Quest Diagnostics 2009 Annual Report Download - page 87

Download and view the complete annual report

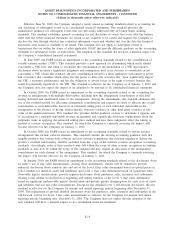

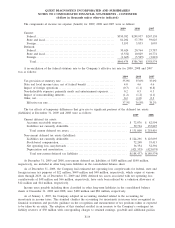

Please find page 87 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.classified within Level 2 because their inputs are derived principally from observable market data by correlation

to the hypothetical investments.

The fair value measurements of foreign currency forward contracts are obtained from a third-party pricing

service and are based on market prices in actual transactions and other relevant information generated by market

transactions involving identical or comparable assets or liabilities. The fair value measurements of the Company’s

interest rate swaps are model-derived valuations as of a given date in which all significant inputs are observable

in active markets including certain financial information and certain assumptions regarding past, present and

future market conditions. The Company does not believe that the changes in the fair values of its foreign

currency forward contracts and interest rate swaps will materially differ from the amounts that could be realized

upon settlement or maturity or that the changes in fair value will have a material effect on its results of

operations, liquidity and capital resources.

In the second quarter of 2009, the Company recorded a charge of $7.0 million associated with the write-

down of an investment due to the uncertainty of recoverability from an other-than-temporary impairment loss. A

fair value measurement, using significant unobservable inputs, has been applied to this asset on a non-recurring

basis.

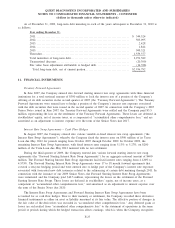

The carrying amounts of cash and cash equivalents, accounts receivable and accounts payable and accrued

expenses approximate fair value based on the short maturities of these instruments. At December 31, 2009 and

2008, the fair value of the Company’s debt was estimated at approximately $3.3 billion and $2.9 billion,

respectively, using quoted market prices and yields for the same or similar types of borrowings, taking into

account the underlying terms of the debt instruments. At December 31, 2009, the estimated fair value exceeded

the carrying value of the debt by $151 million. At December 31, 2008, the carrying value exceeded the estimated

fair value of the debt by $155 million.

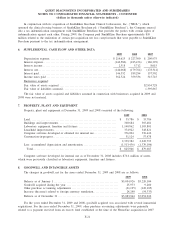

4. BUSINESS ACQUISITIONS

2007 Acquisitions

Acquisition of HemoCue

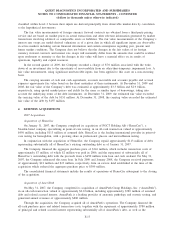

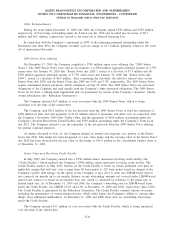

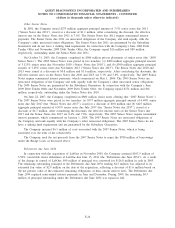

On January 31, 2007, the Company completed its acquisition of POCT Holding AB (“HemoCue”), a

Sweden-based company specializing in point-of-care testing, in an all-cash transaction valued at approximately

$450 million, including $113 million of assumed debt. HemoCue is the leading international provider in point-of-

care testing for hemoglobin, with a growing share in professional glucose and microalbumin testing.

In conjunction with the acquisition of HemoCue, the Company repaid approximately $113 million of debt,

representing substantially all of HemoCue’s existing outstanding debt as of January 31, 2007.

The Company financed the aggregate purchase price of $344 million, which includes transaction costs of

approximately $7 million, of which $2 million was paid in 2006, and the repayment of substantially all of

HemoCue’s outstanding debt with the proceeds from a $450 million term loan and cash on-hand. On May 31,

2007, the Company refinanced this term loan. In July 2009 and January 2008, the Company received payments

of approximately $21 million and $23 million, respectively from an escrow fund established at the time of the

acquisition which reduced the aggregate purchase price to $300 million.

The consolidated financial statements include the results of operations of HemoCue subsequent to the closing

of the acquisition.

Acquisition of AmeriPath

On May 31, 2007, the Company completed its acquisition of AmeriPath Group Holdings, Inc. (“AmeriPath”),

in an all-cash transaction valued at approximately $2.0 billion, including approximately $780 million of assumed

debt and related accrued interest. AmeriPath is a leading provider of anatomic pathology and esoteric testing, and

generated annual revenues of approximately $800 million.

Through the acquisition, the Company acquired all of AmeriPath’s operations. The Company financed the

all-cash purchase price and related transaction costs, together with the repayment of approximately $780 million

of principal and related accrued interest representing substantially all of AmeriPath’s debt, as well as the

F-17

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)