Oracle 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

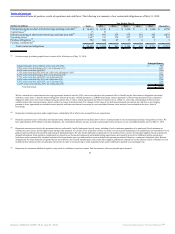

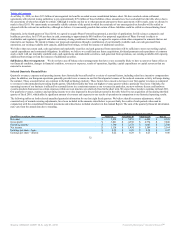

The Compensation Committee of the Board of Directors reviews and approves the organization-wide stock option grants to selected employees, all stock option

grants to executive officers and any individual stock option grants in excess of 100,000 shares. A separate Plan Committee, which is an executive officer

committee, approves individual stock option grants of up to 100,000 shares to non-executive officers and employees. Stock option and restricted stock-based

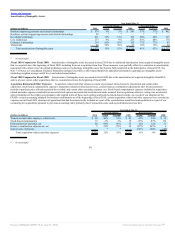

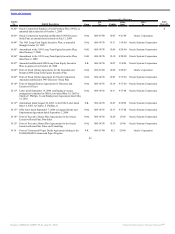

award activity from June 1, 2007 through May 31, 2010 is summarized as follows (shares in millions):

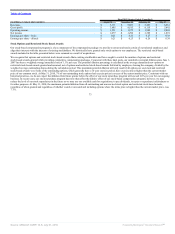

Options and restricted stock-based awards outstanding at May 31, 2007 434

Options granted 202

Options and restricted stock-based awards assumed 66

Options exercised and restricted stock-based awards vested (274)

Forfeitures, cancellations and other, net (72)

Options and restricted stock-based awards outstanding at May 31, 2010 356

Average annualized options and restricted stock-based awards granted and assumed, net of forfeitures 65

Average annualized stock repurchases (122)

Shares outstanding at May 31, 2010 5,026

Basic weighted average shares outstanding from June 1, 2007 through May 31, 2010 5,072

Options and restricted stock-based awards outstanding as a percent of shares outstanding at May 31, 2010 7.1%

In the money options and total restricted stock-based awards outstanding (based on the closing price of our common stock on the last trading day

of our fiscal period presented) as a percent of shares outstanding at May 31, 2010 6.6%

Weighted average annualized options and restricted stock-based awards granted and assumed, net of forfeitures and before stock repurchases, as a

percent of weighted average shares outstanding from June 1, 2007 through May 31, 2010 1.3%

Weighted average annualized options and restricted stock-based awards granted and assumed, net of forfeitures and after stock repurchases, as a

percent of weighted average shares outstanding from June 1, 2007 through May 31, 2010 -1.1%

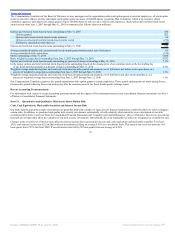

Our Compensation Committee approves the annual organization-wide option grants to certain employees. These annual option grants are made during the ten

business day period following the second trading day after the announcement of our fiscal fourth quarter earnings report.

Recent Accounting Pronouncements

For information with respect to recent accounting pronouncements and the impact of these pronouncements on our consolidated financial statements, see Note 1

of Notes to Consolidated Financial Statements.

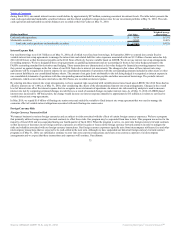

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Cash, Cash Equivalents, Marketable Securities and Interest Income Risk

Our bank deposits and money market investments are generally held with a number of large, diverse financial institutions worldwide which we believe mitigates

certain risks. In addition, we purchase high quality debt security investments, substantially all with relatively short maturities (see a description of our debt

securities held in Notes 3 and 4 of Notes to Consolidated Financial Statements and “Liquidity and Capital Resources” above). Therefore, interest rate movements

generally do not materially affect the valuation of our debt security investments. Substantially all of our marketable securities are designated as available-for-sale.

Changes in the overall level of interest rates affect the interest income that is generated from our cash, cash equivalents and marketable securities. For fiscal

2010, total interest income was $122 million with our investments yielding an average 0.59% on a worldwide basis. This interest rate level was down by 164

basis points from 2.23% for fiscal 2009. If overall interest rates fell by 50 basis points from our average of 0.59%

74

Source: ORACLE CORP, 10-K, July 01, 2010 Powered by Morningstar® Document Research℠