Oracle 2009 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2009 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Approximately 15 million shares outstanding as of May 31, 2010 are not expected to vest.

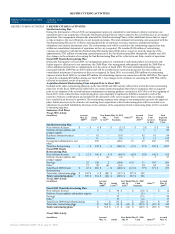

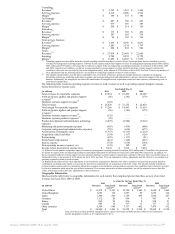

Stock-Based Compensation Expense and Valuation of Stock Options and Restricted Stock-Based Awards

Stock-based compensation is included in the following operating expense line items in our consolidated statements of

operations:

Year Ended May 31,

(in millions) 2010 2009 2008

Sales and marketing $ 81 $ 67 $ 51

Software license updates and product support 17 13 10

Hardware systems products 3 — —

Hardware systems support 2 — —

Services 14 12 13

Research and development 172 155 114

General and administrative 132 93 69

Acquisition related and other 15 15 112

Total stock-based compensation 436 355 369

Estimated income tax benefit included in provision for income

taxes

(146) (122) (128)

Total stock-based compensation, net of estimated income tax

benefit

$ 290 $ 233 $ 241

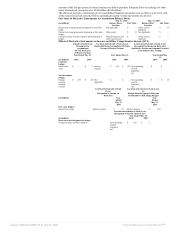

We estimate the fair value of our share-based payments using the Black-Scholes-Merton option-pricing model, which was

developed for use in estimating the fair value of traded options that have no vesting restrictions and are fully transferable.

Option valuation models, including the Black-Scholes-Merton option-pricing model, require the input of assumptions,

including stock price volatility. Changes in the input assumptions can materially affect the fair value estimates and ultimately

how much we recognize as stock-based compensation expense. The fair values of our stock options were estimated at the date

of grant or date of acquisition for options assumed in a business combination. The weighted average input assumptions used

and resulting fair values were as follows for fiscal 2010, 2009 and 2008:

Year Ended May 31,

2010 2009 2008

Expected life (in years) 4.7 5.3 5.0

Risk-free interest rate 2.1% 3.3% 4.6%

Volatility 31% 37% 29%

Dividend yield 0.9% — —

Weighted-average fair value per share $ 5.21 $ 7.93 $ 7.53

The expected life input is based on historical exercise patterns and post-vesting termination behavior, the risk-free interest rate

input is based on United States Treasury instruments and the volatility input is calculated based on the implied volatility of

our longest-term, traded options. Our expected dividend yield was zero prior to our first dividend declaration on March 18,

2009 as we did not historically pay cash dividends on our common stock and did not anticipate doing so for the foreseeable

future for grants issued prior to March 18, 2009. For grants issued subsequent to March 18, 2009, we used an annualized

dividend yield based on the per share dividend declared by our Board of Directors.

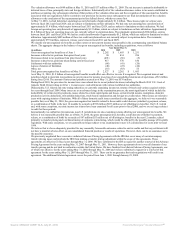

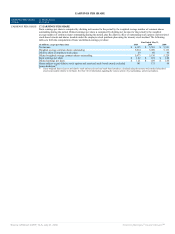

Tax Benefits from Exercise of Stock Options and Vesting of Restricted Stock-Based Awards

Total cash received as a result of option exercises was approximately $812 million, $696 million and $1.2 billion for fiscal

2010, 2009 and 2008, respectively. The aggregate intrinsic value of options exercised and vesting of restricted stock-based

awards was $647 million, $807 million and $2.0 billion for fiscal 2010, 2009 and 2008, respectively. In connection with these

exercises and vesting of restricted stock-based awards, the tax benefits realized by us were $203 million, $252 million and

$588 million for fiscal 2010, 2009 and 2008, respectively. Of the total tax benefits received, we classified excess tax benefits

from stock-based compensation of $110 million, $194 million and $454 million as cash flows from financing activities rather

than cash flows from operating activities for fiscal 2010, 2009 and 2008, respectively.

Employee Stock Purchase Plan

We have an Employee Stock Purchase Plan (Purchase Plan) and have amended the Purchase Plan such that employees can

purchase shares of common stock at a price per share that is 95% of the fair market value of Oracle stock as of the end of the

semi-annual option period. As of May 31, 2010, 75 million shares were reserved for future issuances under the Purchase Plan.

We issued 3 million shares under the Purchase Plan in each of fiscal 2010, 2009 and 2008.

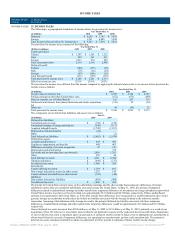

Defined Contribution and Other Postretirement Plans

We offer various defined contribution plans for our U.S. and non-U.S. employees. Total defined contribution plan expense

was $282 million, $258 million and $234 million for fiscal 2010, 2009 and 2008, respectively. The number of plan

participants in our defined contribution plans has generally increased in recent years primarily as a result of additional eligible

employees from our acquisitions.

In the United States, regular employees can participate in the Oracle Corporation 401(k) Savings and Investment Plan (Oracle

401(k) Plan). Participants can generally contribute up to 40% of their eligible compensation on a per- pay-period basis as

defined by the plan document or by the section 402(g) limit as defined by the United States Internal Revenue Service (IRS).

We match a portion of employee contributions, currently 50% up to 6% of compensation each pay period, subject to

maximum aggregate matching amounts. Our contributions to the plan, net of forfeitures, were $90 million, $78 million and

$80 million in fiscal 2010, 2009 and 2008, respectively.

We also offer non-qualified deferred compensation plans to certain key employees whereby they may defer a portion of their

annual base and/or variable compensation until retirement or a date specified by the employee in accordance with the plans.

Deferred compensation plan assets and liabilities were approximately $216 million and $176 million as of May 31, 2010 and

2009, respectively, and are presented in other assets and other non-current liabilities in the accompanying consolidated

balance sheets.

We sponsor certain defined benefit pension plans that are offered primarily by certain of our foreign subsidiaries. Many of

these plans were assumed through our acquisitions. We deposit funds for these plans with insurance companies, third-party

trustees, or into government-managed accounts consistent with local regulatory requirements, as applicable. Our total defined

benefit plan pension expense was $29 million for fiscal 2010 (insignificant for fiscal 2009 and 2008). The aggregate projected

benefit obligation and aggregate net funded status (net liability) of our defined benefit plans were $636 million and $196

million as of May 31, 2010, respectively.

Source: ORACLE CORP, 10-K, July 01, 2010 Powered by Morningstar® Document Research℠