Pizza Hut 2005 Annual Report Download - page 73

Download and view the complete annual report

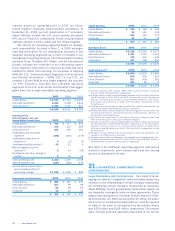

Please find page 73 of the 2005 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.costofdebtatDecember31,2005was$316million.Our

franchiseesaretheprimarylesseesunderthevastmajority

oftheseleases.Wegenerallyhavecross-defaultprovisions

withthesefranchiseesthatwouldputthemindefaultoftheir

franchiseagreementintheeventofnon-paymentunderthe

lease.Webelievethesecross-defaultprovisionssignificantly

reducetheriskthatwewillberequiredtomakepayments

undertheseleases.Accordingly,theliabilityrecordedforour

probableexposureundersuchleasesatDecember31,2005

andDecember25,2004wasnotmaterial.

FranchiseLoanPoolGuarantees Wehadprovidedapproxi-

mately$16millionofpartialguaranteesoftwofranchisee

loan pools related primarily to the Company’s historical

refranchisingprogramsand,toalesserextent,franchisee

development of new restaurants, atDecember31, 2005

andDecember25,2004.Insupportoftheseguarantees,

wepostedlettersofcreditof$4million.Wealsoprovide

a standby letter of credit of $18million under which we

couldpotentiallyberequiredtofundaportionofoneofthe

franchisee loanpools.The totalloans outstandingunder

theseloanpoolswereapproximately$77and$90millionat

December31,2005andDecember25,2004,respectively.

Anyfundingundertheguaranteesorlettersofcredit

wouldbesecuredbythefranchiseeloansandanyrelated

collateral.Webelievethatwehaveappropriatelyprovidedfor

ourestimatedprobableexposuresunderthesecontingent

liabilities.Theseprovisionswereprimarilychargedtonet

refranchisingloss(gain).Newloansaddedtotheloanpools

in2005werenotsignificant.

Unconsolidated Affiliates Guarantees We have guaran-

teed certain lines of credit and loans of unconsolidated

affiliates totaling zero and $34million at December31,

2005andDecember25,2004,respectively.Ourunconsoli-

datedaffiliateshadtotalrevenuesofover$1.8billionfor

theyearendedDecember31,2005andassetsanddebtof

approximately$775millionand$32million,respectively,at

December31,2005.

OtherThirdPartiesGuarantees Wehavealsoguaranteed

certainlinesof credit,loansandlettersofcreditofthird

partiestotaling$1millionand$9millionatDecember31,

2005andDecember25,2004,respectively.Ifallsuchlines

ofcreditandlettersofcreditwerefullydrawnthemaximum

contingent liability under these arrangements would be

approximately $2million as of December31, 2005 and

$26millionasofDecember25,2004.

We have varying levels of recourse provisions and

collateralthatmitigatetheriskoflossrelatedtoourguar-

anteesofthesefinancialarrangementsofunconsolidated

affiliatesandotherthirdparties.Accordingly,ourrecorded

liabilityasofDecember31,2005andDecember25,2004

isnotsignificant.

InsurancePrograms Weareself-insuredforasubstantial

portionofour currentandprioryears’coverageincluding

workers’ compensation, employment practices liability,

general liability, automobile liability and property losses

(collectively,“propertyand casualty losses”).Tomitigate

thecostofourexposuresforcertainpropertyandcasualty

losses,wemakeannualdecisionstoself-insuretherisksof

lossuptodefinedmaximumperoccurrenceretentionsona

linebylinebasisortocombinecertainlinesofcoverageinto

onelosspoolwithasingleself-insuredaggregateretention.

TheCompanythenpurchasesinsurancecoverage,uptoa

certainlimit,forlossesthatexceedtheself-insuranceper

occurrenceoraggregateretention.Theinsurers’maximum

aggregatelosslimitsaresignificantlyaboveouractuarially

determinedprobablelosses;therefore,webelievethelikeli-

hoodoflossesexceedingtheinsurers’maximumaggregate

losslimitsisremote.

IntheU.S.andincertainothercountries,wearealso

self-insuredforhealthcareclaimsandlong-termdisabilityfor

eligibleparticipatingemployeessubjecttocertaindeduct-

iblesandlimitations.Wehaveaccountedforourretained

liabilitiesforpropertyandcasualtylosses,healthcareand

long-termdisabilityclaims,includingreportedandincurred

butnotreportedclaims,basedoninformationprovidedby

independentactuaries.

Duetotheinherentvolatilityofactuariallydetermined

property and casualty loss estimates, it is reasonably

possible that we could experience changes in estimated

losseswhichcouldbematerialtoourgrowthinquarterly

andannualnetincome.Webelievethatwehaverecorded

reservesforpropertyandcasualtylossesatalevelwhich

hassubstantiallymitigatedthepotentialnegativeimpactof

adversedevelopmentsand/orvolatility.

ChangeofControlSeveranceAgreements TheCompany

hasseveranceagreementswithcertainkeyexecutives(the

“Agreements”)thatarerenewableonanannualbasis.These

Agreementsare triggeredbyatermination,undercertain

conditions,oftheexecutive’semploymentfollowingachange

incontroloftheCompany,asdefinedintheAgreements.

Iftriggered,theaffectedexecutiveswouldgenerallyreceive

twicetheamountofboththeirannualbasesalaryandtheir

annualincentive,atthe higher oftarget oractual forthe

precedingyear,aproportionatebonusatthehigheroftarget

oractualperformanceearnedthroughthedateoftermina-

tion,outplacementservicesandataxgross-upforanyexcise

taxes.TheseAgreementshaveathree-yeartermandauto-

maticallyreneweachJanuary1foranotherthree-yearterm

unlesstheCompanyelectsnottorenewtheAgreements.If

theseAgreementshadbeentriggeredasofDecember31,

2005,paymentsofapproximately$39millionwouldhave

beenmade.Intheeventofachangeofcontrol,rabbitrusts

would beestablished andused toprovidepayouts under

existingdeferredandincentivecompensationplans.

Litigation We are subject to various claims and contin-

genciesrelatedtolawsuits,taxes,environmentalandother

mattersarisingoutofthenormalcourseofbusiness.We

providereservesforsuchclaimsandcontingencieswhen

payment is probable and estimable in accordance with

SFASNo.5“AccountingforContingencies.”

On August 13, 2003, a class action lawsuit against

PizzaHut,Inc.,entitledColdironv.PizzaHut,Inc.,wasfiledin

theUnitedStatesDistrictCourt,CentralDistrictofCalifornia.

Yum!Brands,Inc. | 77.