Oracle 2009 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2009 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224

|

|

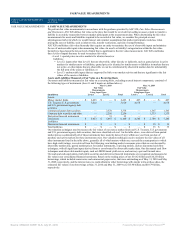

CASH, CASH EQUIVALENTS AND MARKETABLE SECURITIES

CASH, CASH EQUIVALENTS AND MARKETABLE SECURITIES

(USD $)

12 Months Ended

05/31/2010

CASH, CASH EQUIVALENTS AND MARKETABLE SECURITIES 3. CASH, CASH EQUIVALENTS AND MARKETABLE SECURITIES

Cash and cash equivalents primarily consist of deposits held at major banks, money

market funds, Tier-1 commercial paper, U.S. Treasury obligations, U.S. government

agency and government sponsored enterprise obligations, and other securities with

original maturities of 90 days or less. Marketable securities primarily consist of time

deposits held at major banks, Tier-1 commercial paper, corporate notes, U.S. Treasury

obligations and U.S. government agency and government sponsored enterprise debt

obligations and certain other securities.

The amortized principal amounts of our cash, cash equivalents and marketable securities

approximated their fair values at May 31, 2010 and 2009. We use the specific

identification method to determine any realized gains or losses from the sale of our

marketable securities classified as available-for-sale. Such realized gains and losses

were insignificant for fiscal 2010, 2009 and 2008. The following table summarizes the

components of our cash equivalents and marketable securities held, substantially all of

which were classified as available-for-sale:

May 31,

(in millions) 2010 2009

Money market funds $ 2,423 $ 467

U.S. Treasury, U.S. government and U.S. government

agency debt securities

3,010 4,078

Commercial paper, corporate debt securities and other 5,634 2,700

Total investments $ 11,067 $ 7,245

Investments classified as cash equivalents $ 2,512 $ 3,616

Investments classified as marketable securities $ 8,555 $ 3,629

Substantially all of our marketable security investments held as of May 31, 2010 mature

within one year. Our investment portfolio is subject to market risk due to changes in

interest rates. We place our investments with high credit quality issuers as described

above and, by policy, limit the amount of credit exposure to any one issuer. As stated in

our investment policy, we are averse to principal loss and seek to preserve our invested

funds by limiting default risk, market risk and reinvestment risk.

Source: ORACLE CORP, 10-K, July 01, 2010 Powered by Morningstar® Document Research℠