Pizza Hut 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

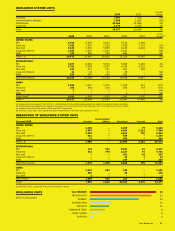

QuarterendedSeptember4,2005

Inter- Unallo-

U.S. national China cated Total

Payrolland

employeebenefits $2 $— $— $— $ 2

Generaland

administrative 4 3 1 4 12

Operatingprofit $6 $ 3 $ 1 $ 4 14

Incometaxbenefit (5)

Netincomeimpact $ 9

QuarterendedDecember31,2005

Inter- Unallo-

U.S. national China cated Total

Payrolland

employeebenefits $2 $1 $— $— $ 3

Generaland

administrative 4 4 1 6 15

Operatingprofit $6 $5 $ 1 $ 6 18

Incometaxbenefit (6)

Netincomeimpact $12

YearendedDecember31,2005

Inter- Unallo-

U.S. national China cated Total

Payrolland

employeebenefits $ 8 $ 2 $— $ — $ 10

Generaland

administrative 14 11 4 19 48

Operatingprofit $22 $13 $ 4 $19 58

Incometaxbenefit (20)

Netincomeimpact $ 38

Prior to 2005, all stock options granted were accounted

for under the recognition and measurementprinciples of

APB25anditsrelatedInterpretations.Accordingly,nostock-

basedemployeecompensationexpensewasreflectedinthe

ConsolidatedStatementsofIncomeforstockoptions,as

allstockoptionsgrantedhadanexercisepriceequaltothe

marketvalueoftheunderlyingcommonstockonthedateof

grant.HadtheCompanyappliedthefairvalueprovisionsof

SFAS123tostockoptionsin2004and2003,netincome

of$740millionand$617million,respectively,wouldhave

beenreducedby$37millionand$38million,respectively,

to$703millionand$579million,respectively.Additionally,

bothbasicanddilutedearningspercommonsharewould

havedecreased$0.12pershareforboth2004and2003.

ExtraWeekin2005 Ourfiscalcalendarresultsina53rd

weekeveryfiveorsixyears.Fiscalyear2005includesa53rd

weekinthefourthquarterforthemajorityofourU.S.busi-

nessesaswellasourinternationalbusinessesthatreport

onaperiod,asopposedtoamonthly,basis.IntheU.S.,

wepermanentlyacceleratedthetimingoftheKFCbusiness

closingbyoneweekinDecember2005,andthus,therewas

no53rdweekbenefitforthisbusiness.Additionally,allChina

Divisionbusinessesreportonamonthlybasisandthusdid

nothavea53rdweek.

Thefollowingtablesummarizestheestimatedincrease

(decrease)ofthe53rdweekonrevenuesandoperatingprofit:

Inter-

national Unallo-

U.S. Division cated Total

Revenues

Companysales $58 $27 $— $85

Franchiseandlicensefees 8 3 — 11

TotalRevenues $66 $30 $— $96

Operatingprofit

Franchiseandlicensefees $ 8 $ 3 $— $11

Restaurantprofit 14 5 — 19

Generaland

administrativeexpenses (2) (3) (3) (8)

Equityincomefrom

investmentsin

unconsolidatedaffiliates — 1 — 1

Operatingprofit $20 $ 6 $(3) $23

Mainland China Issues Our KFC business in mainland

Chinawasnegativelyimpactedbytheinterruptionofproduct

offeringsandnegativepublicityassociatedwithasupplier

ingredientissueexperiencedinlateMarch,2005aswellas

consumerconcernsrelatedtoAvianFluinthefourthquarter

of2005.Asaresultoftheaforementionedissues,theChina

Divisionexperiencedsystemsalesgrowthin2005of11%

excludingforeigncurrency translation whichisbelow our

ongoingtargetofatleast22%.Duringtheyeartodateended

December31, 2005,we enteredinto anagreement fora

partialrecoveryofourlossesrelatedtothesupplieringre-

dientissuewiththesupplier.Asaresultoftheagreement,

werecognizedapproximately$24millioninOther income

(expense)inourConsolidatedStatementofIncomeforthe

yearendedDecember31,2005.

SaleofanInvestmentinUnconsolidatedAffiliate During

thesecondquarterof2005,wesoldourfiftypercentinterest

intheentitythatoperatedalmostallKFCsandPizzaHutsin

PolandandtheCzechRepublictoourthenpartnerinthe

entity, principallyfor cash.Concurrent with the sale,our

formerpartnercompletedaninitialpublicoffering(“IPO”)of

themajorityofthestockitthenownedintheentity.Priorto

thesale,weaccountedforourinvestmentinthisentityusing

theequitymethod.SubsequenttotheIPO,thenewpublicly

heldentity,inwhichYUMhasnoownershipinterest,isa

franchiseeaswastheentityinwhichwepreviouslyhelda

fiftypercentinterest.

Thistransactiongeneratedaone-timegainofapproxi-

mately $11million for YUM as cash proceeds (net of

expenses)ofapproximately$25millionfromthesaleofour

interestintheentityexceededourrecordedinvestmentin

thisunconsolidatedaffiliate.Aswithourequityincomefrom

investmentsinunconsolidatedaffiliates,theapproximate

$11milliongainwasrecordedinOtherincome(expense)in

ourConsolidatedStatementsofIncome.

Yum!Brands,Inc. | 35.