Quest Diagnostics 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

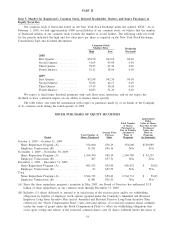

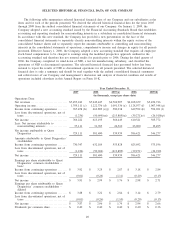

2009 2008 2007(a) 2006 2005(b)

Year Ended December 31,

(in thousands, except per share data)

Balance Sheet Data (at end of year):

Cash and cash equivalents . . . ............ $ 534,256 $ 253,946 $ 167,594 $ 149,640 $ 92,130

Accounts receivable, net................. 827,343 832,873 881,967 774,414 732,907

Goodwill, net ........................... 5,083,944 5,054,926 5,220,104 3,391,046 3,197,227

Total assets ............................. 8,563,643 8,403,830 8,565,693 5,661,482 5,306,115

Long-term debt ......................... 2,936,792 3,078,089 3,377,212 1,239,105 1,255,386

Total debt .............................. 3,107,299 3,083,231 3,540,793 1,555,979 1,592,225

Total Quest Diagnostics stockholders’

equity . . .............................. 3,989,639 3,604,896 3,324,242 3,019,171 2,762,984

Noncontrolling interests ................. 21,825 20,238 21,464 19,632 17,632

Total stockholders’ equity . . . ............ 4,011,464 3,625,134 3,345,706 3,038,803 2,780,616

Other Data:

Net cash provided by operating activities. $ 997,418 (q) $1,063,049 $ 926,924 $ 951,896 $ 851,583

Net cash used in investing activities . . . . . (195,904) (198,883) (1,759,193) (414,402) (1,079,793)

Net cash (used in) provided by financing

activities ............................. (521,204) (777,814) 850,223 (479,984) 247,038

Provision for doubtful accounts .......... 320,974 326,228 300,226 243,443 233,628

Rent expense ........................... 188,813 190,706 170,788 153,185 139,660

Capital expenditures..................... 166,928 212,681 219,101 193,422 224,270

Depreciation and amortization ........... 256,687 264,593 237,879 197,398 176,124

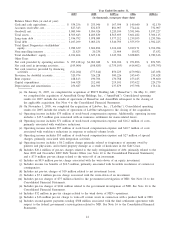

(a) On January 31, 2007, we completed the acquisition of POCT Holding AB, (“HemoCue”). On May 31, 2007,

we completed the acquisition of AmeriPath Group Holdings, Inc., (“AmeriPath”). Consolidated operating

results for 2007 include the results of operations of HemoCue and AmeriPath subsequent to the closing of

the applicable acquisition. See Note 4 to the Consolidated Financial Statements.

(b) On November 1, 2005, we completed the acquisition of LabOne, Inc., (“LabOne”).Consolidated operating

results for 2005 include the results of operations of LabOne subsequent to the closing of the acquisition.

(c) Operating income includes $75 million of stock-based compensation expense. Additionally, operating income

includes a $15.5 million gain associated with an insurance settlement for storm-related losses.

(d) Operating income includes $71 million of stock-based compensation expense and $16.2 million of costs,

primarily associated with workforce reductions.

(e) Operating income includes $57 million of stock-based compensation expense and $10.7 million of costs

associated with workforce reductions in response to reduced volume levels.

(f) Operating income includes $55 million of stock-based compensation expense and $27 million of special

charges, primarily associated with integration activities.

(g) Operating income includes a $6.2 million charge primarily related to forgiveness of amounts owed by

patients and physicians, and related property damage as a result of hurricanes in the Gulf Coast.

(h) Includes $20.4 million of pre-tax charges related to the early extinguishment of debt, primarily related to the

June 2009 and November 2009 Debt Tender Offers (see Note 10 to the Consolidated Financial Statements)

and a $7.0 million pre-tax charge related to the write-off of an investment.

(i) Includes an $8.9 million pre-tax charge associated with the write-down of an equity investment.

(j) Includes income tax benefits of $16.5 million, primarily associated with favorable resolutions of certain tax

contingencies.

(k) Includes net pre-tax charges of $10 million related to net investment losses.

(l) Includes a $7.1 million pre-tax charge associated with the write-down of an investment.

(m) Includes pre-tax charges of $75 million related to the government investigation of NID. See Note 16 to the

Consolidated Financial Statements.

(n) Includes pre-tax charges of $241 million related to the government investigation of NID. See Note 16 to the

Consolidated Financial Statements.

(o) Includes $32 million in pre-tax charges related to the wind down of NID’s operations.

(p) Includes a $16 million pre-tax charge to write-off certain assets in connection with a product hold at NID.

(q) Includes second quarter payments totaling $308 million associated with the final settlement agreement with

respect to the federal government’s investigation related to NID. See Note 16 to the Consolidated Financial

Statements.

41