Oracle 2010 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2010 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In May 2007, we issued $2.0 billion of floating rate senior notes, of which $1.0 billion was due and paid in

May 2009 and $1.0 billion was due and paid in May 2010. We had also entered into certain variable to

fixed interest rate swap agreements related to these senior notes, which settled as of the same dates the

notes were repaid (see Note 11).

In January 2006, we issued $5.75 billion of senior notes, of which $2.25 billion of 5.00% senior notes was

due and paid in January 2011 and $2.0 billion of 5.25% senior notes due 2016 (2016 Notes) remained

outstanding as of May 31, 2011.

The effective interest yields of the 2013 Notes, 2014 Notes, 2016 Notes, 2018 Notes, 2019 Notes, 2020

Notes, 2038 Notes, 2039 Notes and 2040 Notes (collectively, the Senior Notes) at May 31, 2011 were

4.96%, 3.75%, 5.32%, 5.76%, 5.05%, 3.90%, 6.52%, 6.19% and 5.45%, respectively. Interest is payable

semi-annually for the Senior Notes. In September 2009, we entered into interest rate swap agreements that

have the economic effect of modifying the fixed interest obligations associated with the 2014 Notes so that

the interest payable on these notes effectively became variable (1.38% at May 31, 2011; see Note 11 for

additional information). All of the Senior Notes may be redeemed at any time, subject to payment of a

make-whole premium.

The Senior Notes rank pari passu with any other notes we may issue in the future pursuant to our

commercial paper program (see additional discussion regarding our commercial paper program below)

and all existing and future senior indebtedness of Oracle Corporation. All existing and future liabilities of

the subsidiaries of Oracle Corporation are effectively senior to the Senior Notes and any of our

commercial paper notes.

Separately, shortly after the closing of our acquisition of Sun we repaid, in full, $700 million of Sun’s

legacy convertible notes in the third quarter of fiscal 2010.

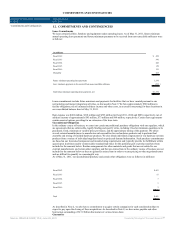

We were in compliance with all debt-related covenants at May 31, 2011. Future principal payments for all

of our borrowings at May 31, 2011 were as follows (in millions):

Fiscal 2012 $ 1,150

Fiscal 2013 1,250

Fiscal 2014 —

Fiscal 2015 1,500

Fiscal 2016 2,000

Thereafter 10,000

Total $ 15,900

Commercial Paper Program & Commercial Paper Notes

We entered into a commercial paper program in February 2006 (amended in May 2008) via dealer

agreements with Banc of America Securities LLC and JP Morgan Securities, Inc. and an Issuing and

Paying Agency Agreement entered into in February 2006 with JPMorgan Chase Bank, National

Association (CP Program). On May 11, 2010, we reduced the overall capacity of our CP Program from

$5.0 billion to $3.0 billion. Our ability to issue commercial paper notes in the future is highly dependent

upon our ability to provide a “back-stop” by means of a revolving credit facility or other debt facility for

amounts equal to or greater than the amounts of commercial paper notes we intend to issue. While

presently we have no such facilities in place that may provide a back-stop to such commercial paper notes

(see additional discussion under “Revolving Credit Agreements” below), we currently believe that, if

needed, we could put in place one or more additional revolving credit facilities or other debt facility in a

timely manner and on commercially reasonable terms.

During fiscal 2010, we issued $2.8 billion of unsecured short-term commercial paper notes pursuant to the

CP Program (none in fiscal 2011 and 2009). As of May 31, 2011, we had no commercial paper notes

outstanding compared to $881 million outstanding as of May 31, 2010.

Revolving Credit Agreements

On May 27, 2011, we entered into two revolving credit agreements with BNP Paribas, as initial lender and

administrative agent; and BNP Paribas Securities Corp., as sole lead arranger and sole bookrunner (the

2011 Credit Agreements) to borrow $1.15 billion pursuant to these agreements. The 2011 Credit

Agreements provided us with short-term borrowings for working capital and other general corporate

purposes. Interest for the 2011 Credit Agreements is based on either (x) a “base rate” calculated as the

highest of (i) BNP Paribas’s prime rate, (ii) the federal funds effective rate plus 0.50% and (iii) the LIBOR

for deposits in U.S. dollars plus 1% or (y) LIBOR for deposits made in U.S. dollars plus 0.25%, depending

on the type of borrowings made by us. Any amounts borrowed pursuant to the 2011 Credit Agreements

are due no later than June 30, 2011, which is the termination date of the 2011 Credit Agreements.

The 2011 Credit Agreements contain certain customary representations, warranties and guarantees,

covenants and pledges of certain assets made by us and our subsidiaries. Events of default result in the

requirement to pay additional interest. If any of the events of default occur and are not cured, any unpaid

amounts under the 2011 Credit Agreements may be declared immediately due and payable and the 2011

Credit Agreements may be terminated. We were in compliance with the 2011 Credit Agreements’

covenants as of May 31, 2011.

On March 14, 2011, our $3.0 billion, five-year Revolving Credit Agreement dated March 15, 2006, among

Oracle and the lenders named therein (the 2006 Credit Agreement) expired pursuant to its terms. No debt

was outstanding pursuant to the 2006 Credit Agreement as of its date of expiration.

Source: ORACLE CORP, 10-K, June 28, 2011 Powered by Morningstar® Document Research℠