Quest Diagnostics 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

capital. The contingent liabilities for tax positions primarily relate to uncertainties associated with the realization

of tax benefits derived from certain state net operating loss carryforwards, the allocation of income and expense

among state jurisdictions, the characterization and timing of certain tax deductions associated with business

combinations and employee compensation, income and expenses associated with certain intercompany licensing

arrangements, and the deductibility of certain settlement payments.

The recognition and measurement of certain tax benefits includes estimates and judgment by management

and inherently involves subjectivity. Changes in estimates may create volatility in the Company’s effective tax

rate in future periods and may be due to settlements with various tax authorities (either favorable or unfavorable),

the expiration of the statute of limitations on some tax positions and obtaining new information about particular

tax positions that may cause management to change its estimates.

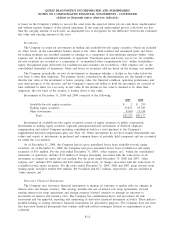

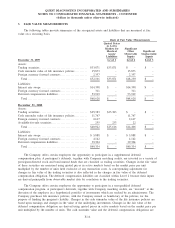

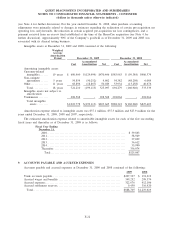

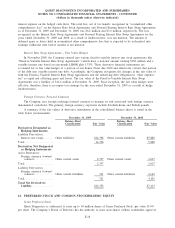

The total amount of unrecognized tax benefits as of and for the years ended December 31, 2009, 2008 and

2007 consists of the following:

2009 2008 2007

Balance, beginning of year................................ $ 70,877 $107,943 $ 91,856

Additions:

for tax positions of current year ...................... 69,219 3,775 14,341

for tax positions of prior years ....................... 22,462 3,916 14,698

Reductions:

Changes in judgment................................. (11,551) (32,684) (1,494)

Expirations of statutes of limitations . . . ............... (4,926) (2,724) (4,423)

Settlements .......................................... (19,627) (9,349) (7,035)

Balance, end of year ..................................... $126,454 $ 70,877 $107,943

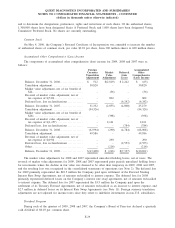

The total amount of unrecognized tax benefits as of December 31, 2009, that, if recognized, would affect the

effective income tax rate from continuing operations is $44 million. Based upon the expiration of statutes of

limitations, settlements and/or the conclusion of tax examinations, the Company believes it is reasonably possible

that the total amount of unrecognized tax benefits for the items previously discussed may decrease by up to $25

million within the next twelve months.

Accruals for interest expense on contingent tax liabilities are classified in income tax expense in the

consolidated statements of operations. Accruals for penalties have historically been immaterial. Interest expense

included in income tax expense in 2009 and 2007 was approximately $2 million and $6 million, respectively. As

a result of changes in judgment and favorable resolutions of uncertain tax positions, $5 million of net interest

was credited to income tax expense in 2008. As of December 31, 2009 and 2008, the Company has

approximately $7 million and $18 million, respectively, accrued, net of the benefit of a federal and state

deduction, for the payment of interest on uncertain tax positions. The Company does not consider this interest

part of its fixed charges.

In the regular course of business, various federal, state and local and foreign tax authorities conduct

examinations of the Company’s income tax filings and the Company generally remains subject to examination

until the statute of limitations expires for the respective jurisdiction. The Internal Revenue Service (“IRS”) has

completed its examinations of the Company’s consolidated federal income tax returns up through and including

the 2005 tax year. In addition, the IRS is currently conducting audits of the Company’s federal tax returns for its

2006 and 2007 tax years, and certain state tax authorities are conducting audits for various years between 2004

and 2008. In December 2008, the Company reached a settlement agreement to pay a state tax authority

approximately $44 million in taxes, penalties and interest ($26 million, net of federal and state benefits) for

certain tax positions associated with intercompany licensing arrangements. This settlement was paid in 2009. At

this time, the Company does not believe that there will be any material additional payments beyond its recorded

contingent liability reserves that may be required as a result of these tax audits. As of December 31, 2009, a

summary of the tax years that remain subject to examination for the Company’s major jurisdictions are:

United States – federal ............................................ 2006–2009

United States – various states ..................................... 2005–2009

F-20

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)