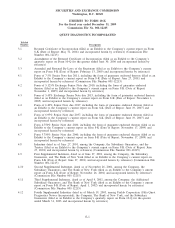

Quest Diagnostics 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During the first quarter of 2007 and second quarter of 2007, the Company acquired Hemocue and

AmeriPath, respectively (see Note 4). Hemocue is included in the Company’s other operating segments.

AmeriPath’s operations are included in the Company’s clinical testing business.

At December 31, 2009, substantially all of the Company’s services are provided within the United States,

and substantially all of the Company’s assets are located within the United States.

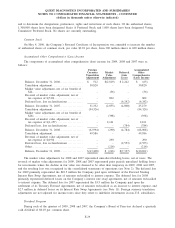

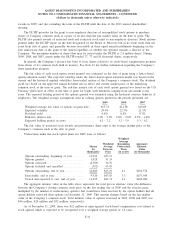

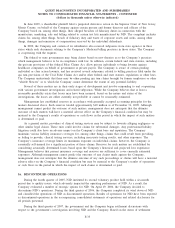

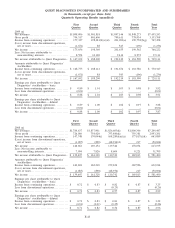

The following table is a summary of segment information for the years ended December 31, 2009, 2008 and

2007. Segment asset information is not presented since it is not used by the chief operating decision maker at the

operating segment level. Operating earnings (loss) of each segment represents net revenues less directly

identifiable expenses to arrive at operating income for the segment. General management and administrative

corporate expenses, including amortization of intangible assets, are included in general corporate expenses below.

The accounting policies of the segments are the same as those of the Company as set forth in Note 2.

2009 2008 2007

Net revenues:

Clinical testing business ............................. $6,824,149 $6,613,101 (a) $6,108,746

All other operating segments......................... 631,094 636,346 596,161

Total net revenues................................... $7,455,243 $7,249,447 $6,704,907

Operating earnings (loss):

Clinical testing business ............................. $1,491,131 (b) $1,318,904 (a) $1,191,139 (c)

All other operating segments......................... 59,862 56,677 (d) 45,285 (e)

General corporate expenses .......................... (191,882) (153,205) (145,088)

Total operating income .............................. 1,359,111 1,222,376 1,091,336

Non-operating expenses, net ......................... (131,179)(f) (171,719)(g) (152,424)(h)

Income from continuing operations before income

taxes ............................................. 1,227,932 1,050,657 938,912

Income tax expense ................................ 460,474 (i) 386,768 (j) 358,574

Income from continuing operations ................. 767,458 663,889 580,338

Loss from discontinued operations, net of taxes . . . . (1,236) (50,694)(k) (213,889)(k)

Net income ......................................... 766,222 613,195 366,449

Less: Net income attributable to noncontrolling

interests.......................................... 37,111 31,705 26,510

Net income attributable to Quest Diagnostics ....... $ 729,111 $ 581,490 $ 339,939

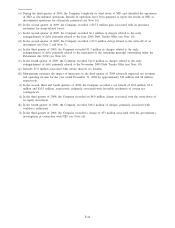

(a) Management estimates the impact of hurricanes in the third quarter of 2008 adversely impacted net revenues

and operating income for the year ended December 31, 2008 by approximately $10 million and $8 million,

respectively, compared to prior year. In addition, operating income for 2008 includes $14.0 million of

charges, primarily associated with workforce reductions.

(b) Includes a $15.5 million gain associated with an insurance settlement for storm-related losses.

(c) Includes $9.9 million of charges associated with workforce reductions in response to reduced volume levels.

(d) Includes $2.2 million of charges, primarily associated with workforce reductions.

(e) Includes $0.8 million of charges associated with workforce reductions in response to reduced volume levels,

and a $4 million charge related to the expensing of in-process research and development associated with the

acquisition of HemoCue.

(f) Includes $20.4 million in charges related to the early extinguishment of debt, primarily related to the June

2009 Debt Tender Offer and the November 2009 Debt Tender Offer (see Note 10), and a charge of $7.0

million related to the write-off of an investment (see Note 2 and Note 3).

(g) Includes a charge of $8.9 million associated with the write-down of an equity investment.

(h) Includes a charge of $4.0 million associated with the write-down of an equity investment.

(i) Includes $7.0 million associated with certain discrete tax benefits.

F-37

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)