Pizza Hut 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AssetsheldforsaleatDecember31,2005andDecember25,

2004total$11millionand$7million,respectively,ofU.S.

property,plantandequipment,primarilyland,onwhichwe

previouslyoperatedrestaurantsandareincludedinprepaid

expenses and other current assets on our Consolidated

BalanceSheets.

Wrench Litigation We recorded income of $2million in

2005fromasettlementwithaninsurancecarrierrelatedto

theWrenchlitigation.Incomeof$14millionwasrecorded

for2004reflectingsettlementsassociatedwiththeWrench

litigationforamountslessthanpreviouslyaccruedaswell

as related insurance recoveries. Expense of $42million

wasrecordedasWrenchlitigationfor2003reflectingthe

amountsawardedtotheplaintiffandinterestthereon.See

Note21foradiscussionofWrenchlitigation.

AmeriServeandOtherCharges(Credits) AmeriServeFood

DistributionInc.(“AmeriServe”)wastheprimarydistributor

offoodandpapersuppliestoourU.S.storeswhenitfiledfor

protectionunderChapter11oftheU.S.BankruptcyCodeon

January31,2000.AplanofreorganizationforAmeriServe

(the“POR”)wasapprovedonNovember28,2000,which

resulted in, among other things, the assumption of our

distributionagreement,subjecttocertainamendments,by

McLaneCompany,Inc.DuringtheAmeriServebankruptcy

reorganizationprocess,wetookanumberofactionstoensure

continuedsupplytooursystem.Thoseactionsresultedin

significantexpensefortheCompany,primarilyrecordedin

2000. Under the POR, we are entitled to proceeds from

certainresidualassets,preferenceclaimsandotherlegal

recoveriesoftheestate.

Incomeof$2million,$16millionand$26millionwas

recordedasAmeriServeandothercharges(credits)for2005,

2004 and 2003, respectively. These amounts primarily

resulted from cash recoveries related to the AmeriServe

bankruptcyreorganizationprocess.

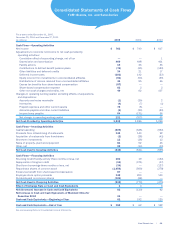

5.SUPPLEMENTALCASHFLOWDATA

2005 2004 2003

CashPaidfor:

Interest $132 $146 $178

Incometaxes 232 276 196

SignificantNon-CashInvesting

andFinancingActivities:

Assumptionofcapitalleases

relatedtotheacquisitionof

restaurantsfromfranchisees — 8 —

Capitalleaseobligationsincurred

toacquireassets 7 13 9

Debtreductionduetoamendment

ofsale-leasebackagreements — — 88

6.FRANCHISEANDLICENSEFEES

2005 2004 2003

Initialfees,includingrenewalfees $ 51 $ 43 $ 36

Initialfranchisefeesincludedin

refranchisinggains (10) (10) (5)

41 33 31

Continuingfees 1,083 986 908

$1,124 $1,019 $939

7.OTHER(INCOME)EXPENSE

2005 2004 2003

Equityincomefrominvestmentsin

unconsolidatedaffiliates $(51) $(54) $(39)

Gainuponsaleofinvestmentin

unconsolidatedaffiliate(a) (11) — —

Recoveryfromsupplier(b) (20) — —

Foreignexchangenet(gain)loss 2 (1) (2)

Other(income)expense $(80) $(55) $(41)

(a)Reflectsagainrelatedtothe2005saleofourfiftypercentinterestintheentity

thatoperatedalmostallKFCsandPizzaHutsinPolandandtheCzechRepublic

toourthenpartnerintheentity,principallyforcash.Thistransactiongenerated

aone-timenetgainofapproximately$11millionforYUMascashproceeds(net

ofexpenses)ofapproximately$25millionfromthesaleofourinterestinthe

entityexceededourrecordedinvestmentinthisunconsolidatedaffiliate.

(b)Relatestoafinancialrecoveryfromasupplieringredientissueinmainland

Chinatotaling$24millionfortheyearendedDecember31,2005,$4million

ofwhichwasrecognizedthroughequityincomefrominvestmentsinunconsoli-

datedaffiliates.OurKFCbusinessinmainlandChinawasnegativelyimpacted

bytheinterruptionofproductofferingsandnegativepublicityassociatedwith

asupplieringredientissueexperiencedinlateMarch,2005.Duringtheyear

endedDecember31,2005,weenteredintoanagreementwiththesupplierfor

apartialrecoveryofourlosses.

8.PROPERTY,PLANTANDEQUIPMENT,NET

2005 2004

Land $ 567 $ 617

Buildingsandimprovements 3,094 2,957

Capitalleases,primarilybuildings 126 146

Machineryandequipment 2,399 2,337

6,186 6,057

Accumulateddepreciationandamortization (2,830) (2,618)

$ 3,356 $ 3,439

Depreciationandamortizationexpenserelatedtoproperty,

plantand equipmentwas $459million, $434millionand

$388millionin2005,2004and2003,respectively.

Yum!Brands,Inc. | 65.