Quest Diagnostics 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

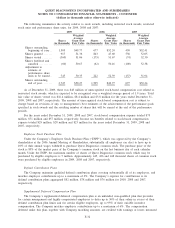

and to determine the designations, preferences, rights and restrictions of such shares. Of the authorized shares,

1,300,000 shares have been designated Series A Preferred Stock and 1,000 shares have been designated Voting

Cumulative Preferred Stock. No shares are currently outstanding.

Common Stock

On May 4, 2006, the Company’s Restated Certificate of Incorporation was amended to increase the number

of authorized shares of common stock, par value $0.01 per share, from 300 million shares to 600 million shares.

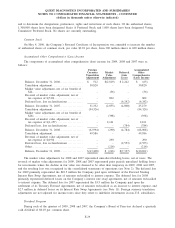

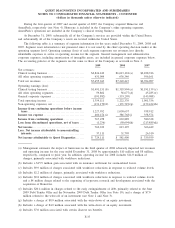

Accumulated Other Comprehensive (Loss) Income

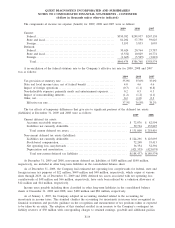

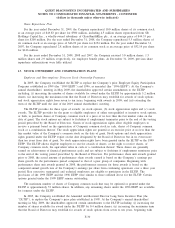

The components of accumulated other comprehensive (loss) income for 2009, 2008 and 2007 were as

follows:

Foreign

Currency

Translation

Adjustment

Market

Value

Adjustment

Deferred

Gain

(Loss)

Accumulated

Other

Comprehensive

(Loss) Income

Balance, December 31, 2006 .................. $ 512 $(2,819) $ 2,242 $ (65)

Translation adjustment ........................ 30,820 - - 30,820

Market value adjustment, net of tax benefit of

$24. . . . .................................... - (36) - (36)

Reversal of market value adjustment, net of

tax expense of $(510) ...................... - 802 - 802

Deferred loss, less reclassifications . . . ......... - - (6,242) (6,242)

Balance, December 31, 2007 .................. 31,332 (2,053) (4,000) 25,279

Translation adjustment ........................ (94,326) - - (94,326)

Market value adjustment, net of tax benefit of

$261 . . .................................... - (398) - (398)

Reversal of market value adjustment, net of

tax expense of $(1,257) . . .................. - 2,161 - 2,161

Deferred loss, less reclassifications . . . ......... - - (784) (784)

Balance, December 31, 2008 .................. (62,994) (290) (4,784) (68,068)

Translation adjustment ........................ 49,586 - - 49,586

Reversal of market value adjustment, net of

tax expense of $(190) ...................... - 290 - 290

Deferred loss, less reclassifications . . . ......... - - (2,553) (2,553)

Other ........................................ - (216) - (216)

Balance, December 31, 2009 .................. $(13,408) $ (216) $(7,337) $(20,961)

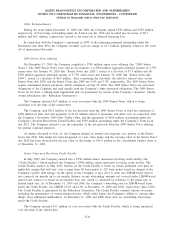

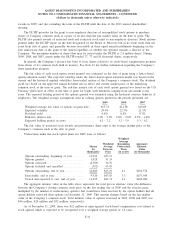

The market value adjustments for 2008 and 2007 represented unrealized holding losses, net of taxes. The

reversal of market value adjustments for 2009, 2008 and 2007 represented prior periods unrealized holding losses

for investments where the decline in fair value was deemed to be other than temporary in 2009, 2008 and 2007,

and the resulting loss was recognized in the consolidated statements of operations (see Note 2). The deferred loss

for 2009 primarily represented the $10.5 million the Company paid upon settlement of the Forward Starting

Interest Rate Swap Agreements, net of amounts reclassified to interest expense. The deferred loss for 2008

primarily represented deferred losses on the Company’s interest rate swap agreements, net of amounts reclassified

to interest expense. The deferred loss for 2007 represented the $3.5 million the Company paid upon the

settlement of its Treasury Forward Agreements, net of amounts reclassified as an increase to interest expense, and

$2.7 million in deferred losses on its Interest Rate Swap Agreements (see Note 11). Foreign currency translation

adjustments are not adjusted for income taxes since they relate to indefinite investments in non-U.S. subsidiaries.

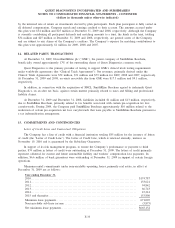

Dividend Program

During each of the quarters of 2009, 2008 and 2007, the Company’s Board of Directors declared a quarterly

cash dividend of $0.10 per common share.

F-29

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)