Oracle 2009 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2009 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2010

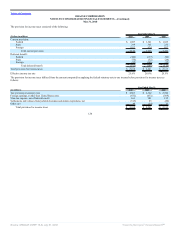

Net Investment Hedges

Periodically, we hedge net assets of certain of our international subsidiaries using foreign currency forward contracts to offset the translation and economic

exposures related to our foreign currency-based investments in these subsidiaries. These contracts have been designated as net investment hedges pursuant to

ASC 815. We entered into these net investment hedges for all of fiscal 2009 and the majority of fiscal 2010. We suspended this program during our fourth

quarter of fiscal 2010 and, as of May 31, 2010, we have no contracts outstanding (one contract was outstanding as of May 31, 2009 in Japanese Yen with a

nominal fair value and notional amount of $694 million).

We used the spot method to measure the effectiveness of our net investment hedges. Under this method for each reporting period, the change in fair value of the

forward contracts attributable to the changes in spot exchange rates (the effective portion) was reported in accumulated other comprehensive income on our

consolidated balance sheet and the remaining change in fair value of the forward contract (the ineffective portion, if any) was recognized in non-operating

income (expense), net, in our consolidated statement of operations. We recorded settlements under these forward contracts in a similar manner. The fair values of

both the effective and ineffective portions were recorded to our consolidated balance sheet as prepaid expenses and other current assets for amounts receivable

from the counterparties or other current liabilities for amounts payable to the counterparties.

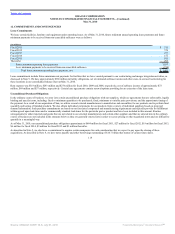

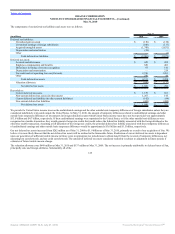

Foreign Currency Forward Contracts Not Designated as Hedges

We transact business in various foreign currencies and are subject to risks associated with the effects of certain foreign currency exposures. We have a program

that primarily utilizes foreign currency forward contracts to offset these risks associated with foreign currency exposures. Our program may be suspended from

time to time. This program was active for the majority of fiscal 2010 and was suspended during our fourth quarter of fiscal 2010. When this program is active, we

enter into foreign currency forward contracts so that increases or decreases in our foreign currency exposures are offset by gains or losses on the foreign currency

forward contracts in order to mitigate the risks and volatility associated with our foreign currency transactions. Our foreign currency exposures typically arise

from intercompany sublicense fees and other intercompany transactions that are expected to be cash settled in the near term. Although we have suspended our

historical foreign currency forward contract program as of May 31, 2010, our subsidiaries continue to enter into cross-currency transactions and create

cross-currency exposures via intercompany arrangements and we expect that these transactions and exposures will continue. Our ultimate realized gain or loss

with respect to currency fluctuations will generally depend on the size and type of cross-currency transactions that we enter into, the currency exchange rates

associated with these exposures and changes in those rates, whether we have entered into foreign currency forward contracts to offset these exposures and other

factors.

Historically, we have neither used these foreign currency forward contracts for trading purposes nor have designated these forward contracts as hedging

instruments pursuant to ASC 815. Accordingly, we recorded the fair value of these contracts as of the end of our reporting period to our consolidated balance

sheet with changes in fair value recorded in our consolidated statement of operations. The balance sheet classification for the fair values of these forward

contracts was prepaid expenses and other current assets for unrealized gains and other current liabilities for unrealized losses. The statement of operations

classification for the fair values of these forward contracts was non-operating income (expense), net, for both realized and unrealized gains and losses.

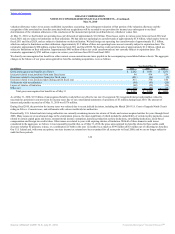

As of May 31, 2010, we had a nominal amount of foreign currency forward contracts outstanding. As of May 31, 2009, the notional amounts of the forward

contracts we held to purchase and sell U.S. Dollars in exchange for other major international currencies were $860 million and $1.1 billion, respectively, and the

notional amounts of the foreign currency forward contracts we held to purchase European Euros in exchange for other major international currencies were

€142 million ($198 million).

116

Source: ORACLE CORP, 10-K, July 01, 2010 Powered by Morningstar® Document Research℠