Pizza Hut 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The sale did not have a significant impact on our

subsequentlyreportedresultsofoperationsin2005noris

itexpectedtohaveasignificantimpactontheCompany’s

resultsofoperationsgoingforward.

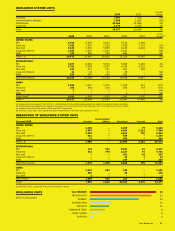

Hurricane Katrina During the third quarter of 2005,

Hurricane Katrina caused significant damage to several

company and franchised stores. This storm resulted in

approximately$4millionofone-timecostsbeingrecorded

inthefullyearfrompropertydamageandassetwrite-offs

related to company restaurants. Additionally, during mid-

September2005,HurricaneRitacausedfurtherdamageto

companyandfranchisedstores,thoughtoalesserextent

than Hurricane Katrina. We estimate that lost operating

profitsin2005asaresultofstoresbeingclosedduetothe

effectsofthesehurricaneswasapproximately$3million.

Wedonotexpectinsurancerecoveries,ifany,relatedtothe

hurricanestobesignificant.

Inthefourthquarter,weexperiencedutilitycostsinthe

U.S.thatwereapproximately$10millionhigherthaninthe

prioryear,whichwebelievewereatleastpartiallyattributable

tothesehurricanes.Weexpectthistrendtocontinueinto

thefirstquarterof2006withyear-over-yearutilityinflationof

approximately20percentorapproximately$7million.

SaleofPuertoRicoBusiness OurPuertoRicobusiness

washeldforsalebeginningthefourthquarterof2002and

wassoldonOctober4,2004foranamountapproximating

its then carrying value. Company sales and restaurant

profit decreased $159million and $29million, respec-

tively, franchise fees increased $10million and general

andadministrativeexpensesdecreased$9millionforthe

yearendedDecember31,2005ascomparedtotheyear

endedDecember25,2004.Companysalesandrestaurant

profit decreased$27million and$4million,respectively,

franchise fees increased $1million and general and

administrativeexpensesdecreased$1millionfortheyear

endedDecember25,2004ascomparedtotheyearended

December27,2003.

Income Tax Impact of Repatriating Qualified Foreign

Earnings The American Jobs Creation Act of 2004 (the

“Act”),whichbecamelawonOctober22,2004,allowsa

dividendsreceiveddeductionof85%ofrepatriatedquali-

fied foreign earnings in fiscal year 2005. We recorded

$6million in income tax expense during the year ended

December25,2004asaresultofourthendetermination

torepatriateapproximately$110millionin2005whichwill

be eligiblefor the Act’s dividends received deduction. In

accordancewithFASBStaffPosition109-2,“Accountingand

DisclosureGuidancefortheForeignEarningsRepatriation

ProvisionswithintheAmericanJobsCreationActof2004,”

wecontinuedtoevaluatein2005whetherwewouldrepa-

triateotherundistributedearningsfromforeigninvestments

asaresultoftheAct.Duringthesecondquarterof2005,

wedeterminedthatwewouldrepatriateadditionalqualified

foreignearningsofapproximately$390millioninfiscalyear

2005whichwillbeeligiblefortheAct’sdividendsreceived

deduction (for atotalrepatriationofqualifiedearningsof

approximately$500million).Asaresultofthisdetermina-

tion,approximately$20millionofadditionaltaxexpensewas

recognizedinfiscal2005.Noadditionalamountsbeyondthe

approximately$500millionasdiscussedaboveareeligible

fortheAct’sdividendsreceiveddeduction.

Lease Accounting Adjustments In the fourth quarter

of2004,werecordedanadjustmenttocorrectinstances

whereourleaseholdimprovementswerenotbeingdepre-

ciatedovertheshorteroftheirusefullivesorthetermof

thelease,includingoptionsinsomeinstances,overwhich

wewererecordingrentexpense,includingescalations,ona

straight-linebasis.

Thecumulativeadjustment,primarilythroughincreased

U.S.depreciationexpense,totaled$11.5million($7million

aftertax).Theportionofthisadjustmentthatrelatedto2004

wasapproximately$3million.Astheportionofouradjust-

mentrecordedthatwasacorrectionoferrorsofamounts

reportedin ourpriorperiod financialstatementswas not

materialtoanyofthosepriorperiodfinancialstatements,the

entireadjustmentwasrecordedinthe2004Consolidated

FinancialStatementsandnoadjustmentwasmadetoany

priorperiodfinancialstatements.

AmendmentofSale-LeasebackAgreements OnAugust15,

2003weamendedtwosale-leasebackagreementsassumed

inour2002acquisitionofYGRsuchthattheagreements

nowqualifyforsale-leasebackaccounting.Restaurantprofit

decreasedby$5millionin2004versus2003asaresultof

thetwoamendedagreementsbeingaccountedforasoper-

atingleasessubsequenttotheamendment.Thedecrease

inrestaurantprofitwaslargelyoffsetbyasimilardecrease

ininterestexpense.

Canada Unconsolidated Af filiate Dissolution On

November10,2003,wedissolvedourunconsolidatedaffil-

iatethatpreviouslyoperated733restaurantsinCanada.We

owned50%ofthisunconsolidatedaffiliatepriortoitsdissolu-

tionandaccountedforourinterestundertheequitymethod.

Oftherestaurantspreviouslyoperatedbytheunconsolidated

affiliate,wenowoperatethevastmajorityofPizzaHutsand

TacoBells,whilealmostallKFCsareoperatedbyfranchi-

sees.Asaresultofoperatingcertainrestaurantsthatwere

previously operated by the unconsolidated affiliate, our

Companysales,restaurantprofitandgeneralandadminis-

trativeexpensesincreasedandourfranchisefeesdecreased

in2004versus2003.Additionally,onafullyearbasisother

incomeincreasedaswerecordedalossfromourinvestment

intheCanadianunconsolidatedaffiliatein2003.

AsaresultofthedissolutionofourCanadianuncon-

solidatedaffiliate,Companysalesincreased$147million,

franchise fees decreased $9million, restaurant profit

increased$8million,generalandadministrativeexpenses

increased$11millionandotherincomeincreased$4million

fortheyearendedDecember25,2004comparedtotheyear

endedDecember27,2003.Theimpacton2004netincome

wasnotsignificant.

36. | Yum!Brands,Inc.