Oracle 2009 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2009 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACQUISITIONS

ACQUISITIONS

(USD $)

12 Months Ended

05/31/2010

ACQUISITIONS 2.ACQUISITIONS

Acquisition of Sun Microsystems, Inc.

On January 26, 2010 we completed our acquisition of Sun Microsystems, Inc., a provider of hardware systems, software and services, by

means of a merger of one of our wholly owned subsidiaries with and into Sun such that Sun became a wholly owned subsidiary of Oracle.

We acquired Sun to, among other things, expand our product offerings by adding Sun's existing hardware systems business and broadening

our software and services offerings. We have included the financial results of Sun in our consolidated financial statements from the date of

acquisition. For fiscal 2010, we estimate that Sun's contribution to our total revenues was $2.8 billion, which included allocations of revenues

from our software and services businesses that were not separately identifiable due to our integration activities. For fiscal 2010, Sun reduced

our operating income by $620 million, which included management's allocations and estimates of revenues and expenses that were not

separately identifiable due to our integration activities, intangible asset amortization, restructuring expenses and stock-based compensation

expenses.

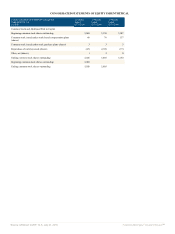

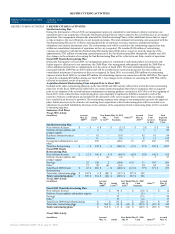

The total purchase price for Sun was approximately $7.3 billion and was comprised of:

(in millions, except per share amounts)

Acquisition of approximately 757 million shares of outstanding common stock of Sun at $9.50 per share in

cash

$ 7,196

Fair values of stock options and restricted stock-based awards assumed 99

Total purchase price $ 7,295

The fair values of stock options assumed were estimated using a Black-Scholes-Merton option-pricing model. The fair values of unvested

Sun stock options and restricted stock-based awards as they relate to post combination services will be recorded as operating expense over

the remaining service periods, while the fair values of vested stock options and restricted stock-based awards, as they relate to pre

combination services, are included in the total purchase price.

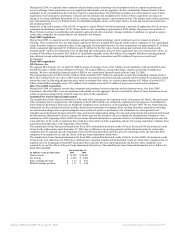

Preliminary Purchase Price Allocation

Pursuant to our business combinations accounting policy, the total purchase price for Sun was allocated to the preliminary net tangible and

intangible assets based upon their preliminary fair values as of January 26, 2010 as set forth below. The excess of the purchase price over the

preliminary net tangible assets and intangible assets was recorded as goodwill. The preliminary allocation of the purchase price was based

upon a preliminary valuation and our estimates and assumptions are subject to change within the measurement period (up to one year from

the acquisition date). The primary areas of the preliminary purchase price allocation that are not yet finalized relate to the fair values of

certain tangible assets and liabilities acquired, certain legal matters, income and non-income based taxes and residual goodwill. We expect to

continue to obtain information to assist us in determining the fair values of the net assets acquired at the acquisition date during the

measurement period. Our preliminary purchase price allocation for Sun is as follows:

(in millions)

Cash, cash equivalents and marketable

securities

$ 2,571

Trade receivables 1,120

Inventories 331

Goodwill 1,291

Intangible assets 3,347

In-process research and development 415

Other assets 2,035

Deferred tax assets, net 1,250

Accounts payable and other liabilities (3,950)

Deferred revenues (1,115)

Total preliminary purchase price $ 7,295

We generally do not expect the goodwill recognized to be deductible for income tax purposes.

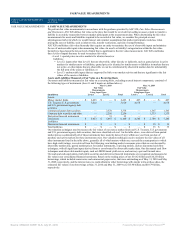

Valuations of Intangible Assets Acquired

The following table sets forth the components of intangible assets acquired in connection with the Sun acquisition:

(Dollars in millions) Fair Value Useful

Life

Hardware systems support agreements and related

relationships

$ 771 7 years

Developed technology 1,349 4 years

Core technology 534 4 years

Customer relationships 467 3 years

Trademarks 226 7 years

Total intangible assets subject to amortization 3,347

In-process research and development 415 N.A.

Total intangible assets $ 3,762

Hardware systems support agreements and related relationships and customer relationships represent the fair values of the underlying

relationships and agreements with Sun's customers. Developed technology represents the fair values of Sun products that have reached

technological feasibility and are a part of Sun's product lines. Core technology represents the fair values of the Sun processes, patents and

trade secrets related to the design and development of Sun's products. This proprietary know-how can be leveraged to develop new

technology and improve our existing products. Trademarks represent the fair values of brand and name recognition associated with the

marketing of Sun's products and services. In-process research and development represents the fair values of incomplete Sun research and

development projects that had not reached technological feasibility as of the date of acquisition.

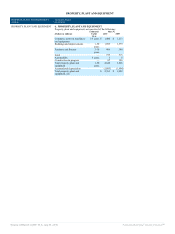

Preliminary Pre-Acquisition Contingencies Assumed

We have evaluated and continue to evaluate pre-acquisition contingencies relating to Sun that existed as of the acquisition date. We have

preliminarily determined that certain of these pre-acquisition contingencies are probable in nature and estimable as of the acquisition date

and, accordingly, have preliminarily recorded our best estimates for these contingencies as a part of the preliminary purchase price allocation

for Sun. We continue to gather information for and evaluate substantially all pre-acquisition contingencies that we have assumed from Sun. If

we make changes to the amounts recorded or identify additional pre-acquisition contingencies during the remainder of the measurement

period, such amounts recorded will be included in the purchase price allocation during the measurement period and, subsequently, in our

results of operations.

Other Fiscal 2010 Acquisitions and Proposed Acquisition of Phase Forward Incorporated and Others

Source: ORACLE CORP, 10-K, July 01, 2010 Powered by Morningstar® Document Research℠