Oracle 2009 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2009 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

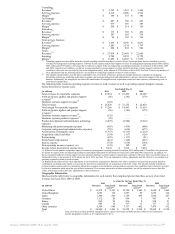

INCOME TAXES

INCOME TAXES

(USD $)

12 Months Ended

05/31/2010

INCOME TAXES 15. INCOME TAXES

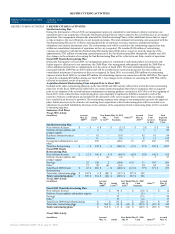

The following is a geographical breakdown of income before the provision for income taxes:

Year Ended May 31,

(in millions) 2010 2009 2008

Domestic $ 4,282 $ 3,745 $ 3,930

Foreign 3,961 4,089 3,904

Total income before provision for income taxes $ 8,243 $ 7,834 $ 7,834

The provision for income taxes consisted of the following:

Year Ended May 31,

(Dollars in millions) 2010 2009 2008

Current provision:

Federal $ 1,307 $ 1,341 $ 1,325

State 299 361 231

Foreign 1,013 934 892

Total current provision 2,619 2,636 2,448

Deferred benefit:

Federal (380) (177) (96)

State (76) (52) (24)

Foreign (55) (166) (15)

Total deferred benefit (511) (395) (135)

Total provision for income taxes $ 2,108 $ 2,241 $ 2,313

Effective income tax rate 25.6% 28.6% 29.5%

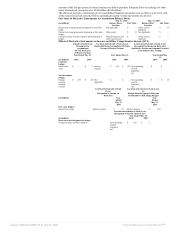

The provision for income taxes differed from the amount computed by applying the federal statutory rate to our income before provision for

income taxes as follows:

Year Ended May 31,

(in millions) 2010 2009 2008

Tax provision at statutory rate $ 2,885 $ 2,742 $ 2,742

Foreign earnings at other than United States rates (672) (673) (569)

State tax expense, net of federal benefit 161 201 135

Settlements and releases from judicial decisions and statute expirations,

net

(315) 25 (20)

Other, net 49 (54) 25

Total provision for income taxes $ 2,108 $ 2,241 $ 2,313

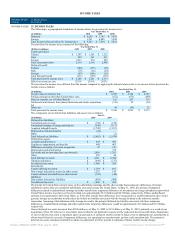

The components of our deferred tax liabilities and assets were as follows:

May 31,

(in millions) 2010 2009

Deferred tax liabilities:

Unrealized gain on stock $ (130) $ (130)

Unremitted earnings of foreign subsidiaries (100) (117)

Acquired intangible assets (1,748) (1,831)

Depreciation and amortization (24) —

Other — (1)

Total deferred tax liabilities $ (2,002) $ (2,079)

Deferred tax assets:

Accruals and allowances $ 629 $ 492

Employee compensation and benefits 649 401

Differences in timing of revenue recognition 67 141

Depreciation and amortization — 219

Tax credit and net operating loss carryforwards 2,916 1,201

Other 250 44

Total deferred tax assets $ 4,511 $ 2,498

Valuation allowance $ (649) $ (137)

Net deferred tax assets $ 1,860 $ 282

Recorded as:

Current deferred tax assets $ 1,159 $ 661

Non-current deferred tax assets (in other assets) 1,267 145

Current deferred tax liabilities (in other current

liabilities)

(142) (44)

Non-current deferred tax liabilities (424) (480)

Net deferred tax assets $ 1,860 $ 282

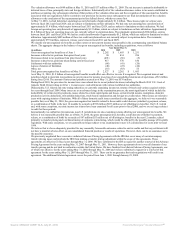

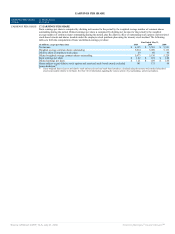

We provide for United States income taxes on the undistributed earnings and the other outside basis temporary differences of foreign

subsidiaries unless they are considered indefinitely reinvested outside the United States. At May 31, 2010, the amount of temporary

differences related to undistributed earnings and other outside basis temporary differences of investments in foreign subsidiaries upon which

United States income taxes have not been provided was approximately $13.0 billion and $4.7 billion, respectively. If these undistributed

earnings were repatriated to the United States, or if the other outside basis differences were recognized in a taxable transaction, they would

generate foreign tax credits that would reduce the federal tax liability associated with the foreign dividend or the otherwise taxable

transaction. Assuming a full utilization of the foreign tax credits, the potential deferred tax liability associated with these temporary

differences of undistributed earnings and other outside basis temporary differences would be approximately $3.6 billion and $1.5 billion,

respectively.

Our net deferred tax assets increased from $282 million as of May 31, 2009 to $1.9 billion as of May 31, 2010, primarily as a result of our

acquisition of Sun. We believe it is more likely than not that the net deferred tax assets will be realized in the foreseeable future. Realization

of our net deferred tax assets is dependent upon our generation of sufficient taxable income in future years in appropriate tax jurisdictions to

obtain benefit from the reversal of temporary differences, net operating loss carryforwards, and tax credit carryforwards. The amount of

deferred tax assets considered realizable is subject to adjustment in future periods if estimates of future taxable income change.

Source: ORACLE CORP, 10-K, July 01, 2010 Powered by Morningstar® Document Research℠