Quest Diagnostics 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

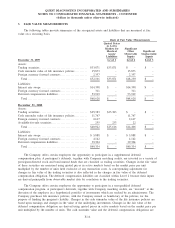

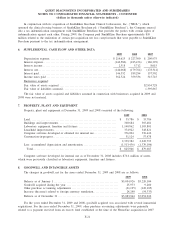

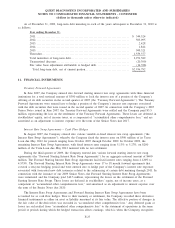

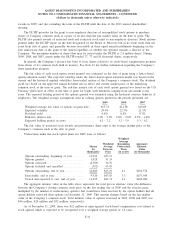

10. DEBT

Long-term debt at December 31, 2009 and 2008 consisted of the following:

2009 2008

Industrial Revenue Bonds due September 2009.............................. $ - $ 1,800

Senior Notes due November 2010 . . ........................................ 165,482 399,724

Senior Notes due July 2011 ................................................ 159,170 274,724

Term Loan due May 2012 ................................................. 742,000 1,092,000

Senior Notes due November 2015 . . ........................................ 499,067 498,907

Senior Notes due July 2017 ................................................ 374,400 374,320

Senior Notes due January 2020 ............................................ 478,115 -

Senior Notes due July 2037 ................................................ 420,683 420,526

Debentures due June 2034 ................................................. - 3,070

Senior Notes due January 2040 ............................................ 243,088 -

Other . . ................................................................... 25,294 18,160

Total long-term debt . ................................................. 3,107,299 3,083,231

Less: current portion of long-term debt ..................................... 170,507 5,142

Total long-term debt, net of current portion ............................ $2,936,792 $3,078,089

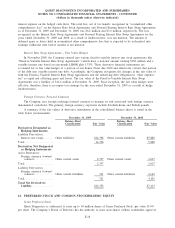

Early Extinguishment of Debt

For the years ended December 31, 2009 and 2008, the Company recorded $20.4 million and $0.9 million of

pre-tax charges related to the early extinguishment of debt, primarily related to the Company’s June 2009 and

November 2009 debt tender offers, the repayment of borrowings outstanding under the Term Loan due 2012 in

2009 and 2008, and the 2009 repayment of the remaining principal outstanding under the Debentures due June

2034.

June 2009 Debt Tender Offer

On May 19, 2009, the Company commenced a cash tender offer to purchase up to $200 million aggregate

principal amount of its 5.125% Senior Notes due 2010 and 7.50% Senior Notes due 2011. On June 16, 2009, the

Company finalized its cash tender offer (the “June 2009 Debt Tender Offer”) by purchasing $174 million

aggregate principal amount of its 5.125% Senior Notes Due 2010 and $26 million aggregate principal amount of

its 7.50% Senior Notes due 2011 that resulted in pre-tax losses of $4.8 million and $1.5 million, respectively.

The aggregate pre-tax loss of $6.3 million includes the write-off of $0.5 million of deferred financing fees and

unamortized discounts and cash payments of $5.8 million related to premiums and other costs to purchase the

5.125% Senior Notes due 2010 and the 7.5% Senior Notes due 2011 and is included in “other expense, net.” The

June 2009 Debt Tender Offer was financed with cash on-hand and $150 million of borrowings under the Secured

Receivables Credit Facility discussed below.

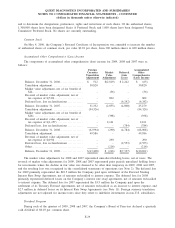

November 2009 Debt Tender Offer

In connection with the 2009 Senior Notes offering which is discussed below, on November 12, 2009, the

Company commenced a cash tender offer to purchase any and all of its outstanding 5.125% Senior Notes due

2010, and any and all of its outstanding 7.50% Senior Notes due 2011. On November 20, 2009, the Company

finalized its cash tender offer (the “November 2009 Debt Tender Offer”) by purchasing $61 million aggregate

principal amount of its 5.125% Senior Notes Due 2010 and $89 million aggregate principal amount of its 7.50%

Senior Notes due 2011 that resulted in pre-tax losses of $2.6 million and $9.4 million, respectively. The

aggregate pre-tax loss of $12.1 million includes the write-off of $0.3 million of deferred financing fees and

unamortized discounts and cash payments of $11.8 million related to premiums and other costs to purchase the

5.125% Senior Notes due 2010 and the 7.5% Senior Notes due 2011 and is included in “other expense, net.” The

November 2009 Debt Tender Offer was financed with the net proceeds from the Company’s 2009 Senior Notes

offering which is discussed below.

F-23

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)