Oracle 2010 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2010 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

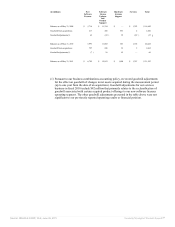

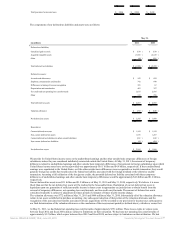

COMMITMENTS AND CONTINGENCIES

COMMITMENTS AND CONTINGENCIES

(USD $)

12 Months Ended

05/31/2011

Commitments and Contingencies 12. COMMITMENTS AND CONTINGENCIES

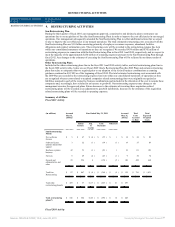

Lease Commitments

We lease certain facilities, furniture and equipment under operating leases. As of May 31, 2011, future minimum

annual operating lease payments and future minimum payments to be received from non-cancelable subleases were

as follows:

(in millions)

Fiscal 2012 $ 458

Fiscal 2013 341

Fiscal 2014 226

Fiscal 2015 159

Fiscal 2016 121

Thereafter 265

Future minimum operating lease payments 1,570

Less: minimum payments to be received from non-cancelable subleases (238 )

Total future minimum operating lease payments, net $ 1,332

Lease commitments include future minimum rent payments for facilities that we have vacated pursuant to our

restructuring and merger integration activities, as discussed in Note 9. We have approximately $320 million in

facility obligations, net of estimated sublease income and other costs, in accrued restructuring for these locations in

our consolidated balance sheet at May 31, 2011.

Rent expense was $406 million, $318 million and $293 million for fiscal 2011, 2010 and 2009, respectively, net of

sublease income of approximately $85 million, $73 million and $69 million, respectively. Certain lease agreements

contain renewal options providing for an extension of the lease term.

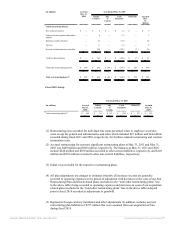

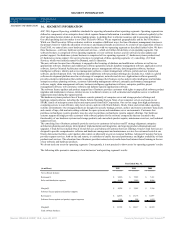

Unconditional Obligations

In the ordinary course of business, we enter into certain unconditional purchase obligations with our suppliers, which

are agreements that are enforceable, legally binding and specify terms, including: fixed or minimum quantities to be

purchased; fixed, minimum or variable price provisions; and the approximate timing of the payment. We utilize

several external manufacturers to manufacture sub-assemblies for our hardware products and to perform final

assembly and testing of finished hardware products. We also obtain individual components for our hardware systems

products from a variety of individual suppliers based on projected demand information. Such purchase commitments

are based on our forecasted component and manufacturing requirements and typically provide for fulfillment within

agreed upon lead-times and/or commercially standard lead-times for the particular part or product and have been

included in the amounts below. Routine arrangements for other materials and goods that are not related to our

external manufacturers and certain other suppliers and that are entered into in the ordinary course of business are not

included in the amounts below as they are generally entered into in order to secure pricing or other negotiated terms

and are difficult to quantify in a meaningful way.

As of May 31, 2011, our unconditional purchase and certain other obligations were as follows (in millions):

Fiscal 2012 $ 453

Fiscal 2013 15

Fiscal 2014 7

Fiscal 2015 3

Fiscal 2016 3

Total $ 481

As described in Note 2, we also have a commitment to acquire certain companies for cash consideration that we

expect to pay upon the closing of these acquisitions. As described in Note 8, we have notes payable and other

borrowings outstanding of $15.9 billion that mature at various future dates.

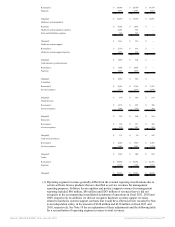

Guarantees

Source: ORACLE CORP, 10-K, June 28, 2011 Powered by Morningstar® Document Research℠