Quest Diagnostics 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

is based on the Company’s ability to recover the asset from the expected future pre-tax cash flows (undiscounted

and without interest charges) of the related operations. If the expected undiscounted pre-tax cash flows are less

than the carrying amount of such asset, an impairment loss is recognized for the difference between the estimated

fair value and carrying amount of the asset.

Investments

The Company accounts for investments in trading and available-for-sale equity securities, which are included

in “other assets” in the consolidated balance sheets at fair value. Both realized and unrealized gains and losses

for trading securities are recorded currently in earnings as a component of non-operating expenses within “other

expense, net” in the consolidated statements of operations. Unrealized gains and losses, net of tax, for available-

for-sale securities are recorded as a component of “accumulated other comprehensive loss” within stockholders’

equity. Recognized gains and losses for available-for-sale securities are recorded in “other expense, net” in the

consolidated statements of operations. Gains and losses on securities sold are based on the average cost method.

The Company periodically reviews its investments to determine whether a decline in fair value below the

cost basis is other than temporary. The primary factors considered in the determination are: the length of time

that the fair value of the investment is below carrying value; the financial condition, operating performance and

near term prospects of the investee; and the Company’s intent and ability to hold the investment for a period of

time sufficient to allow for a recovery in fair value. If the decline in fair value is deemed to be other than

temporary, the cost basis of the security is written down to fair value.

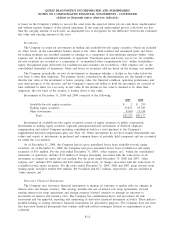

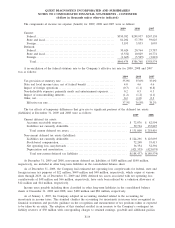

Investments at December 31, 2009 and 2008 consisted of the following:

2009 2008

Available-for-sale equity securities ...................................... $ 2 $ 255

Trading equity securities ............................................... 33,871 25,383

Other investments ...................................................... 8,360 15,539

Total ............................................................. $42,233 $41,177

Investments in available-for-sale equity securities consist of equity securities in public corporations.

Investments in trading equity securities represent participant-directed investments of deferred employee

compensation and related Company matching contributions held in a trust pursuant to the Company’s

supplemental deferred compensation plan (see Note 13). Other investments do not have readily determinable fair

values and consist of investments in preferred and common shares of privately held companies and are accounted

for under the cost method.

As of December 31, 2009, the Company had no gross unrealized losses from available-for-sale equity

securities. As of December 31, 2008, the Company had gross unrealized losses from available-for-sale equity

securities of $0.6 million. For the year ended December 31, 2009, “other expense, net,” within the consolidated

statements of operations, includes $7.8 million of charges principally associated with the write-down of an

investment accounted for under the cost method. For the years ended December 31, 2008 and 2007, “other

expense, net,” includes $8.9 million and $4.0 million, respectively, of charges associated with the write-down of

available-for-sale equity securities. For the years ended December 31, 2009, 2008 and 2007, gains (losses) from

trading equity securities totaled $6.0 million, $(9.9) million and $2.7 million, respectively, and are included in

“other expense, net.”

Derivative Financial Instruments

The Company uses derivative financial instruments to manage its exposure to market risks for changes in

interest rates and foreign currency. This strategy includes the use of interest rate swap agreements, forward

starting interest rate swap agreements and foreign currency forward contracts to manage its exposure to

movements in interest and currency rates. The Company has established policies and procedures for risk

assessment and the approval, reporting and monitoring of derivative financial instrument activities. These policies

prohibit holding or issuing derivative financial instruments for speculative purposes. The Company does not enter

into derivative financial instruments that contain credit-risk-related contingent features or requirements to post

collateral.

F-12

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)