Pizza Hut 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

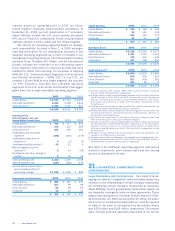

Theannualmaturitiesoflong-termdebtasofDecember31,

2005,excludingcapitalleaseobligationsof$114millionand

derivativeinstrumentadjustmentsof$6million,areasfollows:

Yearended:

2006 $ 202

2007 2

2008 252

2009 3

2010 183

Thereafter 1,115

Total $1,757

Interestexpenseonshort-termborrowings and long-term

debt was $147million, $145million and $185million in

2005,2004and2003,respectively.

12.LEASES

AtDecember31,2005weoperatedover7,500restaurants,

leasingtheunderlyinglandand/orbuildinginover5,500of

thoserestaurantswithourcommitmentsexpiringatvarious

datesthrough2087.Wealsoleaseofficespaceforhead-

quartersandsupportfunctions,aswellascertainofficeand

restaurantequipment.Wedonotconsideranyoftheseindi-

vidualleasesmaterialtoouroperations.Mostleasesrequire

ustopayrelatedexecutorycosts,whichincludeproperty

taxes,maintenanceandinsurance.

Future minimum commitments and amounts to be

receivedaslessororsublessorundernon-cancelableleases

aresetforthbelow:

Commitments LeaseReceivables

Direct

Capital Operating Financing Operating

2006 $ 16 $ 362 $ 4 $ 21

2007 15 326 4 18

2008 14 286 4 14

2009 14 258 5 13

2010 13 230 5 12

Thereafter 91 1,218 45 49

$163 $2,680 $67 $127

AtDecember31,2005andDecember25,2004,thepresent

value of minimum payments under capital leases was

$114millionand$128million,respectively.AtDecember31,

2005andDecember25,2004,unearnedincomeassoci-

atedwithdirectfinancingleasereceivableswas$38million

and$48million,respectively.

Thedetailsofrentalexpenseandincomearesetforth

below:

2005 2004 2003

Rentalexpense

Minimum $380 $376 $329

Contingent 51 49 44

$431 $425 $373

Minimumrentalincome $ 11 $ 13 $ 14

13.FINANCIALINSTRUMENTS

InterestRateDerivativeInstruments Weenterintointerest

rateswapswiththeobjectiveofreducingourexposureto

interestrateriskandloweringinterestexpenseforaportion

ofourdebt.Underthecontracts,weagreewithotherparties

toexchange,atspecifiedintervals,thedifferencebetween

variable rate and fixed rate amounts calculated on a

notionalprincipalamount.AtbothDecember31,2005and

December31,2004,interestratederivativeinstruments

outstandinghadnotionalamountsof$850million.These

swaps have reset dates and floating rate indices which

matchthoseofourunderlyingfixed-ratedebtandhavebeen

designatedasfairvaluehedgesofaportionofthatdebt.As

theswapsqualifyfortheshort-cutmethodunderSFAS133,

noineffectivenesshasbeenrecorded.Thenetfairvalueof

theseswapsasofDecember31,2005wasanetliabilityof

approximately$5million,ofwhich$4millionand$9million

havebeenincludedinotherassetsandotherliabilitiesand

deferredcredits,respectively.Thenetfairvalueofthese

swapsasofDecember25,2004wasanetassetofapprox-

imately $29million, of which $30million and $1million

have been included in other assets and other liabilities

anddeferredcredits,respectively.Theportionofthisfair

valuewhichhasnotyetbeenrecognizedasanaddition/

reductiontointerestexpenseatDecember31,2005and

December25, 2004 has been included as a reduction/

addition to long-term debt (a $6million reduction and a

$21millionaddition,respectively).

Additionally,duetoearlyredemptionoftheunderlying

7.45%SeniorUnsecuredNotesonNovember15,2004(see

Note 11), pay-variable interest rate swaps with notional

amounts of $350million no longer qualified for hedge

accountingatDecember25,2004.Asweelectedtohold

theseswapsuntiltheirMay2005maturity,weenteredinto

newpay-fixedinterestrateswapswithoffsettingnotional

amountsandterms.Gainsorlossesduetochangesinthe

fairvalueofthepay-variableswapswererecognizedinthe

resultsofoperationsthroughMay2005butthesegainsor

losseswerealmostentirelyoffsetbychangesinfairvalue

ofthepay-fixedswaps.Theseswapsweresettledupontheir

maturities.Thefairvalueofbothoftheseswapswereinan

assetpositionasofDecember25,2004withafairvalue

totalingapproximately$9million.Thisfairvaluewasincluded

inprepaidexpensesandothercurrentassets.

ForeignExchangeDerivativeInstruments Weenterinto

foreign currency forward contracts with the objective of

reducingourexposure to cash flowvolatility arising from

foreigncurrencyfluctuationsassociatedwithcertainforeign

currencydenominatedfinancialinstruments,themajority

of which are intercompany short-term receivables and

payables.Thenotionalamount,maturitydate,andcurrency

ofthesecontractsmatchthoseoftheunderlyingreceivables

orpayables.Forthoseforeigncurrencyexchangeforward

contracts that we have designatedas cash flow hedges,

wemeasureineffectivenessbycomparingthecumulative

changeintheforwardcontractwiththecumulativechangein

thehedgeditem.Noineffectivenesswasrecognizedin2005,

68. | Yum!Brands,Inc.