Pizza Hut 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

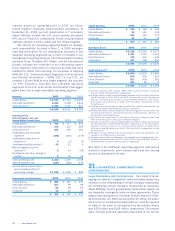

ComponentsofNetPeriodicBenefitCost Thecomponents

ofnetperiodicbenefitcostareasfollows:

PensionBenefits

2005 2004 2003

Servicecost $ 33 $ 32 $ 26

Interestcost 43 39 34

Amortizationofpriorservicecost(a) 3 3 4

Expectedreturnonplanassets (45) (40) (30)

Recognizedactuarialloss 22 19 6

Netperiodicbenefitcost $ 56 $ 53 $ 40

Additionallossrecognizeddueto:

Curtailment(b)$ 1 — —

Settlement(c)$ 3 — —

PostretirementMedicalBenefits

2005 2004 2003

Servicecost $ 2 $ 2 $ 2

Interestcost 5 5 5

Amortizationofpriorservicecost(a) — — —

Expectedreturnonplanassets — — —

Recognizedactuarialloss 1 1 1

Netperiodicbenefitcost $ 8 $ 8 $ 8

Additionallossrecognizeddueto:

Curtailment(b) N/A N/A N/A

Settlement(c) N/A N/A N/A

(a)Prior service costsare amortized on astraight-line basis over the average

remainingserviceperiodofemployeesexpectedtoreceivebenefits.

(b)Cur tailment losses have been recognized in facility actions as they have

resultedprimarilyfromrefranchisingactivities.

(c)Settlementlossresultsfrombenefitpaymentsfromanon-fundedplanexceeding

thesumoftheservicecostandinterestcostforthatplanduringtheyear.

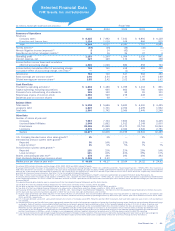

Weighted-averageassumptionsusedtodeterminebenefit

obligationsatSeptember30:

Postretirement

PensionBenefits MedicalBenefits

2005 2004 2005 2004

Discountrate 5.75% 6.15% 5.75% 6.15%

Rateofcompensation

increase 3.75% 3.75% 3.75% 3.75%

Weighted-averageassumptionsusedtodeterminethenet

periodicbenefitcostforfiscalyears:

Postretirement

PensionBenefits MedicalBenefits

2005 2004 2003 2005 2004 2003

Discountrate 6.15% 6.25% 6.85% 6.15% 6.25% 6.85%

Long-termrate

ofreturnon

planassets 8.50% 8.50% 8.50% — — —

Rateof

compensation

increase 3.75% 3.75% 3.85% 3.75% 3.75% 3.85%

Ourestimatedlong-termrateofreturnonplanassetsrepre-

sentstheweighted-averageofexpectedfuturereturnson

theassetcategoriesincludedinourtargetinvestmentallo-

cation basedprimarily onthehistorical returns foreach

asset category, adjusted for an assessment of current

marketconditions.

AssumedhealthcarecosttrendratesatSeptember30:

Postretirement

MedicalBenefits

2005 2004

Healthcarecosttrendrateassumed

fornextyear 10% 11%

Ratetowhichthecosttrendrateis

assumedtodecline(theultimatetrendrate) 5.5% 5.5%

Yearthattheratereachestheultimate

trendrate 2012 2012

Thereisacaponourmedicalliabilityforcertainretirees.The

capforMedicareeligibleretireeswasreachedin2000and

thecapfornon-Medicareeligibleretireesisexpectedtobe

reachedin2009;oncethecapisreached,ourannualcost

perretireewillnotincrease.Aone-percentage-pointincrease

ordecreaseinassumedhealthcarecosttrendrateswould

have less than a $1million impact on total service and

interestcostandonthepostretirementbenefitobligation.

PlanAssets Ourpensionplanweighted-averageassetalloca-

tionsatSeptember30,byassetcategoryaresetforthbelow:

AssetCategory 2005 2004

Equitysecurities 71% 70%

Debtsecurities 29% 28%

Cash — 2%

Total 100% 100%

Ourprimaryobjectivesregardingthepensionassetsareto

optimizereturnonassetssubjectto acceptablerisk and

tomaintainliquidity,meetminimumfundingrequirements

andminimizeplanexpenses.Toachievetheseobjectives,

wehave adopteda passive investmentstrategy inwhich

theassetperformanceisdrivenprimarilybytheinvestment

allocation.Ourtargetinvestmentallocationis70%equity

securitiesand30%debtsecurities,consistingprimarilyof

lowcostindexmutualfundsthattrackseveralsub-catego-

riesofequityanddebtsecurityperformance.Theinvestment

strategyisprimarilydrivenbyourPlan’sparticipants’ages

andreflectsalong-terminvestmenthorizonfavoringahigher

equitycomponentintheinvestmentallocation.

AmutualfundheldasaninvestmentbythePlanincludes

YUMstockintheamountof$0.3millionand$0.2millionat

September30,2005and2004,respectively(lessthan1%

oftotalplanassetsineachinstance).

Yum!Brands,Inc. | 71.