Oracle 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

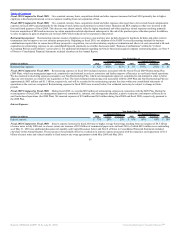

Commercial Paper

Commercial Paper Program: On May 11, 2010, we reduced the overall capacity of our commercial paper program from $5.0 billion to $3.0 billion after our

2009 Credit Agreement (as defined below) terminated pursuant to its terms.

Commercial Paper Notes: During fiscal 2010, we issued $2.8 billion of unsecured short-term commercial paper notes (Commercial Paper Notes) pursuant to

our commercial paper program, which allows us to issue and sell unsecured short-term promissory notes pursuant to a private placement exemption from the

registration requirements under federal and state securities laws. We issued these Commercial Paper Notes to finance a portion of the purchase price for the Sun

acquisition, to assist with the repayment of our $1.0 billion of senior notes that matured in May 2010 and for general corporate purposes. As of May 31, 2010, we

had $881 million of Commercial Paper Notes outstanding at a weighted average yield, including issuance costs, of 0.28% (none outstanding as of May 31, 2009).

We back-stop these notes with our revolving credit agreement and therefore, as of May 31, 2010, we consider that we have $2.1 billion of capacity remaining

under our 2006 commercial paper program. Additional details of our various debt facilities and obligations are included in the “Contractual Obligations” section

below and in Note 8 of Notes to Consolidated Financial Statements included elsewhere in this Annual Report.

Revolving Credit Agreements: On March 16, 2010, our $2.0 billion 364-Day Revolving Credit Agreement dated March 17, 2009, among Oracle; the lenders

named therein; Wachovia Bank, National Association, as administrative agent; BNP Paribas as syndication agent; the documentation agents named therein; and

Wachovia Capital Markets, LLC, and BNP Paribas Securities Corp., as joint lead arrangers and joint bookrunners (the 2009 Credit Agreement), terminated

pursuant to its terms. No debt was outstanding pursuant to the 2009 Credit Agreement as of its date of termination.

As of May 31, 2010, we had a $3.0 billion, five-year Revolving Credit Agreement with certain lenders that we entered into in March 2006 (the 2006 Credit

Agreement). Additional details regarding the 2006 Credit Agreement are included under the heading “Revolving Credit Agreements” in Note 8 of Notes to

Consolidated Financial Statements included elsewhere in this Annual Report.

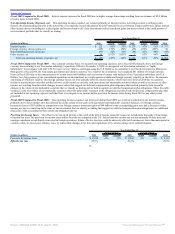

Common Stock Repurchases: Our Board of Directors has approved a program for us to repurchase shares of our common stock. On October 20, 2008, we

announced that our Board of Directors expanded our repurchase program by $8.0 billion and as of May 31, 2010, $5.3 billion was available for share repurchases

pursuant to our stock repurchase program. We repurchased 43.3 million shares for $1.0 billion, 225.6 million shares for $4.0 billion, and 97.3 million shares for

$2.0 billion in fiscal 2010, 2009 and 2008, respectively. Our stock repurchase authorization does not have an expiration date and the pace of our repurchase

activity will depend on factors such as our working capital needs, our cash requirements for acquisitions and dividend repayments, our debt repayment

obligations (described further below), our stock price, and economic and market conditions. Our stock repurchases may be effected from time to time through

open market purchases or pursuant to a Rule 10b5-1 plan. Our stock repurchase program may be accelerated, suspended, delayed or discontinued at any time.

Cash Dividends: In fiscal 2010, we declared and paid cash dividends of $0.20 per share that totaled $1.0 billion, which is an increase in comparison to fiscal

2009 in which we declared and paid the first dividend in our history to our common stockholders of $0.05 per share, which totaled $250 million. In June 2010,

our Board of Directors declared a quarterly cash dividend of $0.05 per share of outstanding common stock payable on August 4, 2010 to stockholders of record

as of the close of business on July 14, 2010. Future declarations of dividends and the establishment of future record and payment dates are subject to the final

determination of our Board of Directors.

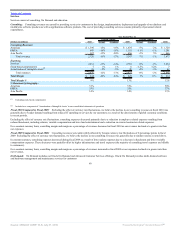

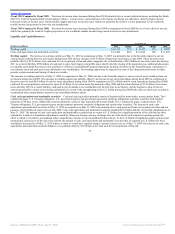

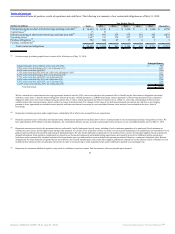

Contractual Obligations: The contractual obligations presented in the table below represent our estimates of future payments under fixed contractual

obligations and commitments. Changes in our business needs, cancellation provisions, changing interest rates and other factors may result in actual payments

differing from these estimates. We cannot provide certainty regarding the timing and amounts of payments. We have presented below a summary of the most

significant assumptions used in preparing this information within the context of

70

Source: ORACLE CORP, 10-K, July 01, 2010 Powered by Morningstar® Document Research℠