Pizza Hut 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

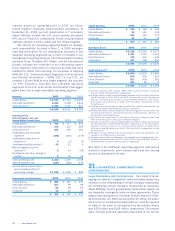

9.GOODWILLANDINTANGIBLEASSETS

Thechangesinthecarryingamountofgoodwillareasfollows:

Inter-

national China World-

U.S. Division Division wide

Balanceasof

December27,2003 $386 $ 79 $56 $521

Acquisitions 19 14 — 33

Disposalsandother,net(a) (10) 7 2 (1)

Balanceasof

December25,2004 $395 $100 $58 $553

Acquisitions — 1 — 1

Disposalsandother,net(a) (11) (5) — (16)

Balanceasof

December31,2005$384 $ 96 $58 $538

(a)Disposalsandother,netforInternationalDivisionandChinaDivision,primarily

reflectstheimpactofforeigncurrencytranslationonexistingbalances.

Intangibleassets,netfortheyearsended2005and2004

areasfollows:

2005 2004

Gross Gross

Carrying Accumulated Carrying Accumulated

Amount Amortization Amount Amortization

Amortizedintangible

assets

Franchisecontract

rights $144 $ (59) $146 $(55)

Trademarks/brands 208 (9) 67 (3)

Favorableoperating

leases 18 (14) 22 (16)

Pension-related

intangible 7 — 11 —

Other 5 (1) 5 (1)

$382 $ (83) $251 $(75)

Unamortizedintangible

assets

Trademarks/brands $ 31 $171

We haverecordedintangibleassetsthroughpastacqui-

sitionsrepresentingthe valueofour KFC,LJS andA&W

trademarks/brands. The value of a trademark/brand is

determinedbaseduponthevaluederivedfromtheroyalty

weavoid, in thecase of Company stores,orreceive, in

thecaseoffranchiseandlicenseestores,fortheuseof

thetrademark/brand. We have determinedthatourKFC

trademark/brandintangibleassethasanindefinitelifeand

thereforeisnotamortized.

When we acquired YGR in 2002 we assigned

$140milliontotheLJStrademark/brandand$72million

totheA&Wtrademark/brand.Atthedateoftheacquisi-

tion,wedeterminedthatbothoftheseintangibleassets

hadindefinitelives.However,basedonbusinessdecisions

wemadein2005and2003withregardtotheseConcepts,

wereconsideredtheexpectedusefullivesofthesebrand

intangiblesandatDecember31,2005bothoftheseassets

arebeingamortizedovertheirexpectedusefullives.

In2005,wedecidedtoadjustdevelopmentofcertain

multibrandcombinationswithLJS.Whileweandourfranchi-

seescontinuetobuildnewLJSstandaloneunitsaswellas

multibrandunitsthatincludeLJS,ourdecisiontoreallocate

certaincapitalspendingintheneartermtootherinvestment

alternativeswasconsideredaneconomicfactorthatmay

limittheusefullifeoftheLJStrademark/brand.Accordingly,

inthefirstquarterof2005webegantoamortizetheLJS

trademark/brandoverthirtyyears,thetypicaltermofour

multibrand franchise agreements including one renewal.

We reviewed the LJS trademark/brand for impairment

priortobeginningamortizationin2005anddeterminedno

impairmentexisted.AmortizationexpenseoftheLJStrade-

mark/brand approximated $4million in 2005. When the

LJStrademark/brand was consideredtobeanindefinite-

lifeintangibleassetin2004and2003andwastherefore

subjecttoannualimpairmenttests,wedeterminedthatthe

fairvalueoftheLJStrademark/brandwasinexcessofits

carryingvalue.

In2003,wedecidedtocloseorrefranchisesubstan-

tially all Company-owned A&W restaurants that we had

acquired.Theserestaurantswerelow-volume,mall-based

units that were inconsistent with the remainder of our

Company-ownedportfolio.Also,atthattimewedecidedto

focusmoreonshort-termdevelopmentopportunitiesatLJS.

Thesedecisionsnegativelyimpactedthefairvalueofthe

A&Wtrademark/brandbecauseweassumedlessdevelop-

mentofA&Wintheneartermthanforecastedatthedateof

acquisition.Accordingly,werecordeda$5millionchargein

2003tofacilityactionstowritethevalueoftheA&Wtrade-

mark/branddowntoitsfairvalue.Ourdecisiontonolonger

operate the acquired stand-alone Company-owned A&W

restaurantswasconsideredafactorthatlimitedtheA&W

trademark/brandexpectedusefullife.Subsequenttothe

recordingoftheimpairmentin2003,webeganamortizing

theA&Wtrademark/brandremainingbalanceoveraperiod

ofthirtyyears,thetypicaltermofourmultibrandfranchise

agreementsincludingonerenewal.Amortizationexpenseof

theA&Wtrademark/brandapproximated$2millionin2005

and2004and$1millionin2003.

Amortization expense for all definite-lived intangible

assetswas$13millionin 2005,$8million in 2004 and

$7millionin2003.Amortizationexpensefordefinite-lived

intangible assets will approximate $12million in 2006

through2010.

66. | Yum!Brands,Inc.