Pizza Hut 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WeadoptedSFAS123Rusingthemodifiedretrospec-

tiveapplicationtransitionmethodeffectiveSeptember4,

2005,thebeginningofourfourthquarter.Aspermittedby

SFAS123R,weappliedthemodifiedretrospectiveapplica-

tiontransitionmethodtothebeginningofthefiscalyearof

adoption(ourfiscalyear2005).Assuch,thefirstthreefiscal

quartersof2005arerequiredtobeadjustedtorecognize

thecompensationcostpreviouslyreportedintheproforma

footnotedisclosures(modifiedsubjecttocertaincorrections

notedduringthefourthquarterof2005thatimpactednet

incomebyapproximately$0.5millionineachquarter)under

theprovisionsofSFAS123.However,yearspriorto2005

havenotbeenrestated.

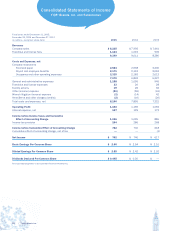

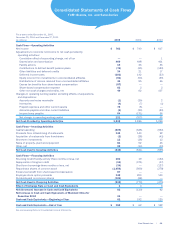

The adoption of SFAS 123R in 2005 resulted in the

reduction of operating profit of $58million ($10million

in payroll and employeebenefits and $48millioninG&A

expense),areductionofnetincomeof$38million(netof

taxbenefitsof$20million),areductionofbothbasicand

dilutedearningspershareof$0.13pershare,areduction

of$87millionincashflowsfromoperatingactivitiesandan

increaseof$87millionincashflowsfromfinancingactivi-

ties.TheadoptionofSFAS123Rresultedinthereduction

offourthquarteroperatingprofitof$18million($3million

in payrolland employee benefits and $15millionin G&A

expense),areductionofnetincomeof$12million(netof

taxbenefitsof$6million)andareductionofbothbasicand

dilutedearningspershareof$0.04pershare.

Thefollowingtableshowsthe2005quarterlyafter-tax

effectofadoptionofSFAS123Ronthefirstthreequarters

of2005aspreviouslyreported.

FirstQuarter SecondQuarter ThirdQuarter

Net Diluted Net Diluted Net Diluted

Income EPS Income EPS Income EPS

Reportedresults

priortoSFAS123R

adoption $161 $0.53 $187 $0.62 $214 $0.72

ImpactofSFAS123R

adoption (8) (0.03) (9)(0.03) (9) (0.03)

Resultssubsequent

toSFAS123R

adoption $153 $0.50 $178 $0.59 $205 $0.69

Priorto2005,allshare-basedpaymentswereaccountedfor

undertherecognitionandmeasurementprinciplesofAPB25

anditsrelatedInterpretations.Accordingly,noexpensewas

reflectedintheConsolidatedStatementsofIncomeforstock

options,asallstockoptionsgrantedhadanexerciseprice

equaltothemarketvalueoftheunderlyingcommonstock

onthedateofgrant.Thefollowingtableillustratesthepro

formaeffectonnetincomeandearningspershareifthe

Companyhadappliedthefairvaluerecognitionprovisionsof

SFAS123toallshare-basedpaymentsforthoseyears.

2004 2003

NetIncome,asreported $ 740 $ 617

Add:Compensationexpenseincluded

inreportednetincome,netofrelatedtax 3 3

Deduct:Totalstock-basedemployee

compensationexpensedeterminedunder

fairvaluebasedmethodforallawards,

netofrelatedtaxeffects (40) (41)

Netincome,proforma 703 579

BasicEarningsperCommonShare

Asreported $2.54 $2.10

Proforma 2.42 1.98

DilutedEarningsperCommonShare

Asreported $2.42 $2.02

Proforma 2.30 1.90

DerivativeFinancialInstruments Wedonotusederivative

instrumentsfortradingpurposesandwehaveproceduresin

placetomonitorandcontroltheiruse.Ouruseofderivative

instrumentshas includedinterestrate swapsand collars,

treasury locks and foreign currency forward contracts. In

addition,onalimitedbasisweutilizecommodityfuturesand

optionscontracts.Ourinterestrateandforeigncurrencyderiv-

ativecontractsareenteredintowithfinancialinstitutionswhile

ourcommodityderivativecontractsareexchangetraded.

Weaccountforthesederivativefinancialinstrumentsin

accordancewithSFASNo.133,“AccountingforDerivative

Instruments and Hedging Activities” (“SFAS 133”) as

amended by SFAS No. 149, “Amendment of Statement

133 on Derivative Instruments and Hedging Activities”

(“SFAS149”).SFAS133requiresthatallderivativeinstru-

mentsberecordedontheConsolidatedBalanceSheetat

fairvalue.Theaccountingforchangesinthefairvalue(i.e.,

gains or losses) of a derivative instrument is dependent

uponwhetherthederivativehasbeendesignatedandquali-

fiesaspartofahedgingrelationshipandfurther,onthetype

ofhedgingrelationship.Forderivativeinstrumentsthatare

designatedand qualifyas afair valuehedge,the gainor

lossonthederivativeinstrumentaswellastheoffsetting

gainorlossonthehedgeditemattributabletothehedged

riskarerecognizedintheresultsofoperations.Forderiva-

tiveinstrumentsthataredesignatedandqualifyasacash

flowhedge,theeffectiveportionofthegainorlossonthe

derivativeinstrumentisreportedasacomponentofother

comprehensiveincome(loss)andreclassifiedintoearnings

inthesameperiodorperiodsduringwhichthehedgedtrans-

actionaffectsearnings.Anyineffectiveportionofthegainor

lossonthederivativeinstrumentisrecordedintheresultsof

operationsimmediately.Forderivativeinstrumentsnotdesig-

natedashedginginstruments,thegainorlossisrecognized

intheresultsofoperationsimmediately.SeeNote13for

adiscussionofouruseofderivativeinstruments,manage-

mentofcreditriskinherentinderivativeinstrumentsandfair

valueinformation.

Yum!Brands,Inc. | 63.