

Deferred Stock Unit Plan for Non-Employee Directors

(“Deferred Plan”). The Deferred Plan replaced the one-time

and annual stock option grants to non-employee directors

(“Directors”) as specified in the 1997, 1999 and 2001 ISPs.

New Directors will receive a one-time grant of 5,000 deferred

stock units (“Units”) on the date they attend their first Board

meeting. Each Director who has served one year or more as of

June 1 of any year will automatically be granted 3,500 Units

on the first business day of June of each year in which he or

she serves as a Director. Under the Deferred Plan, one-third of

the Units vest annually over three years from the date of grant.

Vesting may be accelerated under certain circumstances. At

termination of service, death, disability or change in control

of RadioShack, Directors will receive shares of common stock

equal to the number of vested Units. Directors may receive

these shares in a lump sum or they may defer receipt of these

shares in equal installments over a period of up to ten years.

A brief description of each of our stock plans follows:

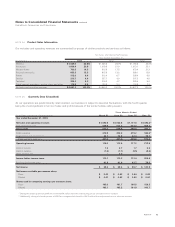

1993 Incentive Stock Plan (“1993 ISP”): The 1993 ISP

permitted the grant of up to 12.0 million shares in the form

of incentive stock options (“ISOs”), non-qualified stock

options (options which are not ISOs) (“NQs”) and restricted

stock. There were no shares available on December 31, 2004,

for grants under the 1993 ISP. The 1993 ISP expired March

28, 2003, and no further grants may be made under this plan.

1994 Stock Incentive Plan (“1994 SIP”): As part of our pur-

chase of AmeriLink in 1999 (see Note 6), we assumed the

existing AmeriLink 1994 Stock Incentive Plan and certain

related agreements and agreed to convert AmeriLink’s stock

options to stock options to purchase our stock, subject to an

agreed upon exchange ratio and conversion price. Thus, the

AmeriLink 1994 SIP was assumed and adopted by us in 1999.

All options in the 1994 SIP were fully vested on the date of

transition and management has determined that no further

grants will be made under this plan; there were no shares

available for grant at December 31, 2004, under the 1994

SIP. There were also certain restricted stock agreements that

were assumed by us at the time of acquisition. On September

10, 2003, we sold AmeriLink.

1997 Incentive Stock Plan (“1997 ISP”): The 1997 ISP permits

the grant of up to 11.0 million shares in the form of ISOs, NQs

and restricted stock. The 1997 ISP provides that the maximum

number of shares of our common stock that an eligible employ-

ee may receive in any calendar year with respect to options

may not exceed 1.0 million shares. There were 705,944 shares

available on December 31, 2004, for grants under the 1997 ISP.

1999 Incentive Stock Plan (“1999 ISP”): The 1999 ISP permits

the grant of up to 9.5 million shares in the form of NQs.

Grants of restricted stock, performance awards and options

intended to qualify as ISO’s under the Internal Revenue Code

are not authorized under the 1999 ISP. The 1999 ISP provides

that the maximum number of shares of our common stock

that an eligible employee may receive in any calendar year

with respect to options may not exceed 1.0 million shares.

There were 493,316 shares available on December 31, 2004,

for grants under the 1999 ISP.

2001 Incentive Stock Plan (“2001 ISP”): The 2001 ISP permits

the grant of up to 9.2 million shares in the form of ISOs and

NQs. The 2001 ISP provides that the maximum number of

shares of our common stock that an eligible employee may

receive in any calendar year with respect to options may not

exceed 0.5 million shares. There were 5,613,018 shares avail-

able on December 31, 2004, for grants under the 2001 ISP.

49

AR2004