Quest Diagnostics 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

interest expense on the hedged cash flows. The total loss, net of tax benefit, recognized in “accumulated other

comprehensive loss” on the Interest Rate Swap Agreements and Forward Starting Interest Rate Swap Agreements

as of December 31, 2009 and December 31, 2008 was $6.2 million and $3.6 million, respectively. The loss

recognized on the Interest Rate Swap Agreements and Forward Starting Interest Rate Swap Agreements for the

years ended December 31, 2009 and 2008, as a result of ineffectiveness, was not material. The amount of

deferred gains or losses held in accumulated other comprehensive loss that is expected to be reclassified into

earnings within the next twelve months is not material.

Interest Rate Swap Agreements – Fair Value Hedges

In November 2009, the Company entered into various fixed-to-variable interest rate swap agreements (the

“Fixed-to-Variable Interest Rate Swap Agreements”) which have a notional amount totaling $350 million and a

variable interest rate based on one-month LIBOR plus 1.33%. These derivative financial instruments are

accounted for as fair value hedges of a portion of our Senior Notes due 2020 and effectively convert that portion

of the debt into variable interest rate debt. Accordingly, the Company recognizes the changes in the fair value of

both the Fixed-to-Variable Interest Rate Swap Agreements and the underlying debt obligation in “other expense,

net” as equal and offsetting gains and losses. The fair value of the Fixed-to-Variable Interest Rate Swap

Agreements was a liability of $14.4 million at December 31, 2009. Since inception, the fair value hedges were

effective; therefore, there is no impact on earnings for the year ended December 31, 2009 as a result of hedge

ineffectiveness.

Foreign Currency Forward Contracts

The Company uses foreign exchange forward contracts to manage its risk associated with foreign currency

denominated cash flows. The primary foreign currency exposures include Swedish krona and British pounds.

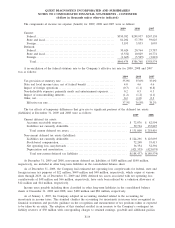

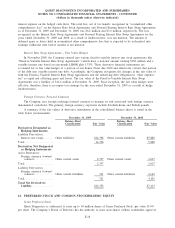

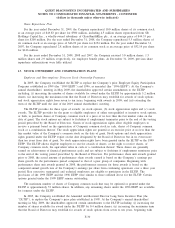

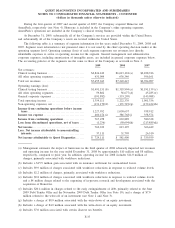

A summary of the fair values of derivative instruments in the consolidated balance sheets is stated in the

table below (in thousands):

Balance Sheet

Classification Fair Value

Balance Sheet

Classification Fair Value

December 31, 2009 December 31, 2008

Derivatives Designated as

Hedging Instruments

Liability Derivatives:

Interest rate swaps........ Other liabilities $14,398 Other current liabilities $5,888

Total. ...................... 14,398 5,888

Derivatives Not Designated

as Hedging Instruments

Asset Derivatives:

Foreign currency forward

contracts. . ............. Other current assets 2,357 Other current assets 2,617

Total. ...................... 2,357 2,617

Liability Derivatives:

Foreign currency forward

contracts. . ............. Other current liabilities 311 Other current liabilities 4,142

Total. ...................... 311 4,142

Total Net Derivatives

Liability ................. $12,352 $7,413

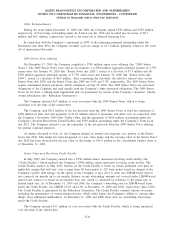

12. PREFERRED STOCK AND COMMON STOCKHOLDERS’ EQUITY

Series Preferred Stock

Quest Diagnostics is authorized to issue up to 10 million shares of Series Preferred Stock, par value $1.00

per share. The Company’s Board of Directors has the authority to issue such shares without stockholder approval

F-28

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)