Pizza Hut 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Common Stock Share Repurchases From time to time,

werepurchasesharesofourCommonStockundershare

repurchaseprogramsauthorizedbyourBoardofDirectors.

Shares repurchased constitute authorized, but unissued

sharesundertheNorthCarolinalawsunderwhichweare

incorporated.Additionally,ourCommonStockhasnoparor

statedvalue.Accordingly,werecordthefullvalueofshare

repurchasesagainstCommonStockexceptwhentodoso

would result in a negative balancein our CommonStock

account.Insuchinstances,onaperiodbasis,werecord

thecostofanyfurthersharerepurchasesasareductionin

retainedearnings.Duetothelargenumberofsharerepur-

chasesandtheincreaseinourCommonStockvalueover

thepastseveralyears,ourCommonStockbalancereached

zeroduringthefourthquarterof2005.Accordingly,inthe

fourthquarterof2005,$87millioninsharerepurchases

wererecordedasareductioninretainedearnings.Wehave

nolegalrestrictionsonthepaymentofdividendsprovided

totalshareholders’equityispositive.SeeNote18foraddi-

tionalinformation.

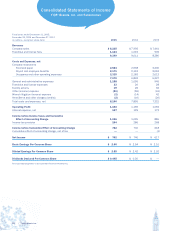

3.EARNINGSPERCOMMONSHARE(“EPS”)

2005 2004 2003

Netincome $ 762 $ 740 $ 617

BasicEPS:

Weighted-averagecommon

sharesoutstanding 286 291 293

BasicEPS $2.66 $2.54 $2.10

DilutedEPS:

Weighted-averagecommon

sharesoutstanding 286 291 293

Sharesassumedissuedon

exerciseofdilutiveshare

equivalents 38 47 52

Sharesassumedpurchased

withproceedsofdilutive

shareequivalents (26) (33) (39)

Sharesapplicabletodiluted

earnings 298 305 306

DilutedEPS $2.55 $2.42 $2.02

Unexercisedemployeestockoptionstopurchaseapproxi-

mately0.5million,0.4millionand4millionsharesofour

CommonStockfortheyears endedDecember31,2005,

December25,2004andDecember27,2003,respectively,

werenotincludedinthecomputationofdilutedEPSbecause

theirexercisepricesweregreaterthantheaveragemarket

priceofourCommonStockduringtheyear.

4.ITEMSAFFECTING

COMPARABILITYOFNETINCOME

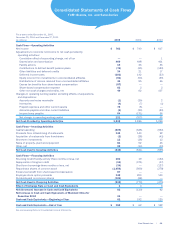

FacilityActions Facilityactionsconsistsofthefollowing

components:

Refranchisingnet(gains)losses;

Storeclosurecosts;

Impairmentoflong-livedassetsforstoresweintend

tocloseandstoresweintendtocontinuetousein

thebusiness;

Impairmentofgoodwillandindefinite-lived

intangibleassets.

2005 2004 2003

U.S.

Refranchisingnet(gains)losses(a)(d) $(40) $(14) $(20)

Storeclosurecosts 2 (3) 1

Storeimpairmentcharges 44 17 10

SFAS142impairmentcharges(c) — — 5

Facilityactions 6 — (4)

InternationalDivision

Refranchisingnet(gains)losses(a)(b)(d) (3) 3 20

Storeclosurecosts (1) 1 5

Storeimpairmentcharges 10 19 13

Facilityactions 6 23 38

ChinaDivision

Refranchisingnet(gains)losses(a)(d) — (1) (4)

Storeclosurecosts (1) (1) —

Storeimpairmentcharges 8 5 6

Facilityactions 7 3 2

Worldwide

Refranchisingnet(gains)losses(a)(b) (43) (12) (4)

Storeclosurecosts — (3) 6

Storeimpairmentcharges 62 41 29

SFAS142impairmentcharges(c) — — 5

Facilityactions $ 19 $ 26 $ 36

(a)IncludesinitialfranchisefeesintheU.S.of$7millionin2005,$2millionin

2004and$3millionin2003,andinInternationalDivisionof$3millionin2005,

$8millionin2004and$1millionin2003andChinaDivisionof$1millionin

2003.SeeNote6.

(b)InternationalDivisionincludeswritedownsof$6millionand$16millionforthe

yearsendedDecember25,2004andDecember27,2003,respectively,related

toourPuertoRicobusiness,whichwassoldonOctober4,2004.

(c)In2003,werecordeda$5millionchargeintheU.S.relatedtotheimpairment

oftheA&Wtrademark/brand(seefurtherdiscussionatNote9).

(d)Refranchising(gains)lossesarenotallocatedtosegmentsforperformance

reportingpurposes.

Thefollowingtablesummarizesthe2005and2004activity

relatedtoreservesforremainingleaseobligationsforclosed

stores.

Estimate/

Beginning Amounts New Decision Ending

Balance UsedDecisions Changes Other(a)

Balance

2004Activity $40 (17) 8 (1) 13 $43

2005Activity$43 (13) 14 — — $44

(a)Primarilyreservesestablisheduponacquisitionsoffranchiseerestaurants.

64. | Yum!Brands,Inc.