Pizza Hut 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

markets based on operating profit in 2005 are China,

UnitedKingdom,Australia,AsiaFranchiseandMexico.At

December31, 2005, wehadinvestmentsin7unconsoli-

datedaffiliatesoutsidetheU.S.whichoperateprincipally

KFC and/or PizzaHutrestaurants. These unconsolidated

affiliatesoperateinChina,JapanandtheUnitedKingdom.

Weidentifyouroperatingsegmentsbasedonmanage-

mentresponsibility.AsnotedinNote1,in2005webegan

reportinginformationforourinternationalbusinessintwo

separateoperatingsegmentsasaresultofchangesinour

managementreportingstructure.TheChinaDivisionincludes

mainlandChina,Thailand,KFCTaiwan,andtheInternational

Divisionincludestheremainderofourinternationalopera-

tions.Segmentinformationforpreviousperiodshasbeen

restatedtoreflectthisreporting.Forpurposesofapplying

SFASNo.131,“DisclosureAboutSegmentsofAnEnterprise

and Related Information” (“SFAS 131”) in the U.S., we

considerLJSandA&Wtobeasinglesegment.Weconsider

our KFC, PizzaHut, TacoBell and LJS/A&W operating

segmentsintheU.S.tobesimilarandthereforehaveaggre-

gatedthemintoasinglereportableoperatingsegment.

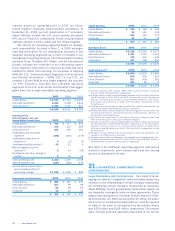

Revenues2005 2004 2003

UnitedStates $5,929 $5,763 $5,655

InternationalDivision 2,124 2,128 1,824

ChinaDivision(a) 1,296 1,120 901

$9,349 $9,011 $8,380

OperatingProfit;

InterestExpense,Net;and

IncomeBeforeIncomeTaxes2005 2004 2003

UnitedStates $ 760 $ 777 $ 812

InternationalDivision(b) 372 337 280

ChinaDivision(b) 211 205 161

Unallocatedandcorporate

expenses (246) (204) (179)

Unallocatedotherincome

(expense)(c) 9 (2) (3)

Unallocatedfacilityactions(d) 43 12 4

Wrenchlitigationincome

(expense)(e) 2 14 (42)

AmeriServeandother(charges)

credits(e) 2 16 26

Totaloperatingprofit 1,153 1,155 1,059

Interestexpense,net (127) (129) (173)

Incomebeforeincometaxes

andcumulativeeffectof

accountingchange $1,026 $1,026 $ 886

DepreciationandAmortization2005 2004 2003

UnitedStates $ 266 $ 267 $ 240

InternationalDivision 107 99 86

ChinaDivision 82 69 60

Corporate 14 13 15

$ 469 $ 448 $ 401

CapitalSpending2005 2004 2003

UnitedStates $ 333 $ 365 $ 395

InternationalDivision 96 121 135

ChinaDivision 159 118 111

Corporate 21 41 22

$ 609 $ 645 $ 663

IdentifiableAssets2005 2004 2003

UnitedStates $3,118 $3,316 $3,279

InternationalDivision(f)1,437 1,441 1,334

ChinaDivision(f) 746 613 546

Corporate(g) 397 326 461

$5,698 $5,696 $5,620

Long-LivedAssets(h)2005 2004 2003

UnitedStates $2,800 $2,900 $2,880

InternationalDivision 804 904 815

ChinaDivision(i) 517 436 391

Corporate 103 99 72

$4,224 $4,339 $4,158

(a)Includesrevenuesof$1.0billion,$903millionand$703millioninmainland

Chinafor2005,2004and2003,respectively.

(b)Includesequityincomeofunconsolidatedaffiliatesof$21million,$25million

and$11millionin2005,2004and2003,respectively,fortheInternational

Division.Includesequityincomeofunconsolidatedaffiliatesof$30million,

$32million,and$33millionin2005,2004and2003,respectively,forthe

ChinaDivision.

(c)Includesaone-timenetgainofapproximately$11millionassociatedwiththe

saleofourPoland/CzechRepublicbusiness.SeeNote7.

(d)Unallocatedfacilityactionscomprisesrefranchisinggains(losses)whichare

notallocatedtotheU.S.,InternationalDivisionorChinaDivisionsegmentsfor

performancereportingpurposes.

(e)SeeNote4foradiscussionofAmeriServeandother(charges)creditsand

Note4andNote21foradiscussionofWrenchlitigation.

(f) Includesinvestmentinunconsolidatedaffiliatesof$117million,$143million

and$136millionfor2005,2004and2003,respectively,fortheInternational

Division. Includes investment in unconsolidated affiliates of $56million,

$51millionand$45millionfor2005,2004and2003,respectively,forthe

ChinaDivision.

(g)Primarily includesdeferredtaxassets,property,plantand equipment,net,

relatedtoourofficefacilities,andcash.

(h)Includesproperty,plantandequipment,net;goodwill;andintangibleassets,net.

(i) Includeslong-livedassetsof$430million,$342millionand$287millionin

MainlandChinafor2005,2004and2003,respectively.

See Note4for additionaloperatingsegment disclosures

relatedtoimpairment,storeclosurecostsandthecarrying

amountofassetsheldforsale.

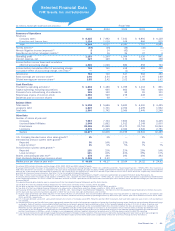

21.GUARANTEES,COMMITMENTSAND

CONTINGENCIES

LeaseGuaranteesandContingencies Asaresultof(a)as-

signingourinterestinobligationsunderrealestateleasesasa

conditiontotherefranchisingofcertainCompanyrestaurants;

(b)contributingcertainCompanyrestaurantstounconsoli-

datedaffiliates;and(c)guaranteeingcertainotherleases,we

arefrequentlycontingentlyliableonleaseagreements.These

leaseshavevaryingterms,thelatestofwhichexpiresin2031.

AsofDecember31,2005andDecember25,2004,thepoten-

tialamountofundiscountedpaymentswecouldberequired

tomakeintheeventofnon-paymentbytheprimarylessee

was$374millionand$365million,respectively.Thepresent

valueofthesepotentialpaymentsdiscountedatourpre-tax

76. | Yum!Brands,Inc.