Oracle 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2011

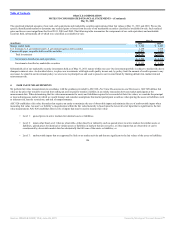

Senior Notes and Other

In July 2010, we issued $3.25 billion of fixed rate senior notes comprised of $1.0 billion of 3.875% notes due July 2020 (2020 Notes) and $2.25 billion of

5.375% notes due July 2040 (2040 Notes). We issued these senior notes in order to repay indebtedness, including the repayment of $2.25 billion of 5.00% senior

notes that matured and were repaid in January 2011, for general corporate purposes, for future acquisitions and in order to replenish cash used to repay $1.0

billion of floating rate senior notes that matured in May 2010. As part of the offering of these senior notes, we entered into a registration rights agreement with

the initial purchasers for the benefit of the holders of these senior notes in which we agreed that we will file with the SEC a registration statement with respect to

senior notes identical in all material respects to these senior notes within fourteen months after the issue date of these senior notes and use commercially

reasonable efforts to cause the registration statement to be declared effective under the U.S. Securities Act of 1933, as amended. If we fail to perform our

registration obligations, holders of these senior notes will be entitled to additional payments based upon an additional interest rate of 0.25% per year that will

accrue and be payable to holders of these senior notes generally from the date of the registration default. Upon the cure of a registration default, the interest rate

on these senior notes will be reduced to the original interest rate.

In July 2009, we issued $4.5 billion of fixed rate senior notes comprised of $1.5 billion of 3.75% notes due July 2014 (2014 Notes), $1.75 billion of 5.00% notes

due July 2019 (2019 Notes) and $1.25 billion of 6.125% notes due July 2039 (2039 Notes). We issued these senior notes for general corporate purposes and for

our acquisition of Sun and acquisition related expenses.

In April 2008, we issued $5.0 billion of fixed rate senior notes, of which $1.25 billion of 4.95% senior notes is due April 2013 (2013 Notes), $2.5 billion of

5.75% senior notes is due April 2018 (2018 Notes), and $1.25 billion of 6.50% senior notes is due April 2038 (2038 Notes). We issued these senior notes for

general corporate purposes and for our acquisition of BEA Systems, Inc. and acquisition related expenses.

In May 2007, we issued $2.0 billion of floating rate senior notes, of which $1.0 billion was due and paid in May 2009 and $1.0 billion was due and paid in May

2010. We had also entered into certain variable to fixed interest rate swap agreements related to these senior notes, which settled as of the same dates the notes

were repaid (see Note 11).

In January 2006, we issued $5.75 billion of senior notes, of which $2.25 billion of 5.00% senior notes was due and paid in January 2011 and $2.0 billion of

5.25% senior notes due 2016 (2016 Notes) remained outstanding as of May 31, 2011.

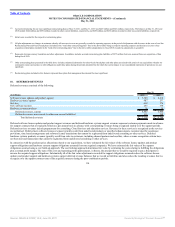

The effective interest yields of the 2013 Notes, 2014 Notes, 2016 Notes, 2018 Notes, 2019 Notes, 2020 Notes, 2038 Notes, 2039 Notes and 2040 Notes

(collectively, the Senior Notes) at May 31, 2011 were 4.96%, 3.75%, 5.32%, 5.76%, 5.05%, 3.90%, 6.52%, 6.19% and 5.45%, respectively. Interest is payable

semi-annually for the Senior Notes. In September 2009, we entered into interest rate swap agreements that have the economic effect of modifying the fixed

interest obligations associated with the 2014 Notes so that the interest payable on these notes effectively became variable (1.38% at May 31, 2011; see Note 11

for additional information). All of the Senior Notes may be redeemed at any time, subject to payment of a make-whole premium.

The Senior Notes rank pari passu with any other notes we may issue in the future pursuant to our commercial paper program (see additional discussion regarding

our commercial paper program below) and all existing and future senior indebtedness of Oracle Corporation. All existing and future liabilities of the subsidiaries

of Oracle Corporation are effectively senior to the Senior Notes and any of our commercial paper notes.

Separately, shortly after the closing of our acquisition of Sun we repaid, in full, $700 million of Sun’s legacy convertible notes in the third quarter of fiscal 2010.

110

Source: ORACLE CORP, 10-K, June 28, 2011 Powered by Morningstar® Document Research℠