Oracle 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2010

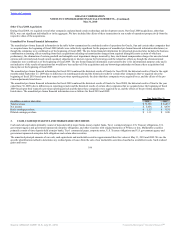

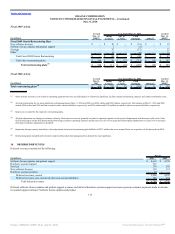

Assets and Liabilities Measured at Fair Value on a Recurring Basis

Our assets and liabilities measured at fair value on a recurring basis, excluding accrued interest components, consisted of the following types of instruments

(Level 1 and 2 inputs are defined above):

May 31, 2010 May 31, 2009

Fair Value

Measurements

Using Input Types

Fair Value

Measurements

Using Input Types

(in millions) Level 1 Level 2 Total Level 1 Level 2 Total

Assets:

Money market funds $ 2,423 $ — $ 2,423 $ 467 $ — $ 467

U.S. Treasury, U.S. government and U.S. government

agency debt securities 3,010 — 3,010 4,078 — 4,078

Commercial paper debt securities — 3,378 3,378 — 1,365 1,365

Corporate debt securities and other — 2,256 2,256 — 1,335 1,335

Derivative financial instruments — 33 33 — — —

Total assets $ 5,433 $ 5,667 $ 11,100 $ 4,545 $ 2,700 $ 7,245

Liabilities:

Derivative financial instruments $ — $ — $ — $ — $ 35 $ 35

Total liabilities $ — $ — $ — $ — $ 35 $ 35

Our valuation techniques used to measure the fair values of our money market funds and U.S. Treasury, U.S. government and U.S. government agency debt

securities, that were classified as Level 1 in the table above, were derived from quoted market prices as substantially all of these instruments have maturity dates

(if any) within one year from our date of purchase and active markets for these instruments exist. Our valuation techniques used to measure the fair values of all

other instruments listed in the table above, generally all of which mature within one year and the counterparties to which have high credit ratings, were derived

from the following: non-binding market consensus prices that are corroborated by observable market data, quoted market prices for similar instruments, or

pricing models, such as discounted cash flow techniques, with all significant inputs derived from or corroborated by observable market data. Our discounted cash

flow techniques used observable market inputs, such as LIBOR-based yield curves, and currency spot and forward rates.

Our cash and cash equivalents, marketable securities and derivative financial instruments are recognized and measured at fair value in our consolidated financial

statements. Based on the trading prices of our $14.62 billion and $10.25 billion borrowings, which included senior notes and commercial paper notes, that were

outstanding as of May 31, 2010 and May 31, 2009, respectively, and the interest rates we could obtain for other borrowings with similar terms at those dates, the

estimated fair values of our borrowings at May 31, 2010 and May 31, 2009 were $15.90 billion and $10.79 billion, respectively.

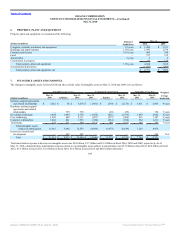

5. INVENTORIES

Inventories consisted of the following as of May 31, 2010 (insignificant as of May 31, 2009):

(in millions) May 31, 2010

Raw materials $ 95

Work-in-process 43

Finished goods 121

Total $ 259

108

Source: ORACLE CORP, 10-K, July 01, 2010 Powered by Morningstar® Document Research℠