Oracle 2010 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2010 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

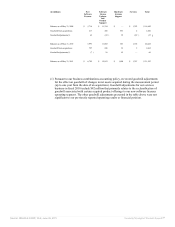

Year Ended May 31,

(in millions) 2011 2010 2009

Interest income $ 163 $ 122 $ 279

Foreign currency gains (losses), net 11 (148 ) (55 )

Noncontrolling interests in income (97 ) (95 ) (84 )

Other income, net 109 56 3

Total non-operating income (expense), net $ 186 $ (65 ) $ 143

Included in our non-operating income (expense), net for fiscal 2010 was a foreign

currency remeasurement loss of $81 million resulting from the designation of our

Venezuelan subsidiary as “highly inflationary” in accordance with ASC 830, Foreign

Currency Matters, and subsequent devaluation of the Venezuelan currency by the

Venezuelan government.

Income Taxes

We account for income taxes in accordance with ASC 740, Income Taxes. Deferred

income taxes are recorded for the expected tax consequences of temporary differences

between the tax bases of assets and liabilities for financial reporting purposes and

amounts recognized for income tax purposes. We record a valuation allowance to reduce

our deferred tax assets to the amount of future tax benefit that is more likely than not to

be realized.

A two-step approach is applied pursuant to ASC 740 in the recognition and measurement

of uncertain tax positions taken or expected to be taken in a tax return. The first step is to

determine if the weight of available evidence indicates that it is more likely than not that

the tax position will be sustained in an audit, including resolution of any related appeals

or litigation processes. The second step is to measure the tax benefit as the largest amount

that is more than 50% likely to be realized upon ultimate settlement. We recognize

interest and penalties related to uncertain tax positions in our provision for income taxes

line of our consolidated statements of operations.

A description of our accounting policies associated with tax related contingencies and

valuation allowances assumed as a part of a business combination is provided under

“Business Combinations” above.

Recent Accounting Pronouncements

Presentation of Comprehensive Income: In June 2011, the FASB issued Accounting

Standards Update No. 2011-05, Comprehensive Income (Topic 220)—Presentation of

Comprehensive Income (ASU 2011-05), to require an entity to present the total of

comprehensive income, the components of net income, and the components of other

comprehensive income either in a single continuous statement of comprehensive income

or in two separate but consecutive statements. ASU 2011-05 eliminates the option to

present the components of other comprehensive income as part of the statement of equity.

ASU 2011-05 is effective for us in our first quarter of fiscal 2013 and should be applied

retrospectively. We are currently evaluating the impact of our pending adoption of ASU

2011-05 on our consolidated financial statements.

Amendments to Achieve Common Fair Value Measurement and Disclosure

Requirements: In May 2011, the FASB issued Accounting Standards Update

No. 2011-04, Amendments to Achieve Common Fair Value Measurement and Disclosure

Requirements in U.S. GAAP and International Financial Reporting Standards (Topic

820)—Fair Value Measurement (ASU 2011-04), to provide a consistent definition of fair

value and ensure that the fair value measurement and disclosure requirements are similar

between U.S. GAAP and International Financial Reporting Standards. ASU 2011-04

changes certain fair value measurement principles and enhances the disclosure

requirements particularly for level 3 fair value measurements (as defined in Note 4

below). ASU 2011-04 is effective for us in our fourth quarter of fiscal 2012 and should be

applied prospectively. We are currently evaluating the impact of our pending adoption of

ASU 2011-04 on our consolidated financial statements.

Disclosure of Supplementary Pro Forma Information for Business Combinations: In

December 2010, the FASB issued Accounting Standards Update No. 2010-29, Disclosure

of Supplementary Pro Forma Information for Business Combinations (Topic

805)—Business Combinations (ASU 2010-29), to improve consistency in how the pro

forma disclosures are calculated. Additionally, ASU 2010-29 enhances the disclosure

requirements and requires description of the nature and amount of any material,

nonrecurring pro forma adjustments directly attributable to a business combination. ASU

2010-29 is effective for us in fiscal 2012 and should be applied prospectively to business

combinations for which the acquisition date is after the effective date. Early adoption is

permitted. We will adopt ASU 2010-29 in fiscal 2012 and do not believe it will have a

material impact on our consolidated financial statements.

Performing Step 2 of the Goodwill Impairment Test: In December 2010, the FASB

Source: ORACLE CORP, 10-K, June 28, 2011 Powered by Morningstar® Document Research℠