Quest Diagnostics 2009 Annual Report Download - page 84

Download and view the complete annual report

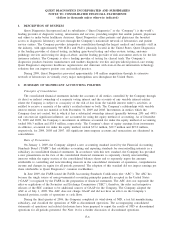

Please find page 84 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Comprehensive Income (Loss)

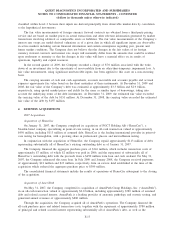

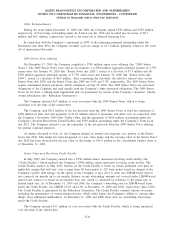

Comprehensive income (loss) encompasses all changes in stockholders’ equity (except those arising from

transactions with stockholders) and includes net income, net unrealized capital gains or losses on available-for-

sale securities, foreign currency translation adjustments and deferred gains and losses related to certain derivative

financial instruments (see Note 12). Total comprehensive income, including the amount attributable to

noncontrolling interests, was $813 million, $520 million and $392 million for the years ended December 31,

2009, 2008 and 2007, respectively.

Subsequent Events

The management of the Company has evaluated the period after the balance sheet date up through February

17, 2010, which is the date that the consolidated financial statements were issued, and determined that there were

no subsequent events or transactions that required recognition in the consolidated financial statements. Refer to

Note 18 for a discussion of subsequent events that are only required to be disclosed.

New Accounting Standards

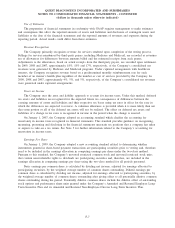

On January 1, 2009, the Company adopted a new accounting standard issued by the FASB related to

accounting for business combinations using the acquisition method of accounting (previously referred to as the

purchase method). Among the significant changes, this standard requires a redefining of the measurement date of

a business combination, expensing direct transaction costs as incurred, capitalizing in-process research and

development costs as an intangible asset and recording a liability for contingent consideration at the measurement

date with subsequent re-measurements recorded in the results of operations. This standard also requires costs for

business restructuring and exit activities related to the acquired company to be included in the post-combination

financial results of operations and also provides new guidance for the recognition and measurement of contingent

assets and liabilities in a business combination. In addition, this standard requires several new disclosures,

including the reasons for the business combination, the factors that contribute to the recognition of goodwill, the

amount of acquisition related third-party expenses incurred, the nature and amount of contingent consideration,

and a discussion of pre-existing relationships between the parties. Transaction costs for potential business

combinations that had not closed by December 31, 2008 were written off on January 1, 2009 and were not

material.

The application of this standard was not material for business combinations completed in 2009, however, it

is likely to have a significant impact on how the Company allocates the purchase price of certain future business

combinations, including the recognition and measurement of assets acquired and liabilities assumed and the

expensing of direct transaction costs and costs to integrate the acquired business.

On January 1, 2009, the Company adopted a new accounting standard issued by the FASB that establishes

accounting and reporting standards for noncontrolling interests in a subsidiary in consolidated financial statements,

including deconsolidation of a subsidiary. This standard requires entities to record the acquisition of

noncontrolling interests in subsidiaries initially at fair value. In accordance with the requirements of this standard,

the Company has provided a new presentation on the face of the consolidated financial statements to separately

classify noncontrolling interests within the equity section of the consolidated balance sheets and to separately

report the amounts attributable to controlling and noncontrolling interests in the consolidated statements of

operations, comprehensive income and changes in equity for all periods presented. The adoption of this standard

did not impact earnings per share attributable to Quest Diagnostics’ common stockholders. There were no

changes in the Company’s ownership interests in subsidiaries or deconsolidation of subsidiaries for the year ended

December 31, 2009.

On January 1, 2009, the Company adopted a new accounting standard issued by the FASB related to the

disclosure of derivative instruments and hedging activities. This standard expanded the disclosure requirements

about an entity’s derivative financial instruments and hedging activities, including qualitative disclosures about

objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of and gains and

losses on derivative instruments, and disclosures about credit-risk-related contingent features in derivative

instruments.

F-14

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)