Oracle 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

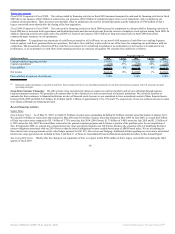

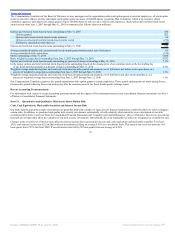

during fiscal 2010, our annual interest income would decline by approximately $97 million, assuming consistent investment levels. The table below presents the

cash, cash equivalent and marketable securities balances and the related weighted average interest rates for our investment portfolio at May 31, 2010. The cash,

cash equivalent and marketable securities balances are recorded at their fair values at May 31, 2010.

May 31, 2010

(Dollars in millions) Fair Value

Weighted Average

Interest Rate

Cash and cash equivalents $ 9,914 0.75%

Marketable securities 8,555 0.46%

Total cash, cash equivalents and marketable securities $ 18,469 0.62%

Interest Expense Risk

Our total borrowings were $14.7 billion as of May 31, 2010, all of which were fixed rate borrowings. In September 2009, we entered into certain fixed to

variable interest rate swap agreements to manage the interest rate and related debt fair value exposures associated with our $1.5 billion of senior notes due July

2014 (2014 Notes) so that the interest payable on the 2014 Notes effectively became variable based on LIBOR. We do not use interest rate swap arrangements

for trading purposes. We have designated these swap agreements as qualifying instruments and are accounting for them as fair value hedges pursuant to the

FASB’s accounting standard for derivatives and hedging. These transactions are characterized as fair value hedges for financial accounting purposes because

they protect us against changes in the fair values of our 2014 Notes due to interest rate movements. The changes in fair values of these interest rate swap

agreements will be recognized as interest expense in our consolidated statements of operations with the corresponding amounts included in other assets or other

non-current liabilities in our consolidated balance sheets. The amount of net gain (loss) attributable to the risk being hedged is recognized as interest expense in

our consolidated statements of operations with the corresponding amount included in notes payable and other non-current borrowings. The periodic interest

settlements, which occur at the same intervals as the 2014 Notes, are recorded as interest expense.

By entering into these interest rate swap arrangements, we have assumed risks associated with variable interest rates based upon LIBOR. Our 2014 Notes had an

effective interest rate of 1.44% as of May 31, 2010, after considering the effects of the aforementioned interest rate swap arrangements. Changes in the overall

level of interest rates affect the interest expense that we recognize in our statements of operations. An interest rate risk sensitivity analysis is used to measure

interest rate risk by computing estimated changes in cash flows as a result of assumed changes in market interest rates. As of May 31, 2010, if LIBOR-based

interest rates increased by 100 basis points, the change would increase our interest expense annually by approximately $15 million as it relates to our fixed to

variable interest rate swap agreements.

In May 2010, we repaid $1.0 billion of floating rate senior notes and settled the variable to fixed interest rate swap agreement that was used to manage the

economic effect of variable interest obligations associated with such floating rate senior notes.

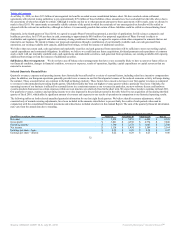

Foreign Currency Risk

Foreign Currency Transaction Risk

We transact business in various foreign currencies and are subject to risks associated with the effects of certain foreign currency exposures. We have a program

that primarily utilizes foreign currency forward contracts to offset these risks. Our program may be suspended from time to time. This program was active for the

majority of fiscal 2010 and was suspended during our fourth quarter of fiscal 2010. When the program is active, we enter into foreign currency forward contracts

so that increases or decreases in our foreign currency exposures are offset by gains or losses on the foreign currency forward contracts in order to mitigate the

risks and volatility associated with our foreign currency transactions. Our foreign currency exposures typically arise from intercompany sublicense fees and other

intercompany transactions that are expected to be cash settled in the near term. Although we have suspended our historical foreign currency forward contract

program as of May 31, 2010, our subsidiaries continue to enter into cross-currency transactions and create cross-currency exposures via intercompany

arrangements and we expect that these transactions and exposures will continue. Our ultimate

75

Source: ORACLE CORP, 10-K, July 01, 2010 Powered by Morningstar® Document Research℠