Oracle 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2011

Performing Step 2 of the Goodwill Impairment Test: In December 2010, the FASB issued Accounting Standards Update No. 2010-28, When to Perform Step

2 of the Goodwill Impairment Test for Reporting Units with Zero or Negative Carrying Amounts (Topic 350)—Intangibles—Goodwill and Other (ASU 2010-28).

ASU 2010-28 amends the criteria for performing Step 2 of the goodwill impairment test for reporting units with zero or negative carrying amounts and requires

performing Step 2 if qualitative factors indicate that it is more likely than not that a goodwill impairment exists. We will adopt ASU 2010-28 in fiscal 2012 and

any impairment to be recorded upon adoption will be recognized as an adjustment to our beginning retained earnings. We will adopt ASU 2010-28 in fiscal 2012

and do not believe it will have a material impact on our consolidated financial statements.

Milestone Method of Revenue Recognition: In April 2010, the FASB issued Accounting Standards Update No. 2010-17, Revenue Recognition—Milestone

Method (Topic 605)—Revenue Recognition (ASU 2010-17). ASU 2010-17 provides guidance on defining the milestone and determining when the use of the

milestone method of revenue recognition for research or development transactions is appropriate. It provides criteria for evaluating if the milestone is substantive

and clarifies that a vendor can recognize consideration that is contingent upon achievement of a milestone as revenue in the period in which the milestone is

achieved, if the milestone meets all the criteria to be considered substantive. ASU 2010-17 is effective for us in our first quarter of fiscal 2012 and should be

applied prospectively. Early adoption is permitted. If we were to adopt ASU 2010-17 prior to the first quarter of fiscal 2012, we must apply it retrospectively to

the beginning of the fiscal year of adoption and to all interim periods presented. We will adopt ASU 2010-17 in fiscal 2012 and do not believe it will have a

material impact on our consolidated financial statements.

Disclosure Requirements Related to Fair Value Measurements: In January 2010, the FASB issued Accounting Standards Update No. 2010-06, Improving

Disclosures about Fair Value Measurements (Topic 820)—Fair Value Measurements and Disclosures (ASU 2010-06), to add additional disclosures about the

different classes of assets and liabilities measured at fair value, the valuation techniques and inputs used, and the activity in Level 3 fair value measurements.

Certain provisions of this update will be effective for us in fiscal 2012 and we and do not believe these provisions will have a material impact on our consolidated

financial statements.

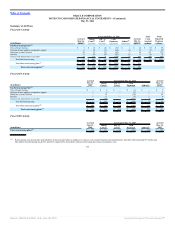

2. ACQUISITIONS

Fiscal 2011 Acquisitions

On January 5, 2011, we completed our acquisition of Art Technology Group, Inc. (ATG), a provider of eCommerce software and related on demand commerce

optimization applications. We have included the financial results of ATG in our consolidated financial statements from the date of acquisition. The total

preliminary purchase price for ATG was approximately $1.0 billion, which consisted of approximately $990 million in cash and $16 million for the fair value of

stock options and restricted stock-based awards assumed. In allocating the total preliminary purchase price for ATG based on estimated fair values, we

preliminarily recorded $549 million of goodwill, $404 million of identifiable intangible assets and $53 million of net tangible assets.

On August 11, 2010, we completed our acquisition of Phase Forward Incorporated (Phase Forward), a provider of applications for life sciences companies and

healthcare providers. We have included the financial results of Phase Forward in our consolidated financial statements from the date of acquisition. The total

preliminary purchase price for Phase Forward was approximately $736 million, which consisted of approximately $735 million in cash and $1 million for the fair

value of restricted stock-based awards assumed. In allocating the total preliminary purchase price for Phase Forward based on estimated fair values, we

preliminarily recorded $355 million of goodwill, $370 million of identifiable intangible assets, $20 million of in-process research and development and $9

million of net tangible liabilities (resulting primarily from deferred tax liabilities assumed as a part of this transaction).

103

Source: ORACLE CORP, 10-K, June 28, 2011 Powered by Morningstar® Document Research℠