Quest Diagnostics 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Senior Notes

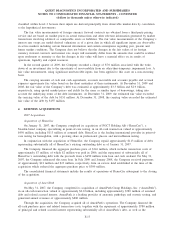

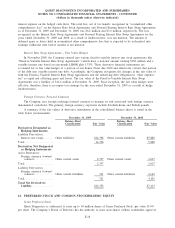

In 2001, the Company issued $275 million aggregate principal amount of 7.5% senior notes due 2011

(“Senior Notes due 2011”), issued at a discount of $1.1 million. After considering the discount, the effective

interest rate on the Senior Notes due 2011 is 7.6%. The Senior Notes due 2011 require semiannual interest

payments. The Senior Notes due 2011 are unsecured obligations of the Company and rank equally with the

Company’s other unsecured senior obligations. The Senior Notes due 2011 are guaranteed by the Subsidiary

Guarantors and do not have a sinking fund requirement. In connection with the Company’s June 2009 Debt

Tender Offer and November 2009 Debt Tender Offer, the Company repaid $26 million and $89 million,

respectively, outstanding under the Senior Notes due 2011.

On October 31, 2005, the Company completed its $900 million private placement of senior notes (the “2005

Senior Notes”). The 2005 Senior Notes were priced in two tranches: (a) $400 million aggregate principal amount

of 5.125% senior notes due November 2010 (“Senior Notes due 2010”); and (b) $500 million aggregate principal

amount of 5.45% senior notes due November 2015 (“Senior Notes due 2015”). The Senior Notes due 2010 and

2015 were issued at a discount of $0.8 million and $1.6 million, respectively. After considering the discounts, the

effective interest rates on the Senior Notes due 2010 and 2015 are 5.3% and 5.6%, respectively. The 2005 Senior

Notes require semiannual interest payments, which commenced on May 1, 2006. The 2005 Senior Notes are

unsecured obligations of the Company and rank equally with the Company’s other unsecured senior obligations.

The 2005 Senior Notes are guaranteed by the Subsidiary Guarantors. In connection with the Company’s June

2009 Debt Tender Offer and November 2009 Debt Tender Offer, the Company repaid $174 million and $61

million, respectively, outstanding under the Senior Notes due 2010.

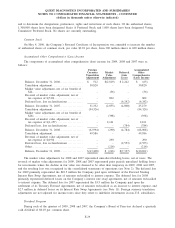

On June 22, 2007, the Company completed an $800 million senior notes offering (the “2007 Senior Notes”).

The 2007 Senior Notes were priced in two tranches: (a) $375 million aggregate principal amount of 6.40% senior

notes due July 2017 (the “Senior Notes due 2017”), issued at a discount of $0.8 million and (b) $425 million

aggregate principal amount of 6.95% senior notes due July 2037 (the “Senior Notes due 2037”), issued at a

discount of $4.7 million. After considering the discounts, the effective interest rates on the Senior Notes due

2017 and the Senior Notes due 2037 are 6.4% and 7.0%, respectively. The 2007 Senior Notes require semiannual

interest payments, which commenced on January 1, 2008. The 2007 Senior Notes are unsecured obligations of

the Company and rank equally with the Company’s other unsecured obligations. The 2007 Senior Notes do not

have a sinking fund requirement and are guaranteed by the Subsidiary Guarantors.

The Company incurred $6.3 million of costs associated with the 2007 Senior Notes, which is being

amortized over the term of the related debt.

The Company used the net proceeds from the 2007 Senior Notes to repay the $780 million of borrowings

under the Bridge Loan, as discussed above.

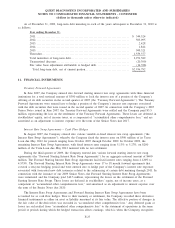

Debentures due June 2034

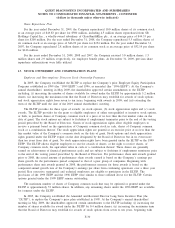

In connection with the acquisition of LabOne in November 2005, the Company assumed $103.5 million of

3.50% convertible senior debentures of LabOne due June 15, 2034 (the “Debentures due June 2034”). As a result

of the change in control of LabOne, $99 million of principal was converted for $126.8 million in cash in 2005.

The remaining outstanding principal of the Debentures due June 2034 totaling $4.5 million was adjusted to its

estimated fair value of $2.9 million on the date of the acquisition, reflecting a discount of $1.6 million based on

the net present value of the estimated remaining obligations, at then current interest rates. The Debentures due

June 2034 required semi-annual interest payments in June and December. During 2009, the remaining $4.5

million of principal outstanding under the Debentures due June 2034 was repaid in full.

F-26

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)