Oracle 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

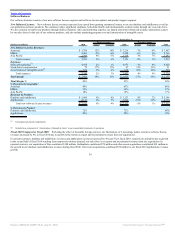

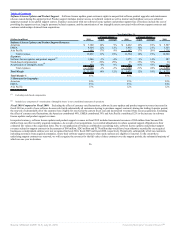

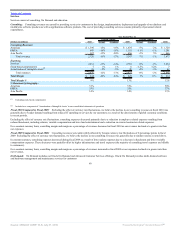

(6) Stock-based compensation is included in the following operating expense line items of our consolidated statements of operations (in millions):

Year ended May 31,

2010 2009 2008

Sales and marketing $ 81 $ 67 $ 51

Software license updates and product support 17 13 10

Hardware systems products 3 — —

Hardware systems support 2 — —

Services 14 12 13

Research and development 172 155 114

General and administrative 132 93 69

Subtotal 421 340 257

Acquisition related and other 15 15 112

Total stock-based compensation $ 436 $ 355 $ 369

Stock-based compensation included in acquisition related and other expenses resulted from unvested stock options and restricted stock-based awards assumed from acquisitions whose

vesting was accelerated upon termination of the employees pursuant to the terms of those options and restricted stock-based awards.

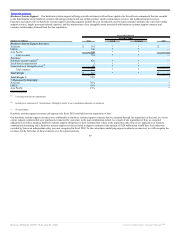

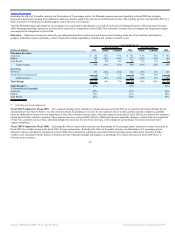

(7) The income tax effects presented were calculated as if the above described charges were not included in our results of operations for each of the respective periods presented.

Income tax effects were calculated based on the applicable jurisdictional tax rates applied to the expense and income items within the table above and resulted in an effective tax rate

of 27.1% for fiscal 2010 instead of 25.6%, which represented our effective tax rate as derived per our consolidated statement of operations, due to differences in jurisdictional tax

rates and related tax benefits attributable to our restructuring expenses in fiscal 2010. The difference in fiscal 2010 was also due to income tax effects related to acquired tax

exposures. Income tax effects were calculated reflecting an effective tax rate of 28.7% for fiscal 2009 instead of 28.6%, which represented our effective tax rate as derived per our

consolidated statement of operations, due to the exclusion of the tax effect of an adjustment to our non-current deferred tax liability associated with acquired intangible assets.

Income tax effects presented for fiscal 2008 were calculated based on our effective tax rate of 29.5%, which was consistent with our tax rate as derived per our consolidated

statement of operations.

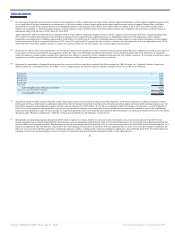

(8) For fiscal 2010, the estimated operating loss contribution from Sun was calculated based upon the margin contribution of our hardware systems business for fiscal 2010, the allocation of

revenues and expenses from our software and services businesses that we estimate were attributable to Sun during fiscal 2010 and the allocation of certain other operating expenses

including research and development expenses, an allocation of general and administrative expenses, amortization of intangible assets, stock-based compensation expenses, an allocation of

acquisition related and other expenses and an allocation of restructuring expenses that we estimated were attributable to Sun during fiscal 2010. Our estimated operating income

contribution from Sun, as adjusted, excludes certain of these charges as further presented in the reconciliation below.

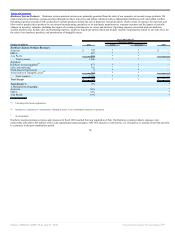

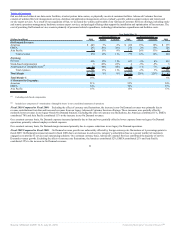

A reconciliation of the margin contribution of our hardware systems business as presented in our discussion of our operational results to our measures of estimated operating loss

contribution from Sun and our estimated operating income contribution from Sun, as adjusted, was as follows for fiscal 2010 (in millions):

Estimated

Sun Margin

Contribution

before

Adjustments Adjustments

Estimated

Sun Margin

Contribution,

as Adjusted

Hardware systems business direct revenues and expenses, net(a) $ 650 $ 157 $ 807

Stock-based compensation(a) (7) 7 —

Amortization of intangible assets, hardware systems business(a) (260) 260 —

Total hardware systems business margin(a) 383 424 807

Allocation of margin from other Sun businesses(b) 63 103 166

Research and development expenses(c) (476) 7 (469)

Allocation of general and administrative expenses and other(c) (136) 3 (133)

Allocation of acquisition related and other expenses(d) (112) 112 —

Allocation of restructuring expenses(d) (342) 342 —

Total estimated operating (loss) income from Sun $ (620) $ 991 $ 371

52

Source: ORACLE CORP, 10-K, July 01, 2010 Powered by Morningstar® Document Research℠