Quest Diagnostics 2009 Annual Report Download - page 104

Download and view the complete annual report

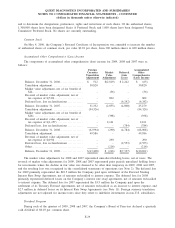

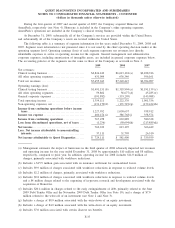

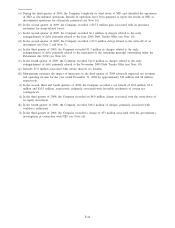

Please find page 104 of the 2009 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating lease rental expense for 2009, 2008 and 2007 aggregated $189 million, $190 million and $171

million, respectively. Rent expense associated with operating leases that include scheduled rent increases and

tenant incentives, such as rent holidays, is recorded on a straight-line basis over the term of the lease.

The Company has certain noncancelable commitments to purchase products or services from various

suppliers, mainly for telecommunications and standing orders to purchase reagents and other laboratory supplies.

At December 31, 2009, the approximate total future purchase commitments are $130 million, of which $51

million are expected to be incurred in 2010, $62 million are expected to be incurred in 2011 through 2012 and

the balance thereafter.

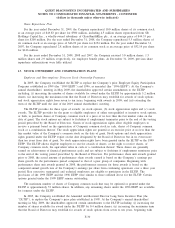

Contingent Lease Obligations

The Company remains subject to contingent obligations under certain real estate leases that were entered into

by certain predecessor companies of a subsidiary prior to the Company’s acquisition of the subsidiary. While the

title to the properties and interest to the subject leases have been transferred to third parties on several occasions

over the course of many years, the lessors have not released the subsidiary predecessor companies from their

original obligations under the leases and therefore remain contingently liable in the event of default. The

remaining terms of the lease obligations and the Company’s corresponding indemnifications range from 15 to 39

years. The lease payments under certain leases are subject to market value adjustments and therefore, the total

contingent obligations under the leases cannot be precisely determined but are likely to total several hundred

million dollars. A claim against the Company would be made only upon the current lessee’s default and after a

series of claims and corresponding defaults by third parties that precede the Company in the order of

indemnification. The Company also has certain indemnification rights from other parties to recover losses in the

event of default on the lease obligations. The Company believes that the likelihood of its performance under

these contingent obligations is remote and no liability has been recorded for any potential payments under the

contingent lease obligations.

Legal Matters

The Company is involved in various legal proceedings. Some of the proceedings against the Company

involve claims that are substantial in amount.

In 2005, the Company received a subpoena from the U. S. Attorney’s Office for the District of New Jersey.

The subpoena seeks the production of business and financial records regarding capitation and risk sharing

arrangements with government and private payers for the years 1993 through 1999. The Company cooperated

with the U. S. Attorney’s Office.

In 2005, the Company received a subpoena from the U. S. Department of Health and Human Services,

Office of the Inspector General, seeking business records including records regarding the Company’s relationship

with health maintenance organizations, independent physician associations, group purchasing organizations, and

preferred provider organizations relating back to 1995. The Company has cooperated with the investigation.

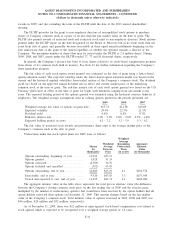

Subsequently, in November 2009, the U.S. District Court for the Southern District of New York partially

unsealed a civil complaint, U. S. ex rel. Fair Laboratory Practices Associates v. Quest Diagnostics Incorporated,

filed against the Company under the whistleblower provisions of the federal False Claims Act. The complaint

alleges, among other things, violations of the federal Anti-Kickback Statute and the federal False Claims Act in

connection with the Company’s pricing of laboratory services. The complaint seeks damages for alleged false

claims associated with laboratory tests reimbursed by government payors, treble damages and civil penalties.

In 2006 and 2008, the Company and several of its subsidiaries received subpoenas from the California

Attorney General’s Office seeking documents relating to the Company’s billings to MediCal, the California

Medicaid program. The Company has cooperated with the government’s requests. Subsequently, the State of

California intervened as plaintiff in a civil lawsuit, California ex rel. Hunter Laboratories, LLC v. Quest

Diagnostics Incorporated., et al., filed in California Superior Court against a number of clinical laboratories,

including the Company and several of its subsidiaries. The complaint alleges overcharging of MediCal for testing

services. The complaint was originally filed by a competitor laboratory in California under the whistleblower

provisions of the California False Claims Act. The complaint was unsealed on March 20, 2009.

F-34

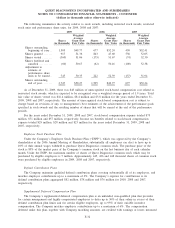

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)