Pizza Hut 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

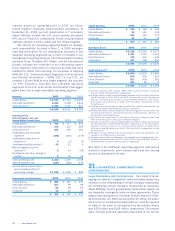

SelectedFinancialData

YUM!Brands,Inc.andSubsidiaries

(inmillions,exceptpershareandunitamounts) FiscalYear

2005 2004 2003 2002 2001

SummaryofOperations

Revenues

Companysales $ 8,225 $ 7,992 $ 7,441 $ 6,891 $ 6,138

Franchiseandlicensefees 1,124 1,019 939 866 815

Total 9,349 9,011 8,380 7,757 6,953

Facilityactions(a) (19) (26) (36) (32) (1)

Wrenchlitigationincome(expense)(b) 2 14 (42) — —

AmeriServeandother(charges)credits(c) 2 16 26 27 3

Operatingprofit 1,153 1,155 1,059 1,030 891

Interestexpense,net 127 129 173 172 158

Incomebeforeincometaxesandcumulative

effectofaccountingchange 1,026 1,026 886 858 733

Incomebeforecumulativeeffectofaccountingchange 762 740 618 583 492

Cumulativeeffectofaccountingchange,netoftax(d) — — (1) — —

Netincome 762 740 617 583 492

Basicearningspercommonshare(e) 2.66 2.54 2.10 1.97 1.68

Dilutedearningspercommonshare(e) 2.55 2.42 2.02 1.88 1.62

CashFlowData

Providedbyoperatingactivities(f)$ 1,238 $ 1,186 $ 1,099 $ 1,112 $ 851

Capitalspending,excludingacquisitions 609 645 663 760 636

Proceedsfromrefranchisingofrestaurants 145 140 92 81 111

Repurchasesharesofcommonstock 1,056 569 278 228 100

Dividendspaidoncommonshares 123 58 — — —

BalanceSheet

Totalassets $ 5,698 $ 5,696 $ 5,620 $ 5,400 $ 4,425

Long-termdebt 1,649 1,731 2,056 2,299 1,552

Totaldebt 1,860 1,742 2,066 2,445 2,248

OtherData

Numberofstoresatyearend

Company 7,587 7,743 7,854 7,526 6,435

UnconsolidatedAffiliates 1,648 1,662 1,512 2,148 2,000

Franchisees 22,666 21,858 21,471 20,724 19,263

Licensees 2,376 2,345 2,362 2,526 2,791

System 34,277 33,608 33,199 32,924 30,489

U.S.Companyblendedsamestoresalesgrowth(g) 4% 3% — 2% 1%

InternationalDivisionsystemsalesgrowth(h)

Reported 9% 14% 13% 6% —

Localcurrency(i) 6% 6% 5% 7% 7%

ChinaDivisionsystemsalesgrowth(h)

Reported 13% 23% 23% 25% 14%

Localcurrency(i) 11% 23% 23% 25% 17%

Sharesoutstandingatyearend(e) 278 290 292 294 293

Cashdividendsdeclaredpercommonshare $ 0.445 $ 0.30 — — —

Marketpricepershareatyearend(e)$ 46.88 $ 46.27 $ 33.64 $ 24.12 $ 24.62

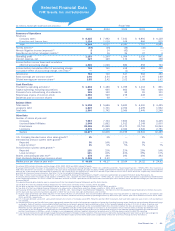

Fiscalyear2005includes53weeksandfiscalyears2004,2003,2002and2001include52weeks.

Fiscalyear2005includestheimpactoftheadoptionofStatementofFinancialAccountingStandards(“SFAS”)No.123R(Revised2004),“ShareBasedPayment,”(“SFAS123R”).Thisresultedina

$38milliondecreaseinnetincome,oradecreaseof$0.13tobasicanddilutedearningspersharefor2005.IfSFAS123Rhadbeeneffectiveforprioryearspresented,reportedbasicanddiluted

earningspersharewouldhavedecreased$0.12and$0.12,$0.12and$0.12,$0.14and$0.13,and$0.13and$0.13persharefor2004,2003,2002,and2001,respectively,consistentwith

previouslydisclosedpro-formainformation.SeeNote2totheConsolidatedFinancialStatements.

FromMay7,2002,resultsincludeLongJohnSilver’s(“LJS”)andA&WAll-AmericanFoodRestaurants(“A&W”),whichwereaddedwhenweacquiredYorkshireGlobalRestaurants,Inc.

Fiscalyear2002includestheimpactoftheadoptionofSFASNo.142,“GoodwillandOtherIntangibleAssets”(“SFAS142”).Asaresultweceasedamortizationofgoodwillandindefinite-lived

assetsbeginningDecember30,2001.IfSFAS142hadbeeneffectivefor2001,reportednetincomewouldhaveincreased$26millionandbothbasicanddilutedearningspersharewouldhave

increased$0.09.

TheselectedfinancialdatashouldbereadinconjunctionwiththeConsolidatedFinancialStatementsandtheNotesthereto.

(a) SeeNote4totheConsolidatedFinancialStatementsforadescriptionofFacilityactionsin2005,2004,and2003.

(b) SeeNote4andNote21totheConsolidatedFinancialStatementsforadescriptionofWrenchlitigationin2005,2004,and2003.

(c) SeeNote4totheConsolidatedFinancialStatementsforadescriptionofAmeriServeandothercharges(credits)in2005,2004,and2003.

(d) Fiscalyear2003includestheimpactoftheadoptionofSFASNo.143,“AccountingforAssetRetirementObligations.”SeeNote2totheConsolidatedFinancialStatementsforfurtherdiscussion.

(e) Pershareandshareamountshavebeenadjustedtoreflectthetwo-for-onestocksplitdistributedonJune17,2002.

(f) Allprioryearspresentedhavebeenadjustedforthereclassificationofdistributionsfromunconsolidatedaffiliatesfrominvestingactivitiestooperatingactivitiesinaccordancewith

SFASNo.95,“StatementofCashFlows.”Thesereclassificationsincreasednetcashprovidedbyoperatingactivitiesby$55million,$46million,$24millionand$19millionfor2004,2003,

2002,and2001,respectively.

(g)U.S.Companyblendedsame-storesalesgrowthincludestheresultsofCompanyownedKFC,PizzaHutandTacoBellrestaurantsthathavebeenopenoneyearormore.LJSandA&Ware

notincluded.

(h) InternationalDivisionandChinaDivisionsystemsalesgrowthincludestheresultsofallrestaurantsregardlessofownership,includingCompanyowned,franchise,unconsolidatedaffiliateandlicense

restaurants.Salesoffranchise,unconsolidatedaffiliateandlicenserestaurantsgeneratefranchiseandlicensefeesfortheCompany(typicallyatarateof4%to6%ofsales).Franchise,unconsoli-

datedaffiliateandlicenserestaurantsalesarenotincludedinCompanysaleswepresentontheConsolidatedStatementsofIncome;however,thefeesareincludedintheCompany’srevenues.

Webelievesystemsalesgrowthisusefultoinvestorsasasignificantindicatoroftheoverallstrengthofourbusinessasitincorporatesallourrevenuedrivers,Companyandfranchisesamestore

salesaswellasnetunitdevelopment.Additionally,aspreviouslynoted,webeganreportinginformationforourinternationalbusinessintwoseparateoperatingsegments(theInternationalDivision

andtheChinaDivision)in2005asaresultofchangesinourmanagementstructure.Segmentinformationforperiodspriorto2005hasbeenrestatedtoreflectthisreporting.

(i) Localcurrencyrepresentsthepercentagechangeexcludingtheimpactofforeigncurrencytranslation.Theseamountsarederivedbytranslatingcurrentyearresultsatprioryearaverageexchange

rates.Webelievetheeliminationoftheforeigncurrencytranslationimpactprovidesbetteryear-to-yearcomparabilitywithoutthedistortionofforeigncurrencyfluctuations.

Yum!Brands,Inc. | 81.