Quest Diagnostics 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Amended Employee Stock Purchase Plan (“ESPP”) based on the 15% discount at purchase. See Note 13 for a

further discussion of stock-based compensation.

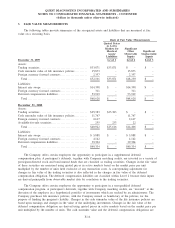

Fair Value Measurements

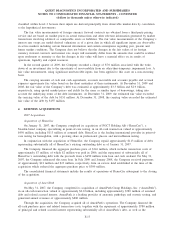

On January 1, 2008, the Company adopted a new standard related to the accounting for financial assets and

financial liabilities and items that are recognized or disclosed at fair value in the financial statements on a

recurring basis, at least annually. This standard provides a single definition of fair value and a common

framework for measuring fair value as well as new disclosure requirements for fair value measurements used in

financial statements. Fair value measurements are based upon the exit price that would be received to sell an

asset or paid to transfer a liability in an orderly transaction between market participants exclusive of any

transaction costs, and are determined by either the principal market or the most advantageous market. The

principal market is the market with the greatest level of activity and volume for the asset or liability. Absent a

principal market to measure fair value, the Company would use the most advantageous market, which is the

market that the Company would receive the highest selling price for the asset or pay the lowest price to settle

the liability, after considering transaction costs. However, when using the most advantageous market, transaction

costs are only considered to determine which market is the most advantageous and these costs are then excluded

when applying a fair value measurement. The adoption of this standard did not have a material effect on the

Company’s financial position, results of operations or cash flows.

On January 1, 2009, the Company adopted an accounting standard for applying fair value measurements to

certain assets, liabilities and transactions that are periodically measured at fair value. The adoption did not have a

material effect on the Company’s financial position, results of operations or cash flows. See Note 3 to the

consolidated financial statements for further details.

In August 2009, the FASB issued an amendment to the accounting standards related to the measurement of

liabilities that are routinely recognized or disclosed at fair value. This standard clarifies how a company should

measure the fair value of liabilities, and that restrictions preventing the transfer of a liability should not be

considered as a factor in the measurement of liabilities within the scope of this standard. This standard became

effective for the Company on October 1, 2009. The adoption of this standard did not have a material impact on

the Company’s consolidated financial statements.

The fair value accounting standard creates a three-level hierarchy to prioritize the inputs used in the

valuation techniques to derive fair values. The basis for fair value measurements for each level within the

hierarchy is described below with Level 1 having the highest priority and Level 3 having the lowest.

Level 1: Quoted prices in active markets for identical assets or liabilities.

Level 2: Quoted prices for similar assets or liabilities in active markets; quoted prices for

identical or similar instruments in markets that are not active; and model-derived

valuations in which all significant inputs are observable in active markets.

Level 3: Valuations derived from valuation techniques in which one or more significant inputs

are unobservable.

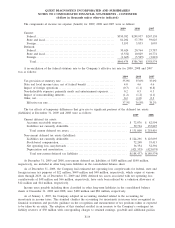

Foreign Currency

The Company predominately uses the U.S. dollar as its functional currency. The functional currency of the

Company’s foreign subsidiaries is the applicable local currency. Assets and liabilities denominated in non-U.S.

dollars are translated into U.S. dollars at exchange rates as of the end of the reporting period. Income and

expense items are translated at average exchange rates prevailing during the year. The translation adjustments are

recorded as a component of “accumulated other comprehensive loss” within stockholders’ equity. Gains and

losses from foreign currency transactions are included within “other operating (income) expense, net” in the

consolidated statements of operations. Transaction gains and losses have not been material. For a discussion of

the Company’s use of derivative financial instruments to manage its exposure for changes in foreign currency

rates refer to the caption entitled “Derivative Financial Instruments – Foreign Currency Risk” below.

F-9

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)