Pizza Hut 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Valuation allowances related to deferred tax assets

inforeigncountriesdecreasedby$10millionin2005and

increasedby$45millionand$19millionin2004and2003,

respectively.Valuationallowancesrelatedtofederaldeferred

tax assets decreased by $13million in 2005. Valuation

allowancesincertainstatesdecreasedby$8millionin2005

($5million,netoffederaltax)andincreasedby$6million

($4million,netoffederaltax)in2003.Thefluctuationswere

aresultofdeterminationsregardingthelikelihoodofuseof

certainlosscarryforwardsandcreditspriortoexpiration.

The2005statedeferredtaxprovisionincludes$8million

($5million,netoffederaltax)fortheimpactofchangesin

statestatutorytaxrates.In2004,thedeferredforeigntax

provisionincludeda$1millioncredittoreflecttheimpactof

changesinstatutorytaxratesinvariouscountries.

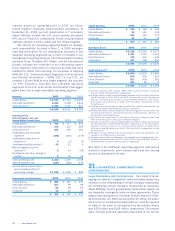

U.S.andforeignincomebeforeincometaxesareset

forthbelow:

2005 2004 2003

U.S. $ 705 $ 704 $669

Foreign 321 322 217

$1,026 $1,026 $886

Thereconciliationof incometaxes calculated attheU.S.

federaltaxstatutoryratetooureffectivetaxrateissetforth

below:

2005 2004 2003

U.S.federalstatutoryrate 35.0% 35.0% 35.0%

Stateincometax,netoffederal

taxbenefit 1.6 1.3 1.8

ForeignandU.S.taxeffects

attributabletoforeignoperations (6.7) (6.3) (3.6)

Adjustmentstoreservesand

prioryears (1.3) (6.7) (1.7)

Repatriationofforeignearnings 2.0 0.5 —

Non-recurringforeigntaxcredit

adjustments (2.9) — (4.1)

Valuationallowanceadditions

(reversals) (1.4) 4.2 2.8

Other,net (0.5) (0.1) —

Effectiveincometaxrate 25.8% 27.9% 30.2%

The2005taxratewasfavorablyimpactedbytherecognition

ofcertainforeigntaxcreditsthatwewereabletosubstan-

tiateduring2005.In2003,weamendedcertainprioryear

returnsuponourdeterminationthatitwasmorebeneficialto

claimcreditonourU.S.taxreturnsforforeigntaxespaidthan

todeductsuchtaxes,ashadbeendonewhenthereturns

wereoriginallyfiled.Bothbenefitsarenon-recurring.

Theadjustmentstoreservesandprioryearsin2005

and2004wereprimarilydrivenbythereversalofreserves

associatedwithauditsthatweresettled.

Seeaboveforadiscussionofthevaluationallowance

additions(reversals).

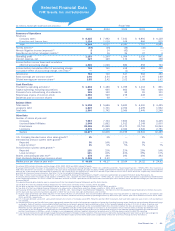

Thedetailsof2005and2004deferredtaxliabilities

(assets)aresetforthbelow:

2005 2004

Intangibleassetsandproperty,plant

andequipment $ 169 $ 151

Other 95 84

Grossdeferredtaxliabilities $ 264 $ 235

Netoperatinglossandtaxcredit

carryforwards $(223) $(193)

Employeebenefits (132) (103)

Self-insuredcasualtyclaims (84) (66)

Leaserelatedassetsandliabilities (50) (45)

Variousliabilities (151) (162)

Deferredincomeandother (111) (114)

Grossdeferredtaxassets (751) (683)

Deferredtaxassetvaluationallowances 233 269

Netdeferredtaxassets (518) (414)

Netdeferredtax(assets)liabilities $(254) $(179)

ReportedinConsolidatedBalanceSheetsas:

Deferredincometaxes $(163) $(156)

Otherassets (156) (89)

Otherliabilitiesanddeferredcredits 24 52

Accountspayableandothercurrentliabilities 41 14

$(254) $(179)

Federal income tax receivables of $59million were

includedinprepaidexpensesandothercurrentassetsat

December25,2004.

We have not provided deferred tax on the undistrib-

utedearningsfromourforeigninvestmentsaswebelieve

they are permanent in nature, except for approximately

$2millionofbothfederalandforeigntaxprovidedonundis-

tributedearningsweintendtodistribute.Weestimatethat

our total net undistributed earningsupon which we have

notprovideddeferredtaxtotalapproximately$400million

atDecember31,2005.Adeterminationofthedeferredtax

liabilityonsuchearningsisnotpracticable.

Wehaveavailablenetoperatinglossandtaxcreditcarry-

forwardstotalingapproximately$1.6billionatDecember31,

2005toreducefuturetaxofYUMandcertainsubsidiaries.

Thecarryforwardsarerelatedtoanumberofforeignand

statejurisdictions.Ofthesecarryforwards,$21millionexpire

in2006and$1.2billionexpireatvarioustimesbetween

2006 and2024. Theremaining carryforwardsof approxi-

mately$330milliondonotexpire.

20.REPORTABLEOPERATINGSEGMENTS

Weareprincipallyengagedindeveloping,operating,fran-

chising and licensing the worldwide KFC, Pizza Hut and

TacoBellconcepts, andsince May 7, 2002, the LJS and

A&Wconcepts,whichwereaddedwhenweacquiredYGR.

KFC,PizzaHut,TacoBell,LJSandA&Woperatethroughout

theU.S.andin95,90,13,5and10countriesandterritories

outsidetheU.S.,respectively.Ourfivelargestinternational

Yum!Brands,Inc. | 75.