Quest Diagnostics 2009 Annual Report Download - page 61

Download and view the complete annual report

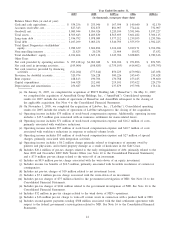

Please find page 61 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Tax Expense

The effective income tax rates for the years ended December 31, 2009 and 2008 were 37.5% and 36.8%,

respectively. The increase is primarily due to the favorable resolution of various tax contingencies reflected in the

effective income tax rate for 2008.

Discontinued Operations

Loss from discontinued operations, net of taxes, for the year ended December 31, 2009 was $1.2 million, or

$0.01 per diluted share, compared to a loss of $51 million, or $0.26 per diluted share, in 2008. During the third

quarter of 2008, the Company and NID reached an agreement in principle with the United States Attorney’s

Office to settle the previously disclosed federal government investigation of NID, a test kit subsidiary voluntarily

closed in 2006. As a result of the agreement in principle, during 2008, the Company recorded charges of $75

million in discontinued operations to increase its reserves for the settlement and related matters. On April 15,

2009, the Company entered into a final settlement agreement with the federal government and paid $308 million,

which had been previously reserved in connection with the final settlement. See Note 16 to the Consolidated

Financial Statements for further details.

Year Ended December 31, 2008 Compared with Year Ended December 31, 2007

Continuing Operations

Income from continuing operations for the year ended December 31, 2008 was $632 million, or $3.22 per

diluted share, compared to $554 million, or $2.84 per diluted share, in 2007. The increase in income from

continuing operations was principally driven by revenue growth and actions we have taken to reduce our cost

structure.

Results for the year ended December 31, 2008 include charges totaling $25.1 million, or $0.08 per diluted

share consisting of: a third quarter charge of $8.9 million, or $0.03 per diluted share, associated with the write-

down of an equity investment; and a fourth quarter charge of $16.2 million, or $0.05 per diluted share, primarily

associated with workforce reductions. These charges were offset by favorable resolutions of various tax

contingencies in 2008, which increased diluted earnings per share by $0.08.

In addition, for 2008 we estimate the impact of hurricanes in the third quarter of 2008 adversely impacted

operating income for the year ended December 31, 2008 by approximately $8 million, or $0.02 per diluted share,

compared to the prior year.

During the first quarter of 2007, we became a non-contracted provider to United Healthcare Group Inc.,

(“UNH”). As a result of the change in status, our revenues and earnings were significantly impacted for the first

quarter and full year 2007. However, the ongoing profit impact was successfully mitigated by the end of 2007 as

a result of our actions to reduce costs, and higher reimbursement for the testing we continued to perform for

UNH members as a non-contracted provider.

Results for the year ended December 31, 2007 include first quarter pre-tax charges of $10.7 million, or

$0.03 per diluted share, associated with workforce reductions in response to reduced volume levels, and a first

quarter pre-tax charge of $4.0 million, or $0.01 per diluted share, related to in-process research and development

expense associated with the acquisition of HemoCue, a Sweden-based company specializing in point-of-care

testing.

Net Revenues

Net revenues for the year ended December 31, 2008 grew by 8.1% over the prior year level to $7.2 billion,

with the carry-over impact from the 2007 acquisition of AmeriPath Group Holdings, Inc. (“AmeriPath”)

contributing approximately 5.0% to revenue growth in 2008.

For 2008, revenues of our clinical testing business, which accounts for over 90% of our net revenues, grew

8.3% above the prior year level, with AmeriPath contributing 5.5% growth. Volume, measured by the number of

requisitions, increased 2.7% for the year ended December 31, 2008, with 2.4% due to the impact of the

AmeriPath acquisition. Our pre-employment drug testing volume, which accounted for approximately 7% of our

total volume in 2008, declined approximately 11% and reduced consolidated volume by approximately 1%. We

believe the volume decrease in pre-employment drug testing was principally due to slower hiring by employers

served by this business. Revenue per requisition increased 5.5% for the year ended December 31, 2008, with

51