Quest Diagnostics 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Health information technologies. Demand is growing toward comprehensive care management solutions that

serve patients, payers and practitioners by improving access to patient data, increasing patient participation in care

management, reducing medical errors and improving clinical outcomes. There is an increasing focus on

interconnectivity, the ability to interact with other software and systems, and real time data aggregation.

Electronic medical records and patient health records continue to grow.

Customer and payer consolidation. Our customers and payers, including physicians, health insurance plans,

employers, pharmaceutical companies and others, have been consolidating. We expect that this trend will

continue. Consolidation is increasing customer and payer bargaining power, enhancing purchasing sophistication

and encouraging internalization of testing.

Highly competitive. The clinical testing industry remains fragmented, is highly competitive and is subject to

new competition. Competition is growing from non-traditional competitors. New market entrants with extensive

resources may make acquisitions or expand into our traditional areas of operations. We also are expanding into

new diagnostic testing areas that are highly competitive.

Legislative, regulatory and policy environment. Government oversight of and attention to the healthcare

industry in the United States is significant and increasing. The 2009 American Recovery and Reinvestment Act

included laws designed to expedite the implementation of electronic health records and build a national electronic

health infrastructure in the United States. In addition, there has been extensive discussion of U.S. federal

legislation to reform healthcare. It is not possible to predict whether U.S. federal legislation to reform healthcare

will be enacted, or the nature or impact of any such legislation.

Prevention and wellness. There is an increased awareness of the benefits of, and increased interest in,

preventative medicine and wellness. Consumers, employers, health plans and government agencies increasingly

are focusing on helping the healthy stay healthy, detecting symptoms among those at risk and providing

preventative care that helps avoid disease.

Globalization. There is a growing demand for healthcare services in emerging market countries.

Opportunities are arising to participate in the restructuring or growth of the healthcare systems in these countries.

Additionally, our customers are establishing positions outside the United States. Demographic changes globally

may also create opportunities.

Customers and Payers. We provide testing services to a broad range of customers, with orders for clinical

testing generally generated by physicians, hospitals and employers. In most cases, the customer that orders the

testing is not responsible for the payments for services. We consider a party that refers a test to us a “customer”

and a party that reimburses us a “payer.” Depending on the billing arrangement and applicable law, the payer

may be (1) a third party responsible for providing health insurance coverage to patients, such as a health

insurance plan, self-insured employer benefit fund, or the traditional Medicare or Medicaid program, (2) the

patient or (3) the physician or other party (such as a hospital, another laboratory or an employer) who referred

the testing to us.

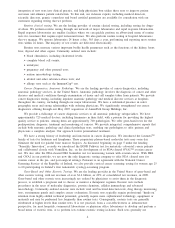

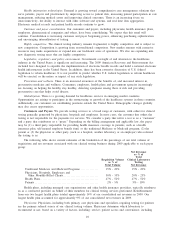

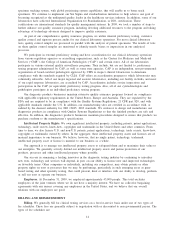

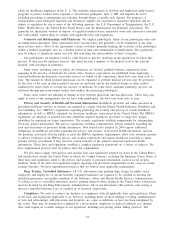

The following table shows current estimates of the breakdown of the percentage of our total volume of

requisitions and net revenues associated with our clinical testing business during 2009 applicable to each payer

group:

Requisition Volume

as % of

Total Volume

Net Revenues

as % of

Total

Clinical Laboratory

Testing

Net Revenues

Traditional Medicare and Medicaid Programs .............. 15% - 20% 15% - 20%

Physicians, Hospitals, Employers and

Other Monthly-Billed Clients. ........................... 30% - 35% 20% - 25%

Health Plans.............................................. 47% - 52% 47% - 52%

Patients .................................................. 2% - 5% 5% - 10%

Health plans, including managed care organizations and other health insurance providers, typically reimburse

us as a contracted provider on behalf of their members for clinical testing services performed. Reimbursement

from our two largest health plans totaled approximately 14% of our consolidated net revenues in 2009. Our

largest health plan accounted for approximately 9% of our consolidated net revenues in 2009.

Physicians. Physicians, including both primary care physicians and specialists, requiring testing for patients

are the primary referral source of our clinical testing volume. Physicians determine which laboratory to

recommend or use, based on a variety of factors, including: service; patient access and convenience, including

10