Pizza Hut 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

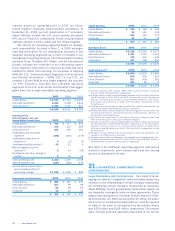

BenefitPayments Thebenefitsexpectedtobepaidineach

ofthenextfiveyearsandintheaggregateforthefiveyears

thereafteraresetforthbelow:

Pension Postretirement

Yearended: Benefits MedicalBenefits

2006 $ 20 $ 4

2007 22 5

2008 26 5

2009 30 5

2010 33 6

2011–2015 260 30

Expected benefits are estimated based on the same

assumptions used to measure our benefit obligation on

ourmeasurementdateofSeptember30,2005andinclude

benefitsattributabletoestimatedfurtheremployeeservice.

15.STOCKOPTIONS

Atyear-end2005,wehadfourstockoptionplansineffect:the

YUM!Brands,Inc.Long-TermIncentivePlan(“1999LTIP”),

the1997Long-TermIncentivePlan(“1997LTIP”),theYUM!

Brands,Inc.RestaurantGeneralManagerStockOptionPlan

(“RGMPlan”)andtheYUM!Brands,Inc.SharePowerPlan

(“SharePower”).During2003,the1999LTIPwasamended,

subsequenttoshareholderapproval,toincreasethetotal

numberofsharesavailableforissuanceandtomakecertain

othertechnicalandclarifyingchanges.

We may grant awards of up to 29.8million shares

and45.0millionsharesofstockunderthe1999LTIP,as

amended,and1997LTIP,respectively.Potentialawardsto

employeesandnon-employeedirectorsunderthe1999LTIP

includestockoptions,incentivestockoptions,stockappre-

ciationrights,restrictedstock,stockunits,restrictedstock

units,performancesharesandperformanceunits.Potential

awardstoemployeesandnon-employeedirectorsunderthe

1997LTIPincludestockappreciationrights,restrictedstock

andperformancerestrictedstockunits.PriortoJanuary1,

2002, we also could grant stock options and incentive

stockoptionsunderthe1997LTIP.ThroughDecember31,

2005,wehaveissuedonlystockoptionsandperformance

restrictedstockunitsunderthe1997LTIPandhaveissued

onlystockoptionsunderthe1999LTIP.

We may grant stock options under the 1999 LTIP to

purchasesharesatapriceequaltoorgreaterthantheaverage

marketpriceofthestockonthedateofgrant.Newoption

grantsunderthe1999LTIPcanhavevaryingvestingprovisions

andexerciseperiods.Previouslygrantedoptionsunderthe

1997LTIPand1999LTIPvestinperiodsrangingfromimme-

diateto2009andexpiretentofifteenyearsaftergrant.

Wemaygrantoptionstopurchaseupto15.0million

sharesofstockundertheRGMPlanatapriceequaltoor

greaterthantheaveragemarketpriceofthestockonthe

dateofgrant.RGMPlanoptionsgrantedhaveafouryear

vestingperiodandexpiretenyearsaftergrant.CertainRGM

Planoptionsaregranteduponattainmentofperformance

conditionsinthepreviousyear.Expenseforsuchoptions

isrecognizedoveraperiodthatincludesthetimewhichthe

performanceconditionismet.

Wemaygrantawardsofupto 14.0millionsharesof

stock under SharePower. Potential awards to employees

under SharePower include stock options, stock appre-

ciationrights,restrictedstockandrestrictedstockunits.

Awardsgrantedshallhave anexercisepriceequaltothe

averagemarketpriceofthestockonthedateofgrantunder

SharePower.SharePowerawardsgrantedsubsequenttothe

Spin-offDateconsistonlyofstockoptionstodate,which

vestoveraperiodrangingfromonetofouryearsandexpire

no longer than ten years after grant. Previously granted

SharePoweroptionshaveexpirationsthrough2015.

At the Spin-off Date, we converted certain of the

unvested options to purchase PepsiCo stock that were

heldbyouremployeestoYUMstockoptionsundereither

the1997LTIPorSharePower.Weconvertedtheoptionsat

amountsandexercisepricesthatmaintainedtheamountof

unrealizedstockappreciationthatexistedimmediatelyprior

totheSpin-off.Thevestingdatesandexerciseperiodsofthe

optionswerenotaffectedbytheconversion.Basedontheir

originalPepsiCograntdate,theseconvertedoptionsvest

inperiodsrangingfromonetotenyearsandexpiretento

fifteenyearsaftergrant.

Weestimatedthefairvalueofeachoptiongrantmade

during2005,2004and2003asofthedateofgrantusing

theBlack-Scholesoption-pricing modelwith thefollowing

weighted-averageassumptions:

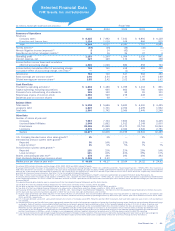

2005 2004 2003

Risk-freeinterestrate 3.8% 3.2% 3.0%

Expectedterm(years) 6.0 6.0 6.0

Expectedvolatility 36.6% 40.0% 33.6%

Expecteddividendyield 0.9% 0.1% 0.0%

InconnectionwithouradoptionofSFAS123R,wedetermined

thatitwasappropriatetogroupourstockoptiongrantsinto

twohomogeneousgroupswhenestimatingexpectedterm.

Thesegroupsconsistofgrantsmadeprimarilytorestaurant-

levelemployeesundertheRGMPlanandgrantsmadeto

executivesunderourotherstockoptionplans.

Wehavetraditionallyusedsixyearsastheexpectedterm

ofallstockoptiongrants.Inconnectionwithouradoptionof

SFAS123Randtheincreasingamountofhistoricaldatawe

nowpossesswithregardtostockoptionexerciseactivity,

werevaluatedourexpectedtermassumptions.Basedon

historicalexerciseandpost-vestingemploymenttermination

behavior,wedeterminedthattheexpectedlifeforoptions

granted under the RGM Plan was five years. For options

grantedtoourabove-storeexecutives,wedeterminedthat

anexpectedlifeofsixyearswasappropriate.Priortothe

adoptionofSFAS123Rwehavetraditionallybasedexpected

volatilityonCompanyspecifichistoricalstockdataoverthe

expectedtermoftheoption.Weareintheprocessofreval-

uating expectedvolatility,includingconsiderationofboth

historicalvolatilityofourstockaswellasimpliedvolatility

associatedwithourtradedoptions.Optionsgrantedsubse-

quenttotheadoptionofSFAS123Rinthefourthquarterof

2005werenotsignificant.

72. | Yum!Brands,Inc.