Quest Diagnostics 2009 Annual Report Download - page 65

Download and view the complete annual report

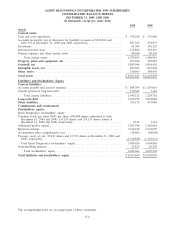

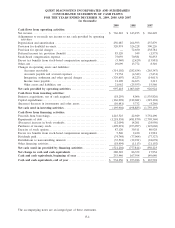

Please find page 65 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.driven by higher earnings in the current year. Days sales outstanding, a measure of billing and collection

efficiency, were 43 days at December 31, 2009 compared to 44 days at December 31, 2008.

Net cash provided by operating activities for 2008 was $1.1 billion compared to $927 million in 2007. This

increase was primarily due to higher earnings during 2008. Net cash provided by operating activities for the year

ended December 31, 2007 was reduced by $57 million of fees and other expenses paid in connection with the

acquisition of AmeriPath.

Cash Flows from Investing Activities

Net cash used in investing activities in 2009 was $196 million, consisting principally of capital expenditures

of $167 million. In addition, we completed several small acquisitions for a total of $39 million, which was

partially offset by $21 million related to the receipt of a payment from an escrow fund established at the time of

an acquisition in 2007.

Net cash used in investing activities in 2008 was $199 million, consisting principally of capital expenditures

of $213 million, partially offset by $23 million related to the receipt of a payment from an escrow fund

established at the time of an acquisition in 2007 and $6 million of proceeds from the sale of an investment in

the first quarter of 2008.

Cash Flows from Financing Activities

Net cash used in financing activities in 2009 was $521 million, consisting primarily of purchases of treasury

stock totaling $500 million, dividend payments of $75 million and $10.5 million in payments to settle certain

forward-starting interest rate swap agreements, partially offset by $93 million in proceeds from the exercise of

stock options, including related tax benefits, and net increases in debt of $27 million. The $500 million in

treasury stock purchases represents 10 million of our common shares purchased at an average price of $49.83 per

share. The net increase in debt consists of $1.25 billion of borrowings and $1.22 billion of repayments.

During 2009, borrowings under our secured receivables credit facility totaled $510 million and were used

primarily to fund the NID settlement payments totaling $308 million and $150 million to fund the retirement of

debt in connection with our debt tender offer in June 2009. In addition, we completed a $750 million senior

notes offering in November 2009 (the “2009 Senior Notes”). We issued the notes principally to repay certain

debt maturing through 2011 and refinance it over a longer term. The 2009 Senior Notes were sold in two

tranches: (a) $500 million of 4.75% senior notes due 2020 issued at a discount of $7.5 million; and $250 million

of 5.75% senior notes due 2040, issued at a discount of $6.9 million. We used the net proceeds from the 2009

Senior Notes offering to fund the retirement of $150 million of debt in connection with our debt tender offer in

November 2009, and the repayment of $100 million outstanding under our secured receivables credit facility and

$350 million outstanding under our term loan due May 2012. The 2009 Senior Notes are further described in

Note 10 to the Consolidated Financial Statements.

Debt repayments of $1.22 billion primarily consisted of $510 million on our secured receivables credit

facility, $350 million on our term loan due May 2012 and $350 million of repayments in connection with our

debt tender offers in June 2009 and November 2009.

In connection with our June 2009 debt tender offer, we repaid $174 million of aggregate principal amount

outstanding under our 5.125% senior notes due 2010 and $26 million of aggregate principal amount outstanding

under our 7.50% senior notes due 2011. Total cash payments of $206 million, including approximately $6 million

related to premiums and other costs incurred to purchase the notes, were funded with cash on-hand and $150

million of borrowings under our secured receivables credit facility.

In connection with our November 2009 debt tender offer, we repaid $61 million of aggregate principal

amount outstanding under our 5.125% senior notes due 2010 and $89 million of aggregate principal amount

outstanding under our 7.50% senior notes due 2011. Total cash payments of $162 million, including

approximately $12 million related to premiums and other costs incurred to purchase the notes, were funded with

a portion of the net proceeds from our 2009 Senior Notes offering.

In December 2009, we amended our existing receivables securitization facility and increased it from $500

million to $525 million. The secured receivables credit facility continues to be supported by back-up facilities

provided on a committed basis by two banks: (a) $275 million, which matures on December 10, 2010 and (b)

$250 million, which also matures on December 10, 2010. Interest on the secured receivables credit facility is

based on rates that are intended to approximate commercial paper rates for highly-rated issuers. There were no

borrowings outstanding under this facility at December 31, 2009.

55