Oracle 2010 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2010 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the business combination. A liability for a cost associated with an exit or disposal activity

is recognized and measured at its fair value in our consolidated statement of operations in

the period in which the liability is incurred. When estimating the fair value of facility

restructuring activities, assumptions are applied regarding estimated sub-lease payments

to be received, which can differ materially from actual results. This may require us to

revise our initial estimates which may materially affect our results of operations and

financial position in the period the revision is made.

For a given acquisition, we generally identify certain pre-acquisition contingencies as of

the acquisition date and may extend our review and evaluation of these pre-acquisition

contingencies throughout the measurement period in order to obtain sufficient

information to assess whether we include these contingencies as a part of the purchase

price allocation and, if so, to determine the estimated amounts.

If we determine that a pre-acquisition contingency (non-income tax related) is probable in

nature and estimable as of the acquisition date, we record our best estimate for such a

contingency as a part of the preliminary purchase price allocation. We often continue to

gather information for and evaluate our pre-acquisition contingencies throughout the

measurement period and if we make changes to the amounts recorded or if we identify

additional pre-acquisition contingencies during the measurement period, such amounts

will be included in the purchase price allocation during the measurement period and,

subsequently, in our results of operations.

In addition, uncertain tax positions and tax related valuation allowances assumed in

connection with a business combination are initially estimated as of the acquisition date.

We reevaluate these items quarterly with any adjustments to our preliminary estimates

being recorded to goodwill provided that we are within the measurement period.

Subsequent to the measurement period or our final determination of the tax allowance’s

or contingency’s estimated value, whichever comes first, changes to these uncertain tax

positions and tax related valuation allowances will affect our provision for income taxes

in our consolidated statement of operations and could have a material impact on our

results of operations and financial position.

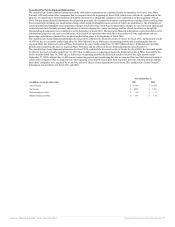

Marketable and Non-Marketable Securities

In accordance with ASC 320, Investments—Debt and Equity Securities, and based on our

intentions regarding these instruments, we classify substantially all of our marketable

debt and equity securities as available-for-sale. Marketable debt and equity securities are

reported at fair value, with all unrealized gains (losses) reflected net of tax in

stockholders’ equity. If we determine that an investment has an other than temporary

decline in fair value, we recognize the investment loss in non-operating income

(expense), net in the accompanying consolidated statements of operations. We

periodically evaluate our investments to determine if impairment charges are required.

We hold investments in certain non-marketable equity securities in which we do not have

a controlling interest or significant influence. These equity securities are recorded at cost

and included in other assets in the accompanying consolidated balance sheets. If based on

the terms of our ownership of these non-marketable securities we determine that we

exercise significant influence on the entity to which these non-marketable securities

relate, we apply the requirements of ASC 323, Investments—Equity Method and Joint

Ventures to account for such investments. Our non-marketable securities are subject to

periodic impairment reviews.

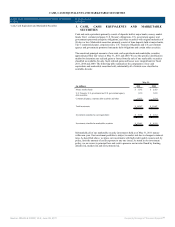

Fair Value of Financial Instruments

We apply the provisions of ASC 820, Fair Value Measurements and Disclosures, to our

financial instruments that we are required to carry at fair value pursuant to other

accounting standards, including our investments in marketable debt and equity securities

and our derivative financial instruments.

The additional disclosures regarding our fair value measurements are included in Note 4.

Allowances for Doubtful Accounts

We record allowances for doubtful accounts based upon a specific review of all

significant outstanding invoices. For those invoices not specifically reviewed, provisions

are provided at differing rates, based upon the age of the receivable, the collection history

associated with the geographic region that the receivable was recorded in and current

economic trends. We write-off a receivable and charge it against its recorded allowance

when we have exhausted our collection efforts without success.

Concentrations of Credit Risk

Financial instruments that are potentially subject to concentrations of credit risk consist

primarily of cash and cash equivalents, marketable securities and trade receivables. Our

cash and cash equivalents are generally held with a number of large, diverse financial

institutions worldwide to reduce the amount of exposure to any single financial

institution. Investment policies have been implemented that limit purchases of marketable

debt securities to investment grade securities. We generally do not require collateral to

secure accounts receivable. The risk with respect to trade receivables is mitigated by

credit evaluations we perform on our customers, the short duration of our payment terms

for the significant majority of our customer contracts and by the diversification of our

customer base. No single customer accounted for 10% or more of our total revenues in

fiscal 2011, 2010 or 2009.

Inventories

Inventories are stated at the lower of cost or market value. Cost is computed using

standard cost, which approximates actual cost, on a first-in, first-out basis. We evaluate

our ending inventories for estimated excess quantities and obsolescence. This evaluation

includes analysis of sales levels by product and projections of future demand within

specific time horizons (generally six months or less). Inventories in excess of future

demand are written down and charged to hardware systems products expenses. In

addition, we assess the impact of changing technology to our inventories and we write

Source: ORACLE CORP, 10-K, June 28, 2011 Powered by Morningstar® Document Research℠