Oracle 2010 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2010 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

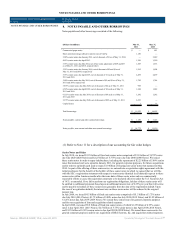

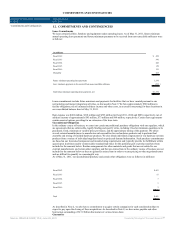

NOTES PAYABLE AND OTHER BORROWINGS

NOTES PAYABLE AND OTHER BORROWINGS

(USD $)

12 Months Ended

05/31/2011

NOTES PAYABLE AND OTHER BORROWINGS 8. NOTES PAYABLE AND OTHER BORROWINGS

Notes payable and other borrowings consisted of the following:

(Dollars in millions) May 31,

2011

May 31,

2010

Commercial paper notes $ — $ 881

Short-term borrowings (effective interest rate of 0.44%) 1,150 —

5.00% senior notes due January 2011, net of discount of $1 as of May 31, 2010 — 2,249

4.95% senior notes due April 2013 1,250 1,250

3.75% senior notes due July 2014, net of fair value adjustment of $69 and $33

as of May 31, 2011 and 2010, respectively(1)

1,569 1,533

5.25% senior notes due January 2016, net of discount of $5 and $6 as of

May 31, 2011 and 2010, respectively

1,995 1,994

5.75% senior notes due April 2018, net of discount of $1 each as of May 31,

2011 and 2010

2,499 2,499

5.00% senior notes due July 2019, net of discount of $5 and $6 as of May 31,

2011 and 2010, respectively

1,745 1,744

3.875% senior notes due July 2020, net of discount of $2 as of May 31, 2011 998 —

6.50% senior notes due April 2038, net of discount of $2 each as of May 31,

2011 and 2010

1,248 1,248

6.125% senior notes due July 2039, net of discount of $8 each as of May 31,

2011 and 2010

1,242 1,242

5.375% senior notes due July 2040, net of discount of $25 as of May 31, 2011 2,225 —

Capital leases 1 15

Total borrowings $ 15,922 $ 14,655

Notes payable, current and other current borrowings $ 1,150 $ 3,145

Notes payable, non-current and other non-current borrowings $ 14,772 $ 11,510

(1) Refer to Note 11 for a description of our accounting for fair value hedges

Senior Notes and Other

In July 2010, we issued $3.25 billion of fixed rate senior notes comprised of $1.0 billion of 3.875% notes

due July 2020 (2020 Notes) and $2.25 billion of 5.375% notes due July 2040 (2040 Notes). We issued

these senior notes in order to repay indebtedness, including the repayment of $2.25 billion of 5.00% senior

notes that matured and were repaid in January 2011, for general corporate purposes, for future acquisitions

and in order to replenish cash used to repay $1.0 billion of floating rate senior notes that matured in May

2010. As part of the offering of these senior notes, we entered into a registration rights agreement with the

initial purchasers for the benefit of the holders of these senior notes in which we agreed that we will file

with the SEC a registration statement with respect to senior notes identical in all material respects to these

senior notes within fourteen months after the issue date of these senior notes and use commercially

reasonable efforts to cause the registration statement to be declared effective under the U.S. Securities Act

of 1933, as amended. If we fail to perform our registration obligations, holders of these senior notes will

be entitled to additional payments based upon an additional interest rate of 0.25% per year that will accrue

and be payable to holders of these senior notes generally from the date of the registration default. Upon

the cure of a registration default, the interest rate on these senior notes will be reduced to the original

interest rate.

In July 2009, we issued $4.5 billion of fixed rate senior notes comprised of $1.5 billion of 3.75% notes

due July 2014 (2014 Notes), $1.75 billion of 5.00% notes due July 2019 (2019 Notes) and $1.25 billion of

6.125% notes due July 2039 (2039 Notes). We issued these senior notes for general corporate purposes

and for our acquisition of Sun and acquisition related expenses.

In April 2008, we issued $5.0 billion of fixed rate senior notes, of which $1.25 billion of 4.95% senior

notes is due April 2013 (2013 Notes), $2.5 billion of 5.75% senior notes is due April 2018 (2018 Notes),

and $1.25 billion of 6.50% senior notes is due April 2038 (2038 Notes). We issued these senior notes for

general corporate purposes and for our acquisition of BEA Systems, Inc. and acquisition related expenses.

Source: ORACLE CORP, 10-K, June 28, 2011 Powered by Morningstar® Document Research℠